On Monday, the world markets were relieved after the news came from the US and North Korea, which somewhat lessen the degree of geopolitical tensions between the DPRK and the States. They reacted to this news by weakening the rates of the Japanese yen, the Swiss franc, and a decline in gold prices.

Positive dynamics resumed today during Asian trading session. The US dollar continues to grow smoothly relative to major currencies. The most noticeable dynamics of the dollar's growth is paired with the Japanese yen, which traditionally reacts most actively to all kinds of fears and risks associated with the world's policy instability.

But what should be acknowledged is that considering the words of American officials is not good as a variant of the final solution for the "North Korean issue". Most likely, these statements are of tactical nature and nothing more. The Americans have a significant problem which is to support their reputation as a strong and all-defining country in the world. Hence, the States will never make concessions to the DPRK. They did not make concessions with the more influential Soviet power, which led to difficult negotiations and confrontation. Therefore, in the case of the DPRK, they will still try solving this problem for their own sake. Proceeding from this, it can be assumed that the geopolitical factor will not disappear in the foreseeable future and will actively influence the mood of investors.

Today, the focus of the market will be on the UK output data. First of all, these are the figures for consumer inflation and the values of retail sales indices. Positive values will definitely have limited support for the US dollar, but in general, we continue to consider the overall scenario for the currency market characterized by the lateral movement of the major currency pairs. This is because of the summer "dead season" factor and the desire of investors to see objectives at their September meetings about the ECB monetary policy of the ECB and the US Federal Reserve.

To sum it up, we note that our forecast for the currency market remains the same until the end of the month which indicates lateral dynamics with a smooth strengthening of the dollar.Forecast of the day:

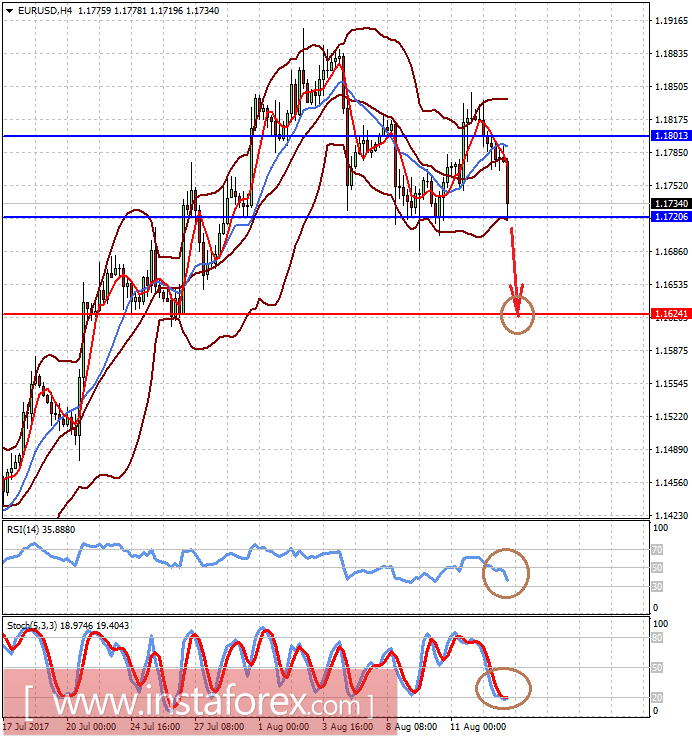

The EURUSD pair is trading above the 1.1720 level, overcoming of which may cause the correction of the pair to 1.1625.

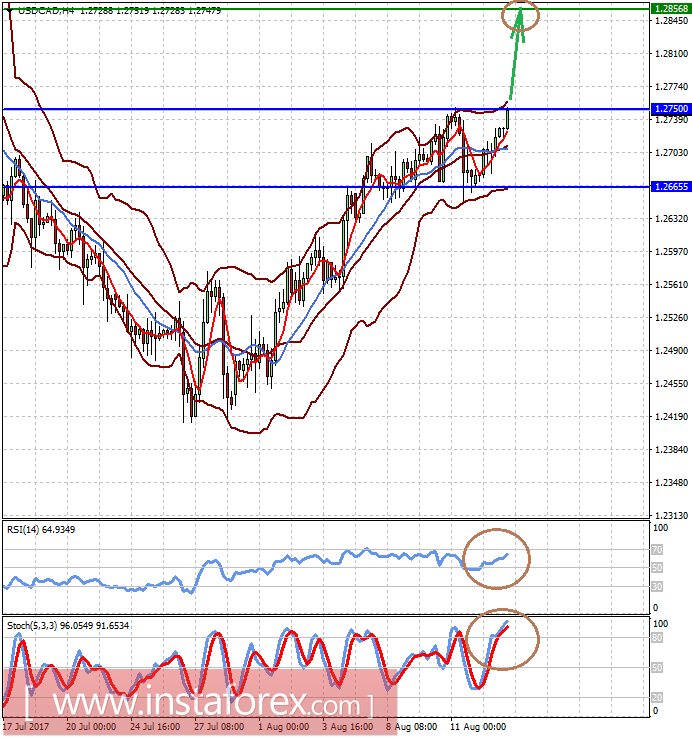

The USDCAD pair is testing the resistance level 1.2750, the breakthrough of which the wave of falling crude oil prices could lead to a further price increase to 1.2850-55.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română