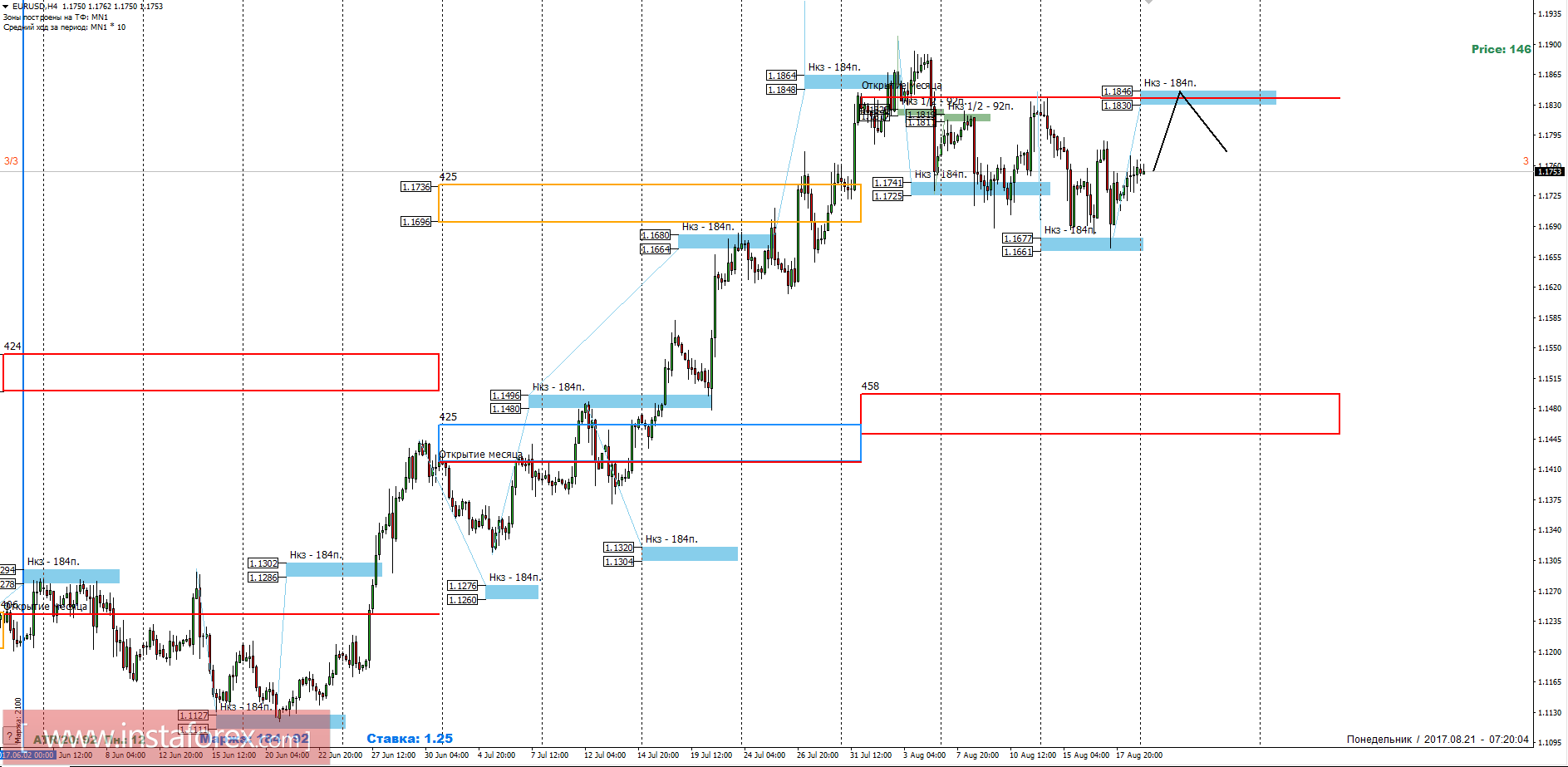

Last week, a short-term shortage of 1.1677-1.1661 occurred, which led to the emergence of large demand. In the case of continuation of the upward movement, the first goal of growth will be the weekly short-term fault of 1.1846-1.1830.

Medium-term plan.

The pair continues to form a correction model for the latest medium-term growth. Last week, the next weekly short-term fault of 1.1677-1.1661 was tested. To continue the growth and update the monthly maximum, you need to consolidate above the level of 1.1846 in one of the American sessions. The junior time frame has already formed a reversal pattern, which could be the first push in the continuation of the upward medium-term impulse. It is important to understand that impulse movement often has a continuation, so the search for entry points in the buy-in should be considered when the rate decreases.

