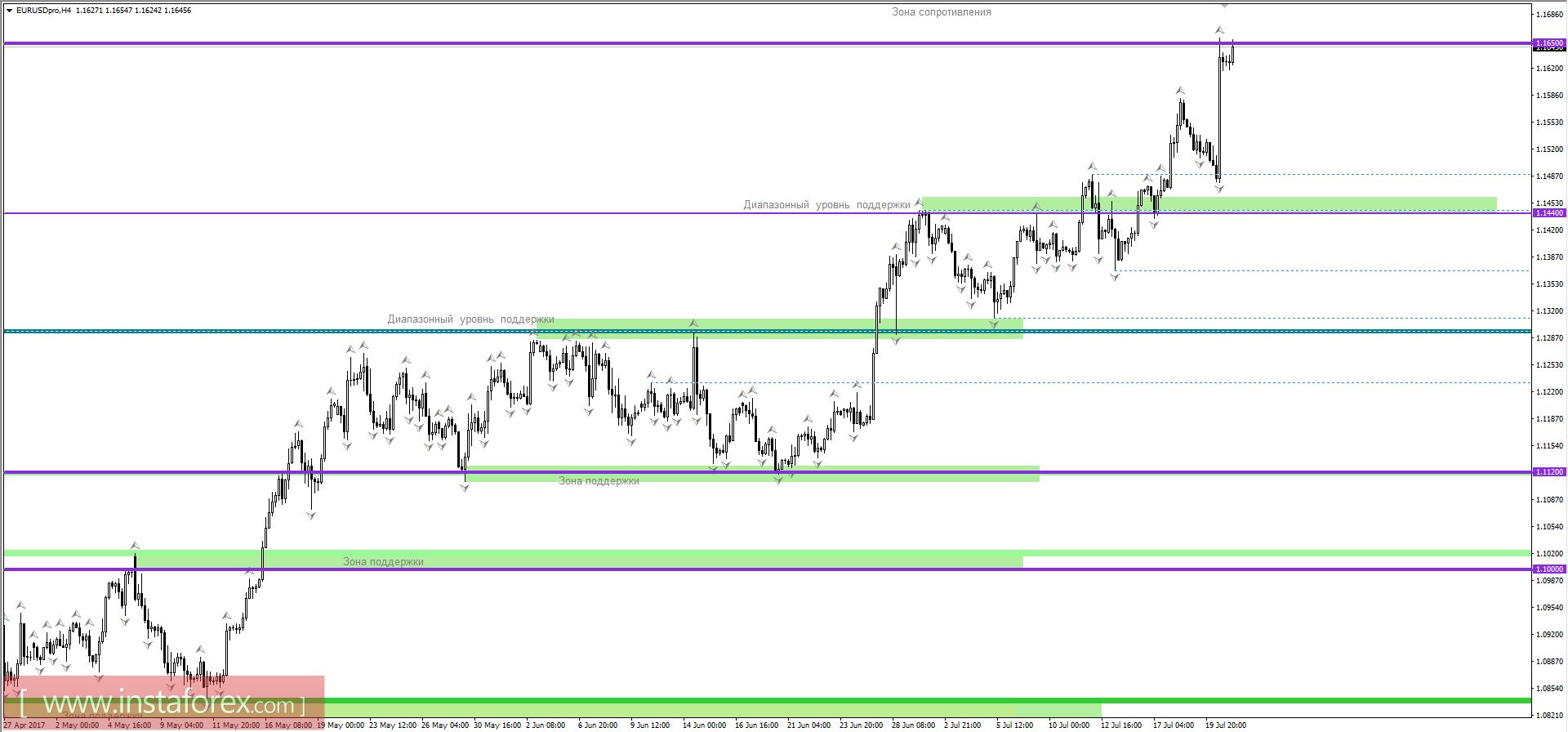

The currency pair EUR / USD showed high volatility during the past day, mostly because of the speech of Mario Draghi, where he stated the need to maintain incentive programs in the eurozone and promised to return to the issue of their breakdown in the autumn. The pair has already reached an important resistance level of 1.1650, about a two-year high of 1.1713 by a global survey. It is possible to assume that in the very near future, the quotation will expect a periodic ceiling before itself, giving us attractive short positions in the market. In case of a coincidence of the forecast, it is possible to expect the formation of the reverse movement with the first coordinates of 1.1500 / 1.1440.

Key levels

Resistance - 1.1650; 1.1713 (maximum); 1.1850.

Support - 1,1650; 1.1440; 1.1300.

Signals

- Buying a pair is recommended after fixing the price above 1.1650, with the prospect of a move to 1.1700.

- Sale of a pair is recommended to be made at a price of 1.1610, with the prospect of a move to 1.1500 / 1.1440.

Note: Forecasts are not a direct guide to action!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română