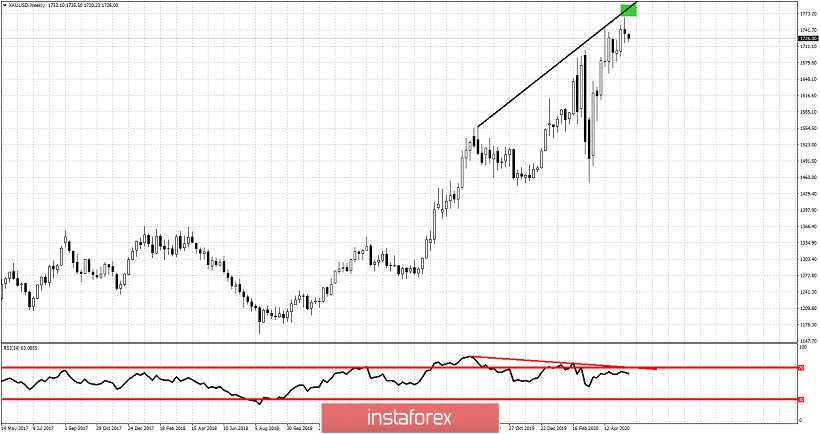

Gold has started the week on a negative note following last week's inability to hold above $1,750. Despite moving higher towards our target of $1,770 last week, price closed around $1,735 and this week prices move lower.

Green rectangle -target area

Black line -higher highs

Gold price is making higher highs but the RSI is not following. Price of the RSI is making lower highs thus providing us with a bearish divergence. This is not a reversal signal but a warning sign for bulls to be extra cautious and raise protective stops. Over the last few weeks our main view was to be bearish Gold around $1,750 and higher, as long as the RSI was diverging. Our short-term view when price broke above $1,710-20 turned bullish targeting $1,770. Last week we came so close to this target area. Now price is turning back down again. Key support remains at $1,710-15. Breaking below this level will open the way for a move towards $1,650 at least. It is important to see if this weekly candle hold above $1,700-10 support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română