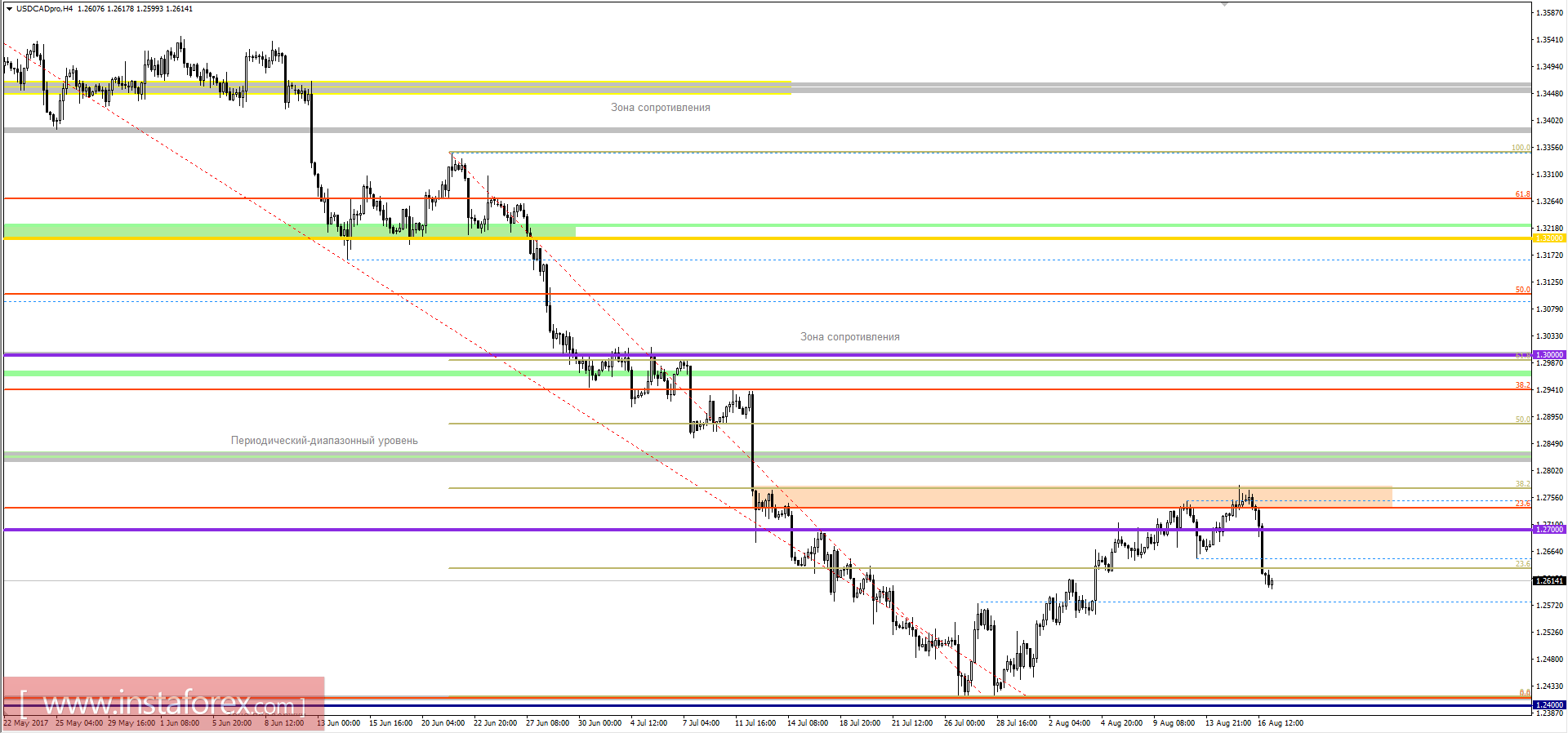

On the four-hour chart, we can observe an intense downward movement, where the currency pair, gaining from the value of 1.2770 (a cluster of Fibo levels), jerked down, drawing a pulse candle. Now we see how the quotation slightly reduced volatility, but still holding a "bearish" interest. Probably assume that we will see a temporary pullback or a stagnation within the values of 1.2580 / 1.2635, where the "bears" will try to regroup and again return to the market. In case of a coincidence of the forecast, we expect further downward movement to the values of 1.2500 / 1.2420

Key levels

Resistance - 1.2700; 1.2840; 1.3000 (+/- 30p).

Support - 1,2400; 1.2200; 1.2000.

Signals

- Buying a pair is recommended to make at a price above 1.2660, with the prospect of a move to 1.2700 / 1.2750.

- Selling a pair is recommended to be made at a price below 1.2580, with the prospect of a move to 1.2500 / 1.2420.

Note: Forecasts are not a direct guide to action!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română