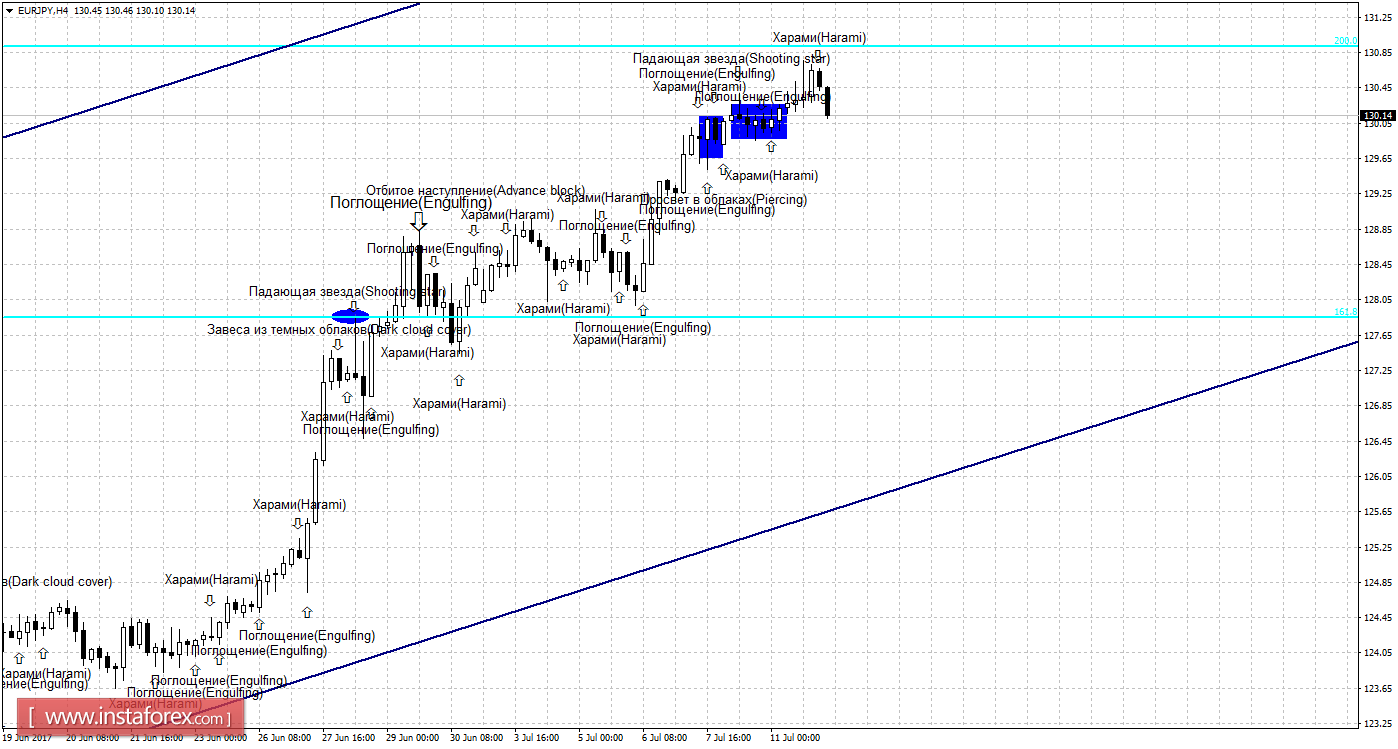

4h

The formation of the bull pattern on July 12 would allow traders to anticipate a trend beneficial for the European currency. The growth will continue through the direction of the correction level of 200.0% - 130.91. Such formation will be recognized as a trend based on the direction of the equidistant channel. Setting the rate above the Fibo level of 200.0% will increase chances of consistent growth towards the next correction level of 261.8% - 135.91.

The Fibonacci grid is established on the upper limits of March 13, 2017 and April 17, 2017.

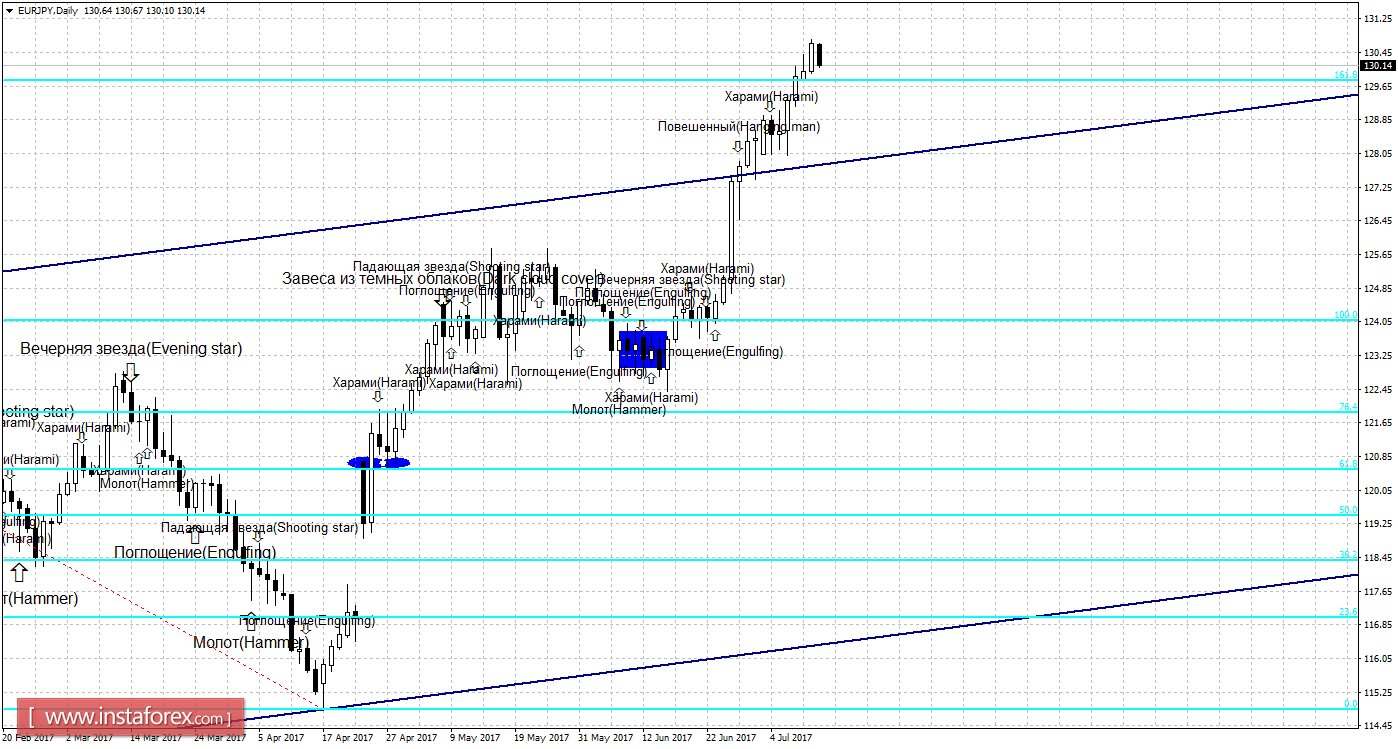

Daily

In the 24-hour chart, the prices were fixed above the correction level of 161.8% - 129.78, which eventually allows to resume the growth towards the next Fibo level of 200.0% - 133.33.

The Fibonacci grid is placed on the extremes from December 15, 2016 and April 17, 2017.

Specification:

Weak candle formations will be marked by plain text with a smaller size of the arrows.

Strong candle formations will be marked by bold text with a larger size of arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română