- 1.07 million barrels per day of offshore US crude production cut in the Gulf of Mexico because of the threat of Hurricane Marco and Tropical storm Laura.

US oil up at highs of the day at 42.56

As I discussed in the previous review, the EUR/USD managed to complete the downside correction and it tested my target from last week at the price of 1,1845 (Middle Bollinger band H4)

There is potential for the buyers exhaustion and downside rotation due to good area of consolidation there and middle Bollinger line.

Further Development

Analyzing the current trading chart, I found that buyers might get exhausted at 1,1840 and there is potential for the downside rotation towards the 1,1760

Anyway, in case of the stronger breakout of 1.1840 there is potential for test of 1.1880.

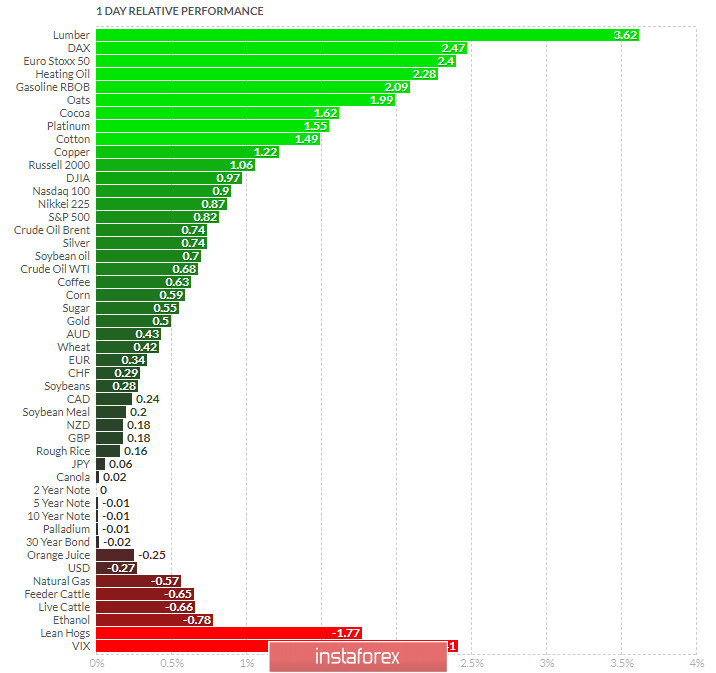

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and DAX oday and on the bottom VIX and Lean Hogs.

EUR is on the positive territory, which is sign that buyers are in control but on the same time they got exhausted intraday.

Key Levels:

Resistance: 1,1840

Support level: 1,1760

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română