German recovery is more or less on track

- But recovery remains fragile

- Sees GDP growth of around 7% in Q3

- German exporters doing pretty well considering situation in other countries

The report earlier certainly keeps the optimism flowing with regards to the economic recovery, but it'll be a real challenge to see how sustainable such conditions will be particularly towards the end of the year.

As I discussed in the previous review, the EUR is still in the sideways regime and there is potential for the re-test of the 1,1780 and 1,1760.

Further Development

Analyzing the current trading chart of the EUR, I found that the buyers got exhausted at important resistance at 1,1845 and that sellers took control.

I would watch for potential selling opportunities on the rallies with the downside targets at 1,1787 and 1,1760.

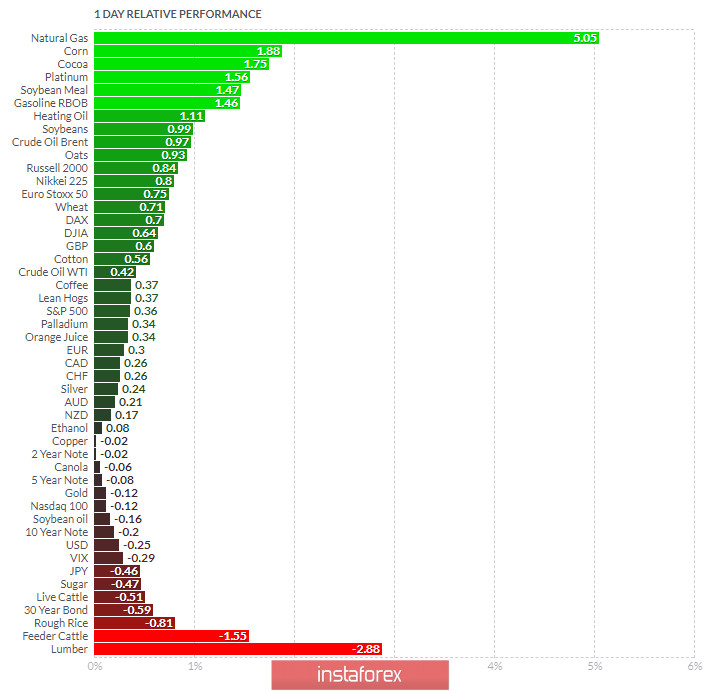

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and COrn today and on the bottom Lumber and Feeder Cattle.

EUR is slightly negative with no evidence of any directional move.

Key Levels:

Resistance: 1,1845

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română