Today, European news will have a strong impact on the market. First, the data on inflation will come out, which should remain at the same level. But this is on an annual basis, so all attention to the monthly data. But they can bring a lot of surprises because in a monthly comparison, consumer prices should show a reduction of 0.5%. Naturally, this will not add optimism to the single European currency. After the data on inflation, the text of the minutes of the ECB's meeting on the monetary policy is published. Considering the fact that even when inflation grew, the ECB did not particularly want to hint at a possible increase in the refinancing rate, so with all signs of its slowdown, it is not worth hoping. In the text of the protocol there will be no indications of a possible tightening of monetary policy, which, coupled with a decline in consumer prices, will further weaken the euro.

Already towards evening, the dollar will be able to consolidate its success due to data on industrial production, the growth rate of which should accelerate from 2.0% to 2.1%.

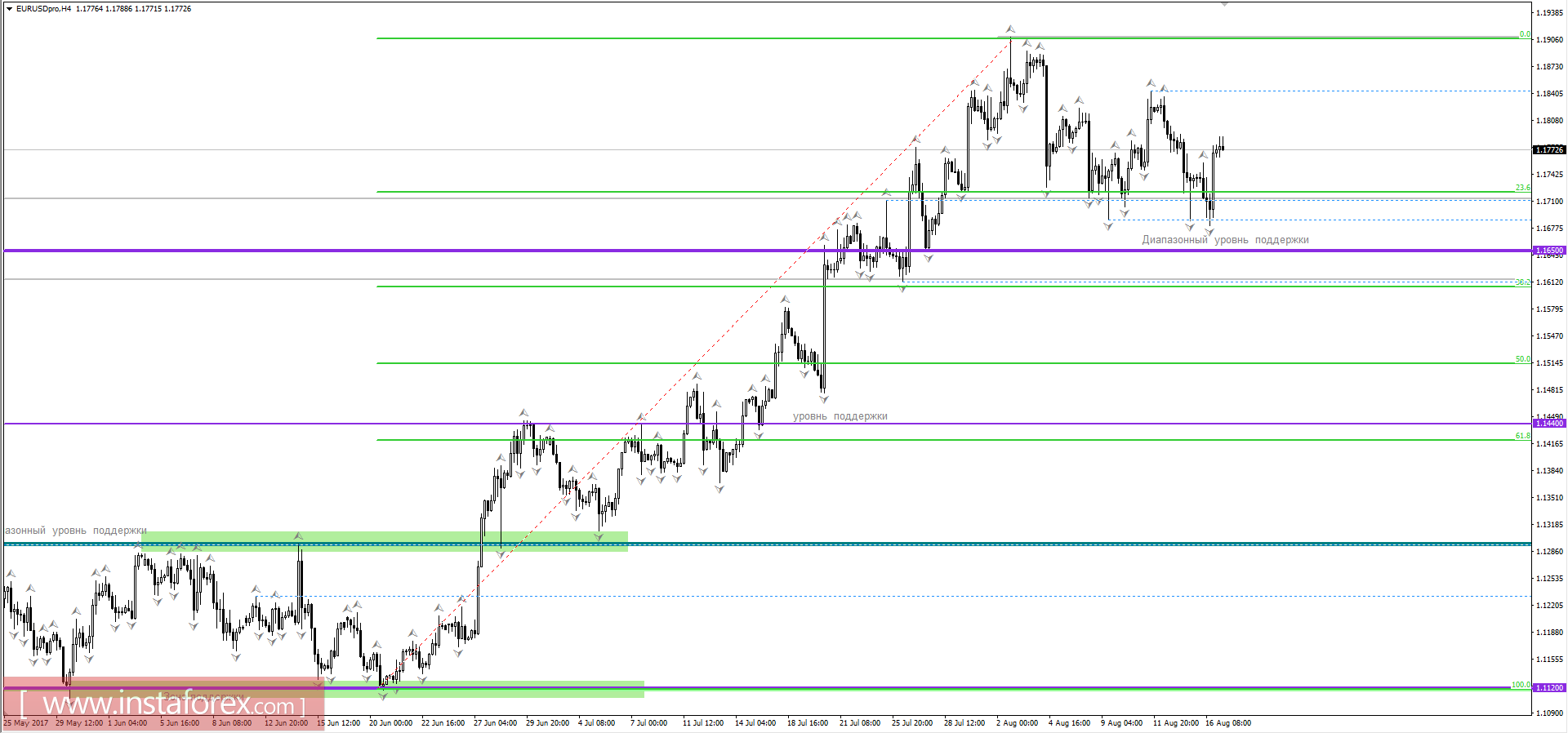

The currency pair euro/dollar, practicing the range level of 1.1650, jerked up, forming a pulse candle. It is likely that the volatility will subside, giving the opportunity for the bears to adjust the quotation to the values of 1.1715 / 1.1690, thereby returning us to the range level.

