The current ban on large events was extended back in June to 31 October, but the latest proposal is saying that officials are looking to extend that to 31 December due to the coronavirus situation in the country/region.

Just be mindful as this will just mean a more gradual return to "normal" conditions and potentially limit the robustness in the economic recovery.

As mentioned back in June, this also means that there will be no major Oktoberfest festivities this year - which brings in about $1 billion for the city of Munich each year.

As I discussed in the previous review, the EUR managed to complete the upside correction and I see potential for the new downside leg.

The level at 1,1840 seems like major resistance on EUR/USD.

Further Development

Analyzing the current trading chart, I found that the buyers got exhausted today and the downside rotation did start.

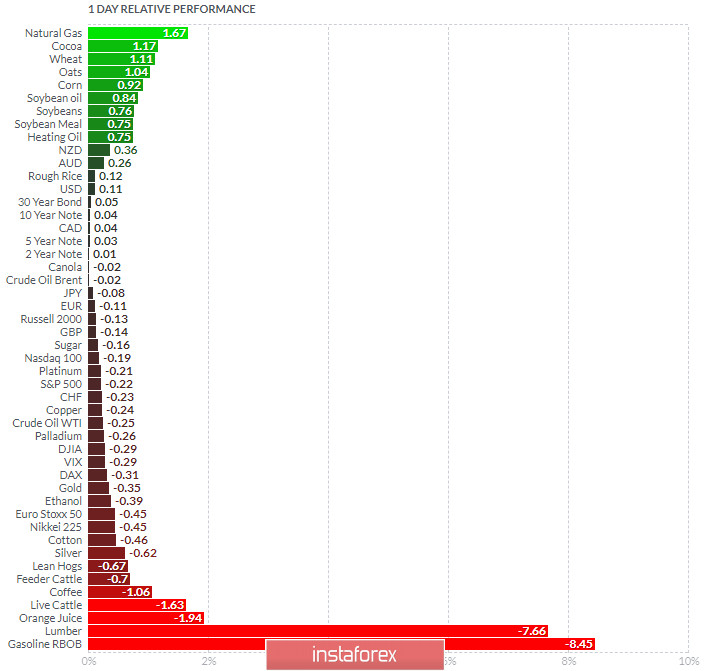

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and Cocoa today and on the bottom Gasoline RBOB and Lumber

Key Lvels:

Resistance: 1,1840

Support levels: 1,1760 and 1,1720

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română