For the formation of an alternative model, it is necessary to absorb the growth of the end of last week and consolidate below the local minimum of the month. This will open the way for the fall, where the target will be the monthly short-term fault of August.

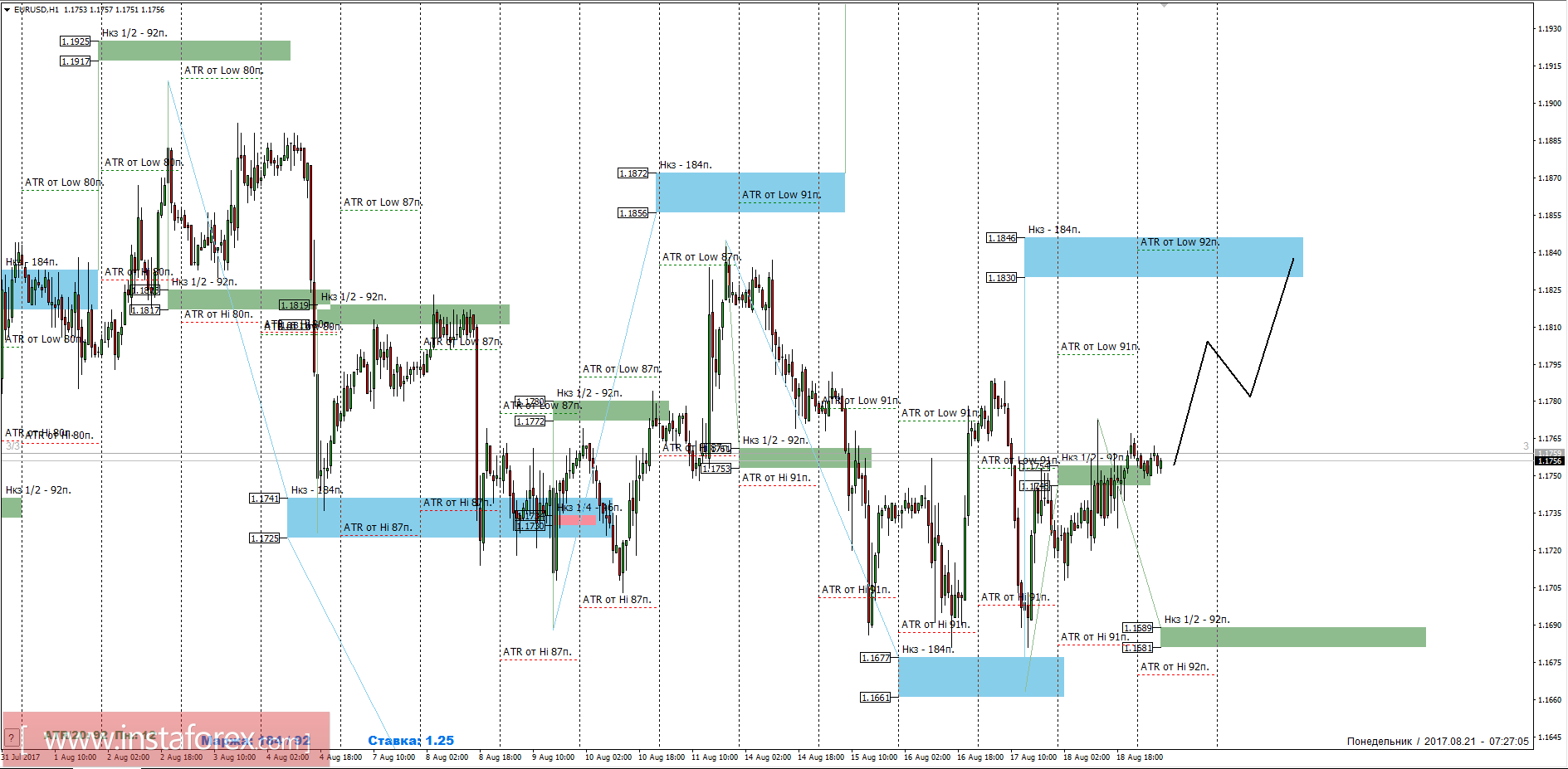

Intraday plan.

At the end of last week, a reversal pattern was formed in the direction of strengthening the Euro exchange rate. The breakdown and anchoring above the NCP 1/2 1.1754-1.1746 opens the way for growth to the week-long fault of 1.1846-1.1830. Any decrease in the pair should be considered as an opportunity to get more favorable prices for the purchase of the instrument. The decisive support will be made by the NCP 1/2 1.1689-1.1681. While the pair is trading above this zone, the upward model will have priority status.

The daytime short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română