Dear colleagues.

For the EUR/USD pair, the cancellation of the downward structure is expected after surpassing the price of the noise range of 1.1783 - 1.1806. For the GBP/USD pair, we expect a correction. For the USD/CHF pair, the level 0.9636 is the key support for the top. For the USD/JPY pair, the range of 109.57 - 109.85 is the key support for the upward cycle. For the EUR/JPY pair, the price is still in the initial conditions for the upward cycle of August 11. For the GBP/JPY pair, the development of the downward structure is expected after the breakdown of 141.47.

Forecast for August 17:

Analytical review of currency pairs in the scale of H1:

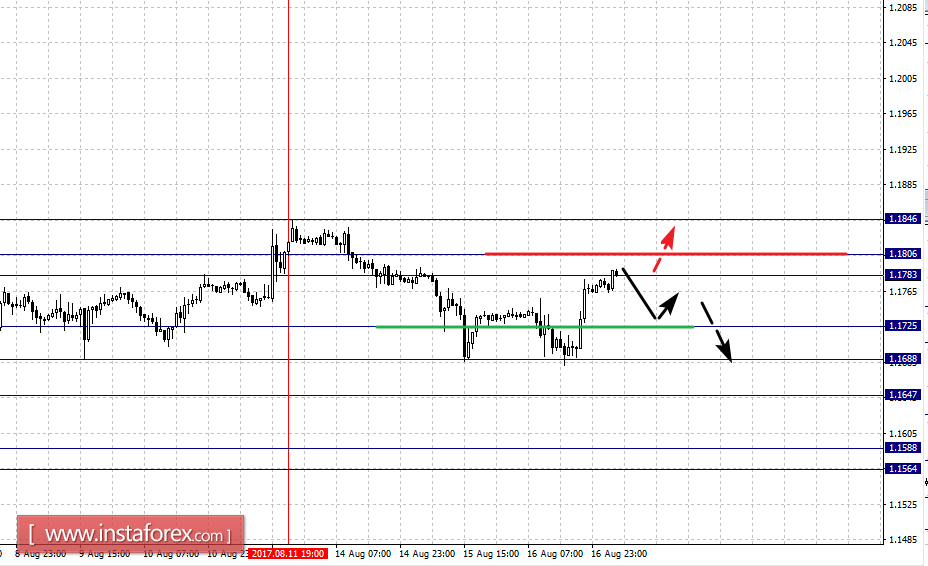

For the EUR/USD pair, the key levels on the scale of H1 are: 1.1846, 1.1806, 1.1783, 1.1688, 1.1647, 1.1588 and 1.1564. Here, the cancellation of the downward structure from August 11 is expected after surpassing the price of the noise range of 1.1783-1.1806. In this case, the first target is 1.1846. The continuation of the downward movement is expected after the breakdown of 1.1725. In this case, the first target is 1.1688. The breakdown of this level will allow us to count on the movement towards the level of 1.1647. Near this level is the consolidation of the price. Breaking the level of 1.1645 should be accompanied by a pronounced movement towards the level of 1.1588, upon reaching which we expect consolidation in the area of 1.1588 - 1.1564.

The main trend is the formation of the downward structure from August 11 which is also the stage of deep correction.

Trading recommendations:

