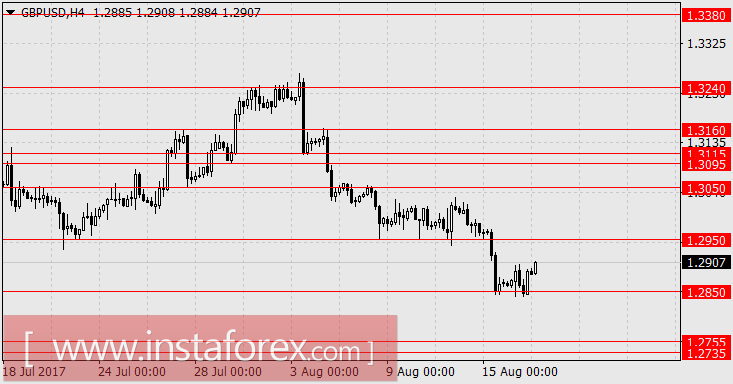

EUR / USD, GBP / USD

News agencies continue to confuse investors.

Actually, the Fed's Committee did not express any fears for inflation.

In the beginning of the Fed's contract of the balance in the minutes, hinting for the month of September stated: "The committee plans to begin the program for the normalization of the balance in a relatively short time."

The ECB representative Ardo Hansson (Estonian Central Bank) spoke on the same day and said that the impact of curbing QE program's on the market will be minimal, as the ECB's balance sheet will already be heavily loaded and will support itself the economy. Thus, the investors reacted again to the flow of information inadequately despite the British pound failed to rise amid a positive data on labor where the unemployment rate in June fell from 4.5% to 4, 4%. The indicator was expected to remain unchanged with the average wage increased by 2.1% against expectations of 1.8%.

In the US, the pace of construction has slightly decreased.

Today, an interest will develop on the protocol from the ECB meeting (11.30 London time).

The euro zone's trade balance for June is expected to grow from 19.7 billion euros to 20.4 billion.

In the US, the industrial production is expected to recover from 76.6% to 76.7%.

We are waiting for the decline of the euro to 1.1640 and the decline of the British pound in the range of 1.2735 / 55.

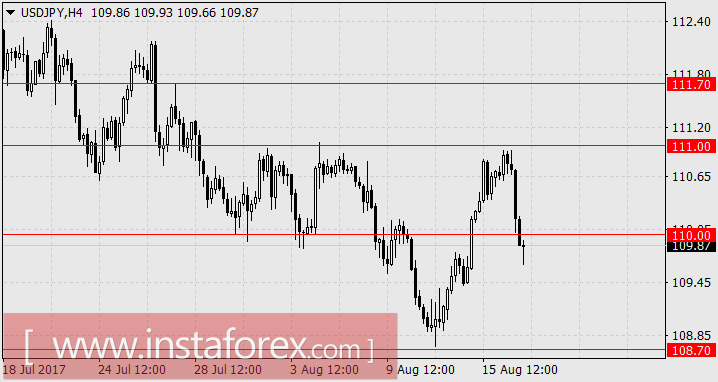

USD / JPY

The Japanese yen failed repeatedly in an attempt to break away from a technically uncomfortable level at 110.00 which happens when the dollar falls against European currencies. It is because of the speculators in the euro. This means that yen's growth potential is quite high and it will take advantage of any weakness of the euro. Today, excellent trade balance indicators were published for July assessment. Taking into account seasonal variations, Trade Balance amounted to 340 billion yen against 90 billion yen in June. The forecast was 190 billion yen. Exports increased from 9.7% y / y to 13.4% y / y, which is an increase for the eighth month in a row. Import increased from 15.5% y / y to 16.3% y / y. The Nikkei225 stock index falls unreasonably by 0.05%, while the Chinese Shanghai Composite up by 0.38% despite all negative trends this week. The American market (S&P500) added 0.14% yesterday. Perhaps, there are fears on worsening of relations between the United States and North Korea in connection with the joint military exercises between the United States and South Korea starting on the 21st.

We are waiting for the yen to return to 111.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română