EUR/USD, GBP/USD

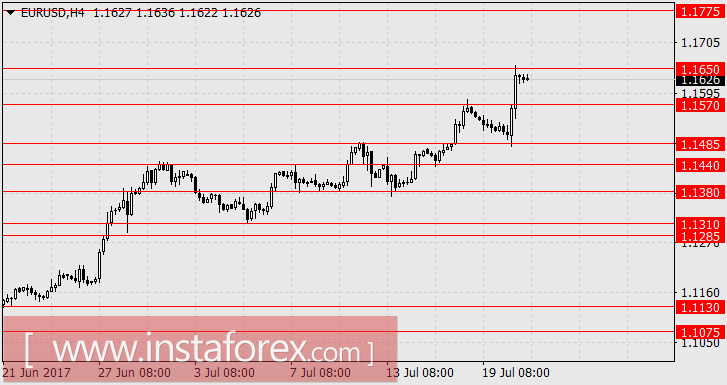

Unfortunately, as we suspected, the speech of Mario Draghi at the press conference following the ECB meeting was absolutely neutral. The caused the buying of the euro amid a scenario that we did seriously consider. In fact, his speech was even slightly "dovish" but the euro still added 117 points. He said that inflation will grow very slowly. Meanwhile, the growth of the European economy is primarily due to the global economic growth and, on the whole, incentives are still needed. The main thing that he said was a confirmation of the market's expectations regarding the issue of changes in the quantitative easing program which he said will be considered not earlier than autumn. There is not a single assumption that bull speculators could seize. The market, therefore, misunderstood Draghi's speech once again. The reason, in our opinion, is in another area - the eurozone economy is really stronger than ever. Yesterday, before the decision of the ECB, eurozone data on the balance of payments for may was at 30.1 billion euros against the forecast of 23.3 billion euros and April's data of 23.5 billion euros (revised for an increase from 22.2 billion euros). This is one of the highest indicators on the history of the eurozone, even more than the pre-crisis period and more than before the announcement of Russia's sanctions. The trade balance month by month shows uneven dynamics but overall trend is upward. The current value at 21.4 billion euros is also significantly higher than the pre-crisis figures which was at 5.3 billion euros in May 2007. The matter here is not at all the weak euro, since both the trade balance and the industrial production in the United States for the past 12 months are growing. The indicator of commercial bankruptcies in the US has been steadily declining since 2010.

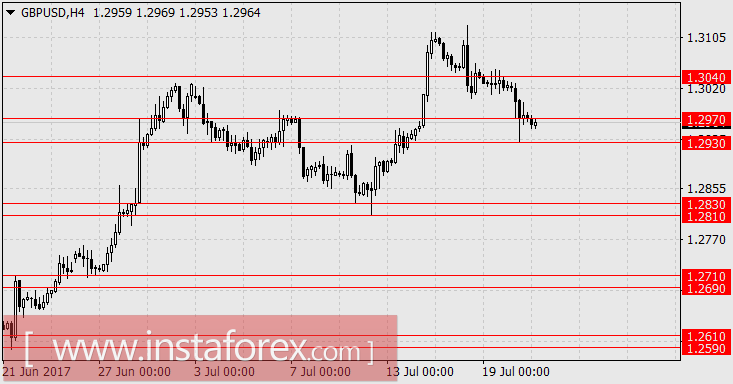

The market has completely got used to an exchange rate for the EUR/USD at 1.09-1.12 which was the average for the last 2.5 years. However, logically speaking, since the market has adapted to exchange rates, it should not grow but instead fall further on the development of new, lower ranges. This is because it is the current US policy. The market does not obey Draghi, obviously. Now, it's Yellen and the Fed's turn. Next week, on July 26, the Fed will hold a meeting on monetary policy. After the meeting, we will be waiting for aggressive comments and explicit attempts to deploy the euro. At the same time, we note that retail sales in the UK yesterday showed an increase of 0.6% against the forecast of 0.4%. Despite this, the pound was down by 50 points.

Today, there are no major economic indicators released with the exception of net borrowing of the public sector of the UK for July. The forecast is 4.3 billion pounds against 6.0 billion pounds from a month earlier. We are looking forward to the continuous decline of the pound to the range of 1.2810/30. For the euro, the current situation has become unpredictable but if the growth continues, then the target level is 1.1785. If the reversal begins, then the target is the level of 1.1485.

AUD/USD

Yesterday, employment data in Australia came out weaker than forecast. The May unemployment rate was revised down to 5.5% from 5.6% while the June figure remained at the same rate of 5.6%. This actually means that there is an increase in unemployment. Participation in the workforce increased from 64.9% to 65.0%. The number of new jobs created was at 14,000 against the forecast of 15,000 and the May results of 38,000. The May figure lowered from 42,000. The good news was that the index of business confidence in NAB for the second quarter formally increased from 6 to 7. The formality here is that the indicator for the first quarter was revised to increase from 6 points. On mixed data, the Australian dollar closed the day with symbolic increase.

This morning, the Deputy Reserve Bank of Australia Chairman, Guy Debelle, said that amid the residual effects of the financial crisis, weak investment, low inflation, and low salary growth, the RBA will continue to hold a soft monetary policy. Against the background of Mario Draghi's speech yesterday that sounded dissonant, the Australian dollar lost 70 points in the morning session. But even in Australia, everything is not so bad: the trade balance had a positive and high balance for the last seven months (the last positive balance in four months was in late 2013 - early 2014), industrial production is very weak (declining overall in 2016), retail sales have growing for the last three months, and consumer spending has risen significantly since 2009 (although there is a problem of crediting). Meanwhile, steel production (432,000 tons per month) is on high volumes since spring of last year.

Well, Guy Debelle felt the market qualitatively and it became clear that he was weak. We are waiting for the AUD/USD in the range of 0.7750/75.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română