Buy: 1.1807 Take profit: 1.1844

Sell: 1.1725 Take profit: 1.1690

Sell: 1.1686 Take profit: 1.1648

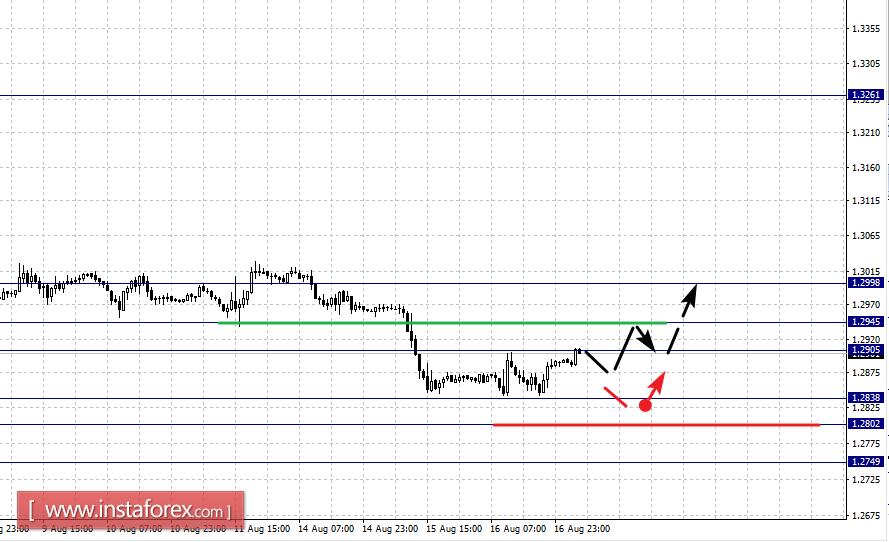

For the GBP/USD pair, the key levels in the scale of H1 are: 1.2998, 1.2945, 1.2905, 1.2838, 1.2802 and 1.2749. Here, we continue to follow the development of the downward structure of August 3. Short-term downward movement is expected in the range of 1.2838 - 1.2802. The breakdown of the last value will lead to a movement to the potential target of 1.2749. From this level, we expect a rollback to correction.

Short-term upward movement is possible in the range of 1.2905 - 1.2945. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.2998. This level is the key support for the bottom.

The main trend is the downward structure of August 3.

Trading recommendations:

Buy: 1.2905 Take profit: 1.2944

Buy: 1.2947 Take profit: 1.2995

Sell: 1.2838 Take profit: 1.2805

Sell: 1.2800 Take profit: 1.2750

For the USD/CHF pair, the key levels on the scale of H1 are: 0.9884, 0.9846, 0.9787, 0.9743, 0.9697, 0.9636 and 0.9583. Here, the level of 0.9636 is the key support for the upward structure. Its breakdown will initiate the development of a downward trend on the scale of H1. In this case, the target is 0.9583. Continued upward movement is expected after the breakdown of 0.9697. In this case, the target is 0.9742. The breakdown of this level will allow us to count on the movement towards the level of 0.9787. Near this level is the consolidation of the price. Breaking the level of 0.9790 should be accompanied by a pronounced upward movement to the level of 0.9846. The potential value for the top is the level of 0.9884.

The main trend is the formation of an upward structure from August 11 which is also a stage of deep correction.

Trading recommendations:

Buy: 0.9697 Take profit: 0.9740

Buy: 0.9744 Take profit: 0.9785

Sell: 0.9634 Take profit: 0.9590

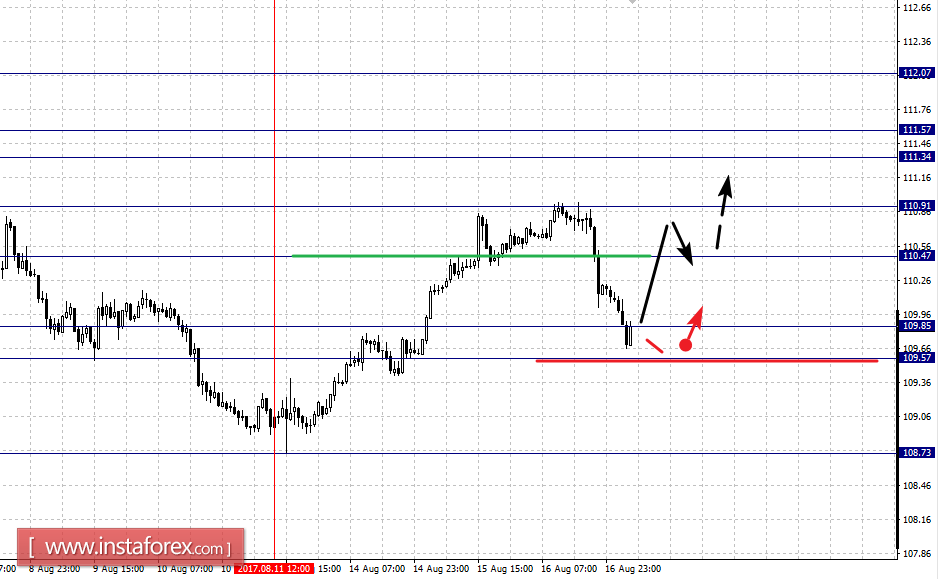

For the USD/JPY pair, the key levels on the scale of H1 are: 112.07, 111.57, 111.34, 110.91, 110.47, 109.85 and 109.57. Here, we follow the development of the upward cycle of August 11. At the moment, the price is in a deep withdrawal into correction. The range of 109.85 - 109.57 is the key support for the top. Continued upward movement is expected after the breakdown of 110.47. In this case, the first target is 110.91. The breakdown of this level will start the development of an upward trend. Here, the target is 111.34. In the area of 111.34 - 111.57 is the consolidation of the price. The potential value for the top is the level 112.07, upon reaching which we expect a pullback downwards.

