Latest data released by Markit - 6 August 2020

"The PMI data suggest that the constructor sector is yet to escape from its recent slump, although there are some signs of improvement in the detail. The residential building sector looks to be more resilient to the troubles being caused by the COVID-19 pandemic, with housing activity returning to growth in July and helping to at least partially offset the subdued trends in both commercial and civil engineering activity.

As I discussed in the previous review, the Gold managed to reach projected target at $2,050 but I still see strong upside momentum and potential for another upside swing to develop.

The level at $2,055 seems like an major pivot and top of the another new ascending triangle on the hourly time-frame.

Further Development

Analyzing the current trading chart, I found potential for the upside continuation in case of the upside breakout of the $2,055. The projected target for the new ascending triangle is set at $2,100.

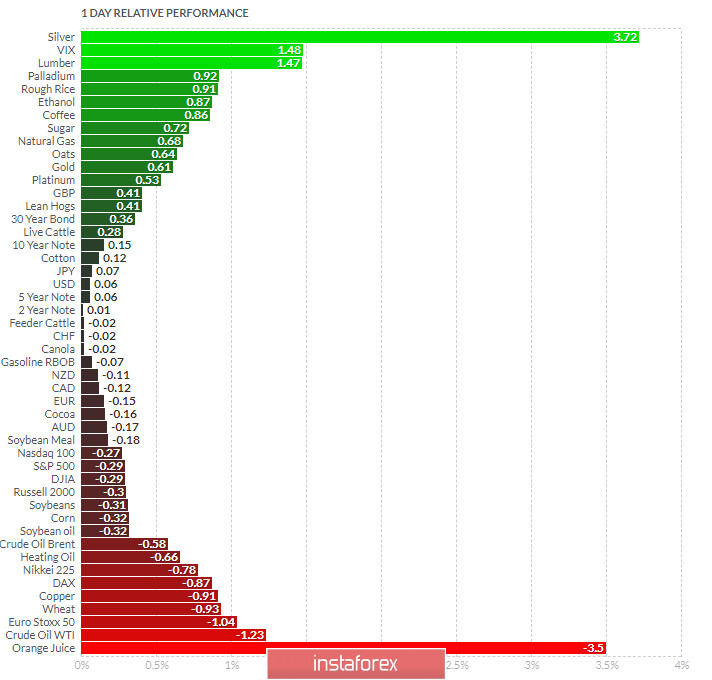

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Lumber second day in a row today and on the bottom Crude Oil and Orange Juice.

Key Levels:

Resistance: $2,055

Support levels: $2,040, $2,030

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română