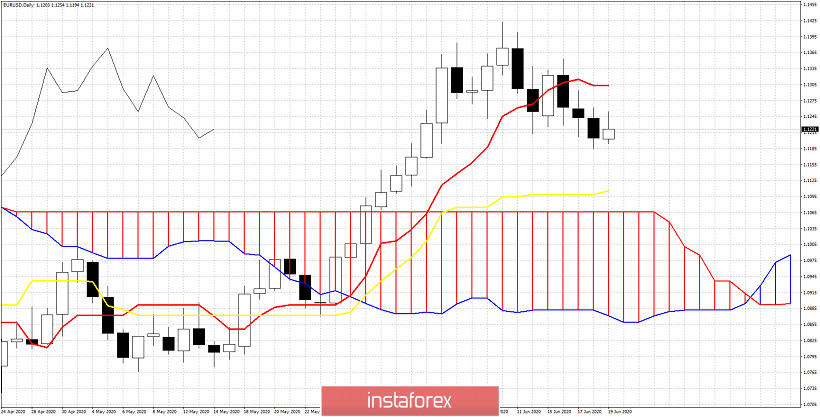

EURUSD remains in a bearish trend. Price is vulnerable to a move towards 1.1175-1.1135. We focus on the lower lows and lower highs pattern and on the trend line resistance of the RSI. Both point to a move lower.

Black line- RSI resistance

Red lines - expected path

EURUSD was expected to pull back towards the 38% Fibonacci retracement. EURUSD has potential to move towards the 100% extension of the first leg down, towards the 50% retracement. As long as price is below 1.1260 and as long as the RSI is below the black trend line, we remain bearish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română