The main trend is the upward structure of August 11 which is also a stage of deep correction.

Trading recommendations:

Buy: 110.47 Take profit: 110.90

Buy: 110.95 Take profit: 111.34

Sell: 109.55 Take profit: 109.00

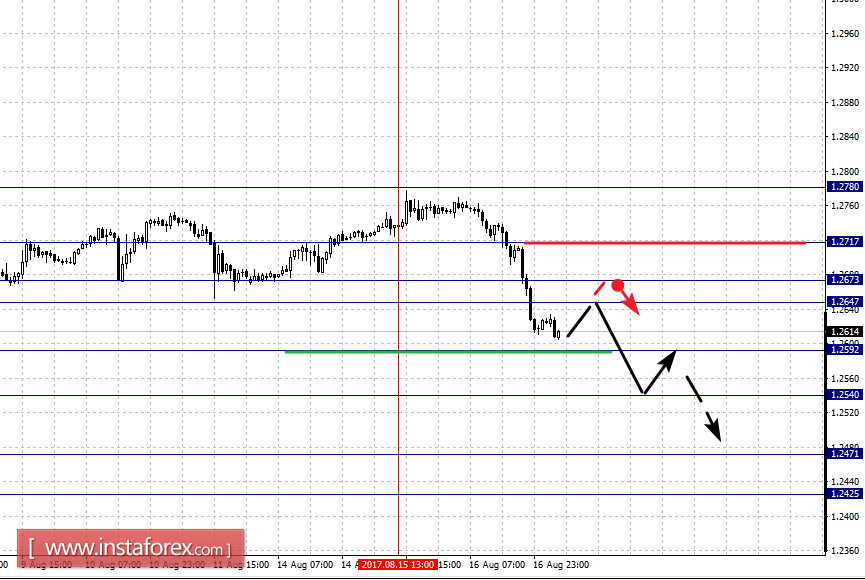

For the CAD/USD pair, the key levels on the scale of H1 are: 1.2717, 1.2673, 1.2647, 1.2592, 1.2540, 1.2471 and 1.2425. Here, we follow the formation of a downward structure from August 15. Continued downward movement is expected after the breakdown of 1.2592. In this case, the target is 1.2540. Near this level is the consolidation of the price. Breaking the level of 1.2540 should be accompanied by a pronounced downward movement. Here, the target is 1.2471. The potential value for the bottom is the level of 1.2425, upon reaching which we expect a move towards correction.

Short-term uptrend is possible in the area of 1.2647 - 1.2673. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2715. This level is the key support for the bottom.

The main trend is the formation of a downward structure from August 15.

Trading recommendations:

Buy: 1.2675 Take profit: 1.2715

Buy: 1.2719 Take profit: 1.2780

Sell: 1.2590 Take profit: 1.2545

Sell: 1.2538 Take profit: 1.2475

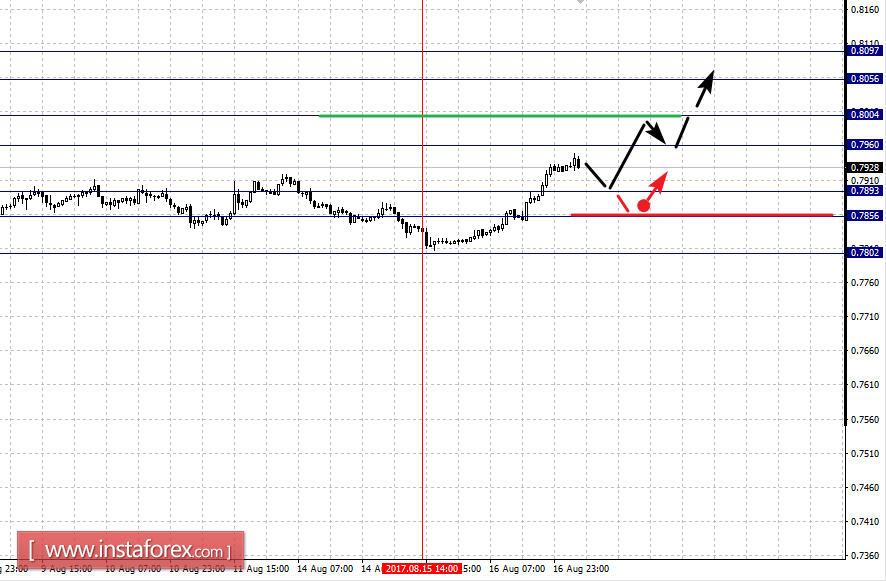

For the AUD/USD pair, the key levels on the H1 scale are: 0.8097, 0.8056, 0.8004 0.7960, 0.7893, 0.7856 and 0.7802. Here, we follow the formation of the upward structure of August 15. Continued upward movement is expected after the breakdown of 0.7960. In this case, the target is 0.8004. In this range is consolidation. Breaking the level of 0.8006 will allow us to count on the movement to the level of 0.8056. The potential value for the top is the level of 0.8097, from which we expect a pullback downwards.

