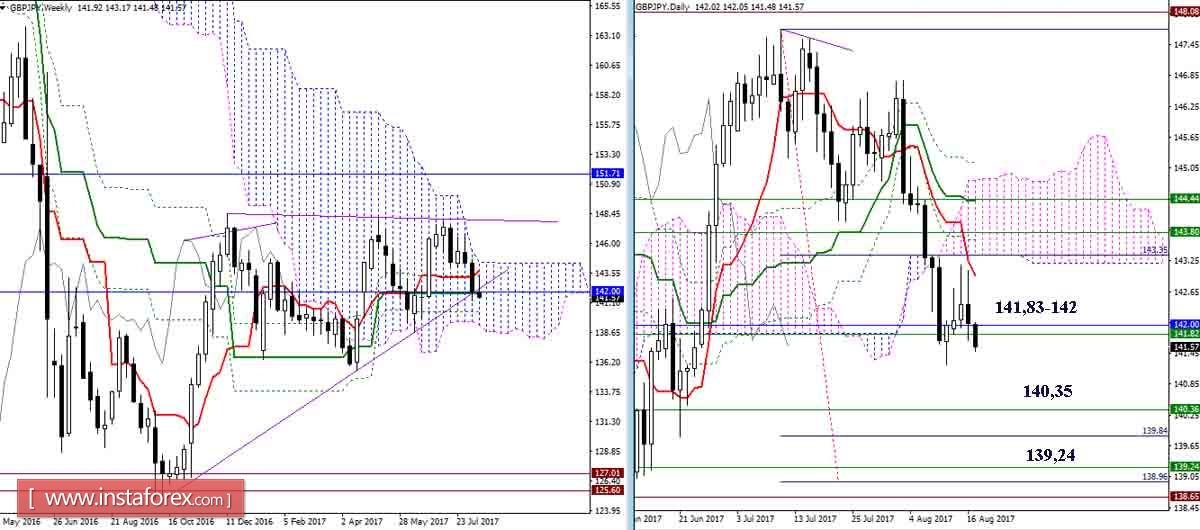

GBP/JPY

In the past day, the pair again formed a long upper shadow and closed the day with a candle with a bearish body, but it remained above the supports (weekly Kijun 141.83 + monthly Tenkan 142.00). As a result, the main task for the bears is now to overcome the supports and descend to the minimum extremum (141.23). Restoration of the downward trend will open the way to weekly levels (140.35 + 139.24) and allow us to consider the execution of the daily downward target on the breakdown of the cloud.

At the lower time frames, the pair executed the descending target for the breakdown of the H1 cloud on the first target, and descended to support (141,83-142), but this is not enough for the final victory. Now for players on the downgrade, it is important to gain a foothold not only under the support, but also at a minimum (141,23), confirming at the senior times the fixing data. If bears now can not overcome the attraction and influence of support (141,83-142), then it is necessary to note the resistance that can affect the situation. The nearest resistance is 142.27-52 (cloud H1 + Kijun H1 + cross H4), then there is a wide zone formed by the cloud H4 and the levels of the higher halves (142.95 - 143.37 - 143.80 - 144.44).

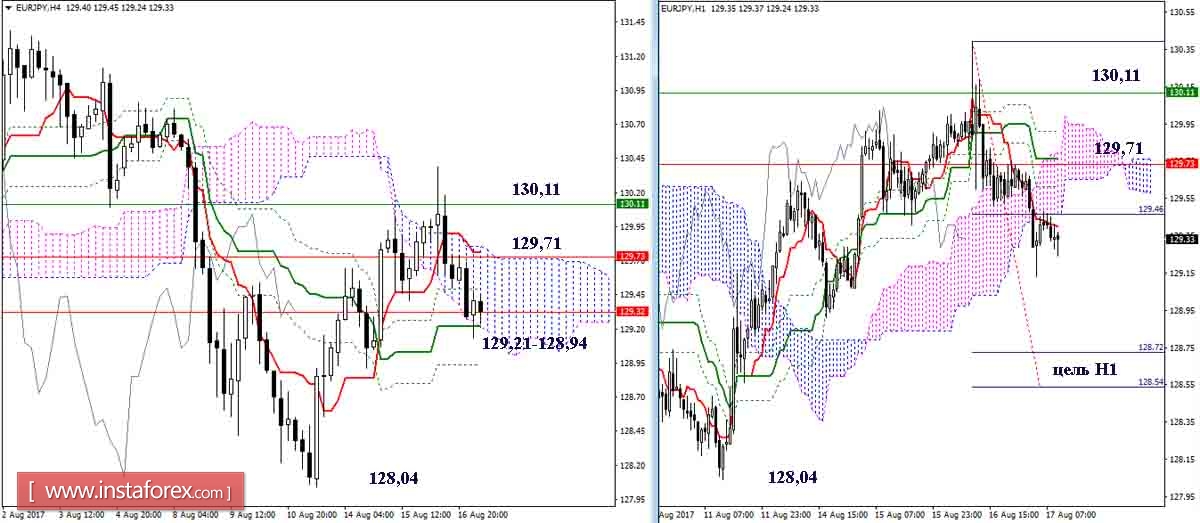

EUR / JPY

Bears are trying to complete testing the resistance of the daytime dead cross (Kijun 129.71 + Fibo Kijun 130.11). Confirmation in the coming days bearish sentiment will allow to continue the decline and perform a weekly correction to Tenkan (127.52). Weekly short-term trend joined forces with the monthly Fibo Kijun (127.73) and a daytime cloud.

Today, the key resistance retained its position at 129.71 (Tenkan N4 + Senkou Span B N4 + Kijun N1 + N1 cloud + daytime Kijun) and 130.11 (daytime Fibo Kijun). At the moment, the pair has descended into the support area, formed by the levels of different time intervals. The release from the supports of the day cross (129.32) and the cross H4 (129,21-94) will allow considering further reduction and fulfillment of the goal of H1. An important guide for the bears will be to overcome the minimum extremum (128.04).

Indicator parameters:

All time intervals 9 - 26 - 52

The color of the indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun - green dotted line,

Chinkou - gray,

Clouds: Senkou Span B (SSB, long-term Trend) - blue,

Senkou Span A (SSA) - pink.

The color of the additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română