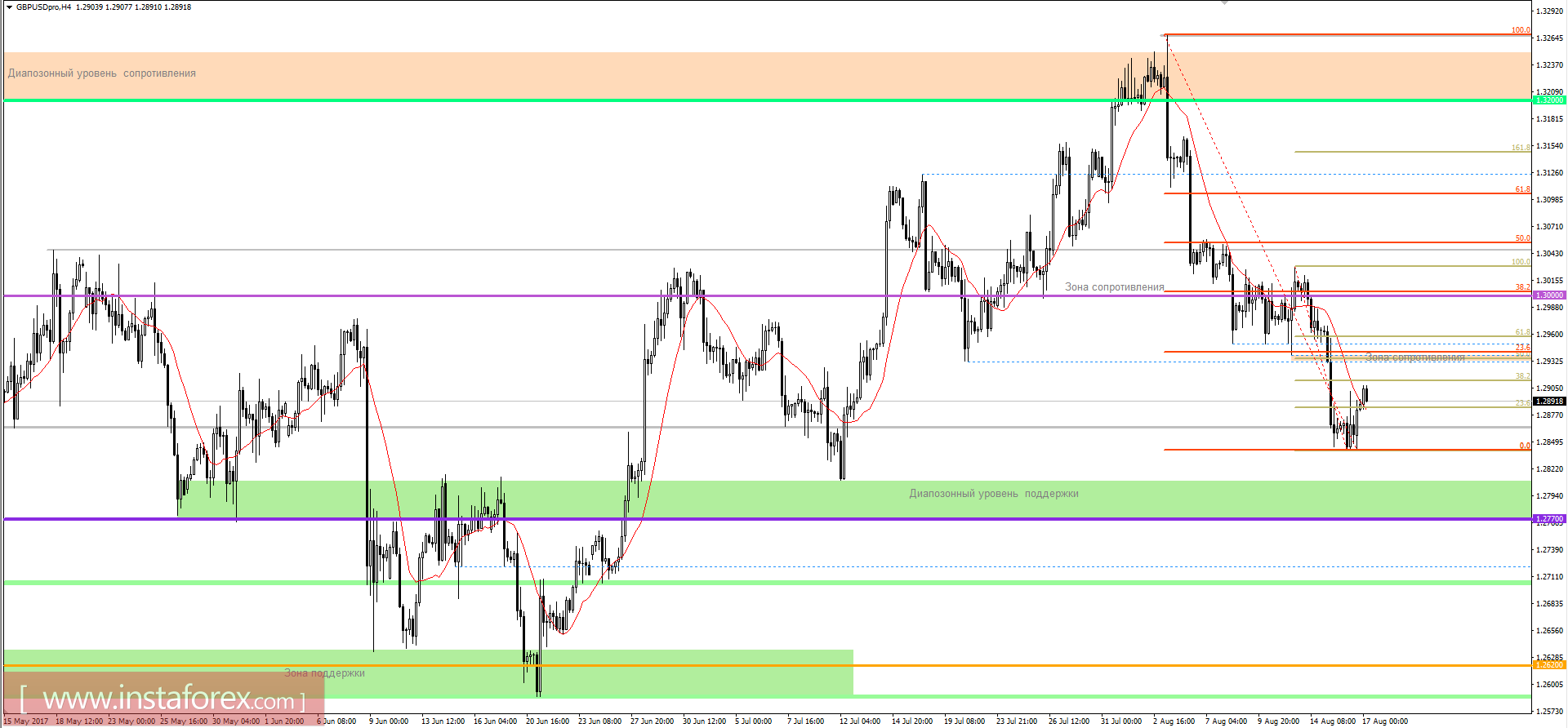

The pound/dollar currency pair will also be cheaper due to the growth of the dollar index, provoked by the weakening of the single European currency and the benchmark is 1.2825.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română