Short-term downward movement is possible in the range of 0.7893 - 0.7856. Hence, the probability of a turn up is high. The breakdown of the level of 0.7856 will have a downward structure. Here, the first target is 0.7802.

The main trend is the upward structure of August 15.

Trading recommendations:

Buy: 0.7960 Take profit: 0.8002

Buy: 0.8006 Take profit: 0.8055

Sell: 0.7890 Take profit: 0.7857

Sell: 0.7854 Take profit: 0.7802

For the EUR/JPY pair, the key levels on the scale of H1 are: 131.34, 130.88, 130.26, 129.98, 129.25, 128.83 and 128.03. Here, we monitor the formation of the initial conditions for the upward cycle of August 11. At the moment, it is important to know whether or not the GBP / JPY will abolish the initial conditions of August 11. Continued development of the upward trend is expected after surpassing at the price of the noise range of 129.98 - 130.26. In this case, the target is 130.88. Potential value for the top is the level of 131.34, upon reaching which we expect a rollback to correction.

Short-term downward movement is possible in the area of 129.25 - 128.83. The breakdown of the latter value will lead to the development of a downward structure. In this case, the target is 128.03.

The main trend is the formation of the upward structure of August 11.

Trading recommendations:

Buy: 130.26 Take profit: 130.85

Buy: 130.90 Take profit: 131.30

Sell: 129.25 Take profit: 128.85

Sell: 128.78 Take profit: 128.10

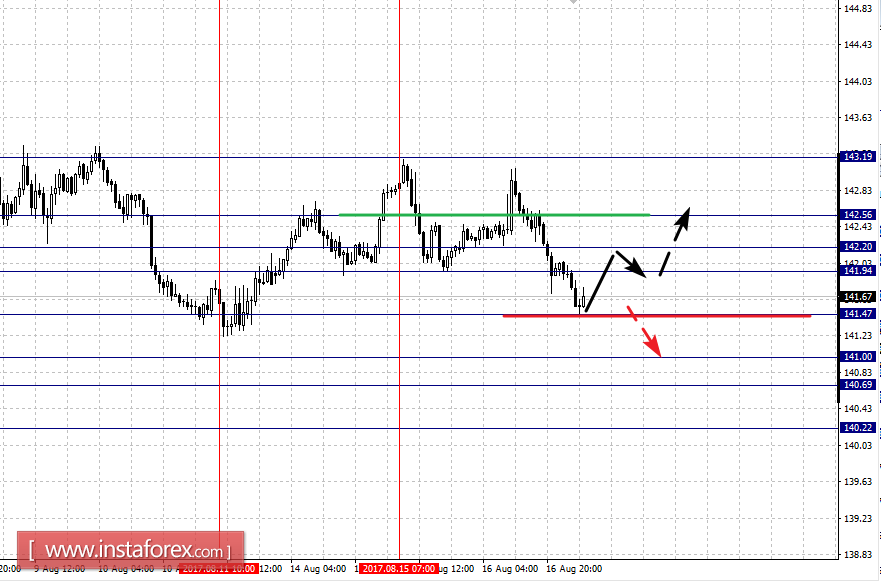

For the GBP/JPY pair, the key levels on the scale of H1 are: 143.19, 142.56, 142.20, 141.94, 141.47, 141.00, 140.69 and 140.22. Here, the lifting of the upward structure from August 11 is possible after the breakdown of 141.47. In this case, the first target is 141.00. In the area of 141.00 - 140.69 is the consolidation of the price. Potential value for the bottom is the level of 140.22, near which we expect consolidation.

Short-term upward movement is possible in the area of 141.94 - 142.20. The breakdown of the last value will lead to an in-depth correction. Here, the target is 142.56. This level is the key support for the downward structure from August 15. Its breakdown will have an upward structure. In this case, the potential target is 143.19.

The main trend is a deep correction from the upward structure of August 11.

Trading recommendations:

Buy: 142.20 Take profit: 142.52

Buy: 142.60 Take profit: 143.15

Sell: 141.44 Take profit: 141.05

Sell: 140.65 Take profit: 140.33

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română