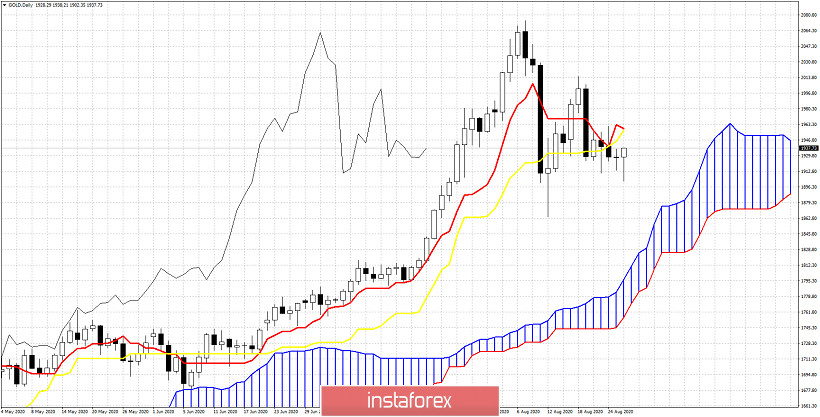

Gold price has tested today the short-term support at $1,900 and bounced back towards $1,940. In previous posts we noted the bearish head and shoulders pattern and the importance of the $1,900 price level as the first key support.

Gold price remains above the Daily Kumo, confirming medium-term trend remain bullish, but as long as price is below both the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator), then price is vulnerable to a move towards the cloud. As we explained in previous posts, bulls need to recapture $1,950 in order to decrease chances of a deeper pull back. The tenkan-sen and kijun-sen are found around $1,950-60 area. This resistance area is key. A rejection here could bring price back to the $1,900 support. Today's candlestick so far confirms the importance of the $1,900 support. We can now say with a high degree of certainty that if price now breaks below $1,900, we could see a deep corrective pull back towards $1,850-20 area. If bulls manage to recapture $1,950-60 then we can challenge the $2,000 price level again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română