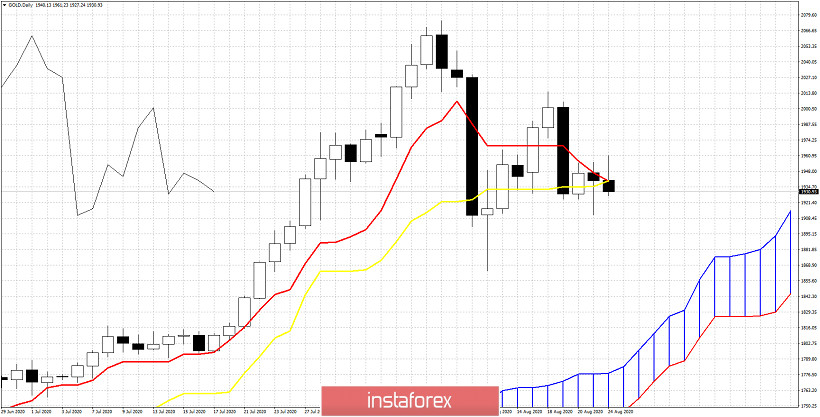

Gold price continues to trade around $1,950-$1,930 area. Bulls have not managed to break above $1,950 and the rejection/ weakness at $1,950 increases the chances of breaking below $1,920-25 support.

In a previous analysis we noted the bearish Head and shoulders pattern and we noted the importance of $1,925-20 support zone. Today using the Ichimoku cloud indicator we get another warning signal. Price is breaking below the tenkan-sen and the kijun-sen (red and yellow line) indicators. This is a bearish sign. Also the tenkan-sen (red line indicator) is about to cross to the downside and below the kijun-sen (yellow line indicator). This will also be a bearish sign. All the above point to the increased chances of price pushing towards the cloud support at $1,880-$1,830. As long as we trade below today's highs we are short-term bearish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română