Dear colleagues.

The Euro / Dollar pair follow the formation of the upward structure of August 17. For the Pound / Dollar pair, we still expect the development of the upward movement to reach the level of 1.2998. For the pair USD / Franc, we expect the development of the downward structure from August 16 after the breakdown of 0.9579. For the pair Dollar / Yen, the price is still in the correction zone from the descending structure on August 16. For the Euro / Yen pair, we follow the formation of the downward structure from August 16, the level of 129.60 is the key support for the bottom. For the Pound / Yen pair, the price is still in the correction area, the continuation of the movement downwards is possible after the breakdown of 139.90.

Forecast for August 22:

Analytical review of currency pairs on the scale of H1:

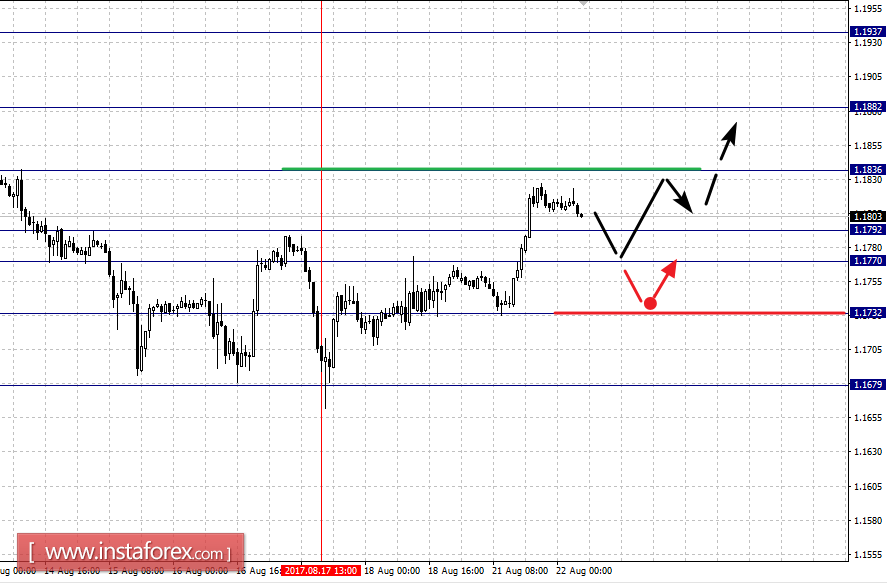

For the pair Euro / Dollar, the key levels on the scale of H1 are: 1.1937, 1.1882, 1.1836, 1.1792, 1.1770 and 1.1732. Here, we follow the formation of the ascending structure of August 17. The continuation of the upward movement is expected after the breakdown of 1.1836. In this case, the target is 1.1882 and near this level the consolidation of the price. The potential value for the top is still 1.1937, after which we expect a rollback to correction.

The short-term downward movement is possible in the corridor of 1.1792 - 1.1770 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1732 and this level is the key support for the top.

The main trend is the formation of the ascending structure of August 17.

Trading recommendations:

Buy: 1.1836 Take profit: 1.1880

Buy: 1.1884 Take profit: 1.1935

Sell: 1.1790 Take profit: 1.1773

Sell: 1.1768 Take profit: 1.1735

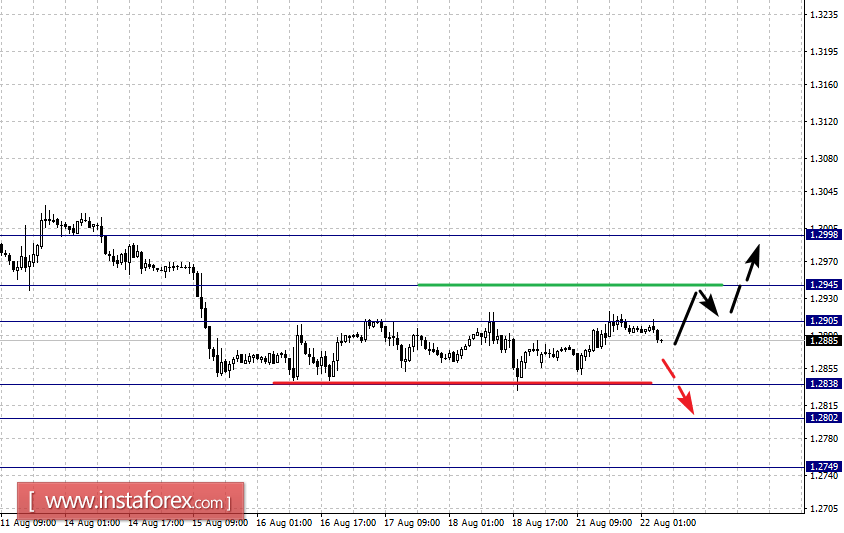

For the Pound / Dollar pair, the key levels on the scale of H1 are: 1.2998, 1.2945, 1.2905, 1.2838, 1.2802 and 1.2749. Here, we continue to follow the development of the downward structure from August 3. The upward movement is considered as a correction. The short-term downward movement is expected in the range of 1.2838 - 1.2802 and the breakdown of the last value will lead to a movement to the potential target of 1.2749, from this level we expect a rollback to correction.

The short-term upward movement is possible in the range of 1.2905 - 1.2945 and the breakdown of the latter value will lead to an in-depth movement. Here, the target is 1.2998 and this level is the key support for the bottom.

The main trend is the downward structure of August 3.

Trading recommendations:

Buy: 1.2905 Take profit: 1.2944

Buy: 1.2947 Take profit: 1.2995

Sell: 1.2838 Take profit: 1.2805

Sell: 1.2800 Take profit: 1.2750

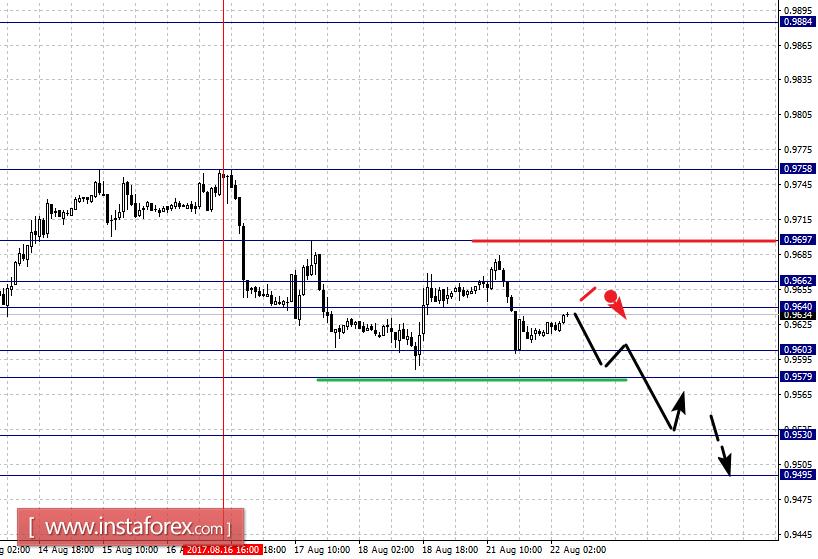

For the pair Dollar / Franc, the key levels on the scale of H1 are: 0.9697, 0.9662, 0.9640, 0.9603, 0.9579, 0.9530 and 0.9495. Here, the price forms the potential for the downward cycle from August 16 and the breakdown at the level of 0.9603 will begin the development of this structure. Here, the first target is 0.9579 and the breakdown of 0.9579 should be accompanied by a pronounced downward movement to the level of 0.9530. The potential value for the bottom is the level of 0.9495, upon which we expect consolidation, as well as a rollback to the top.

The short-term upward movement is possible in the corridor of 0.9640 - 0.9662 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 0.9697 and this level is the key support for the downward structure from August 16.

The main trend is the formation of a downward structure from August 16.

Trading recommendations:

Buy: 0.9640 Take profit: 0.9660

Buy: 0.9664 Take profit: 0.9695

Sell: 0.9603 Take profit: 0.9580

Sell: 0.9575 Take profit: 0.9530

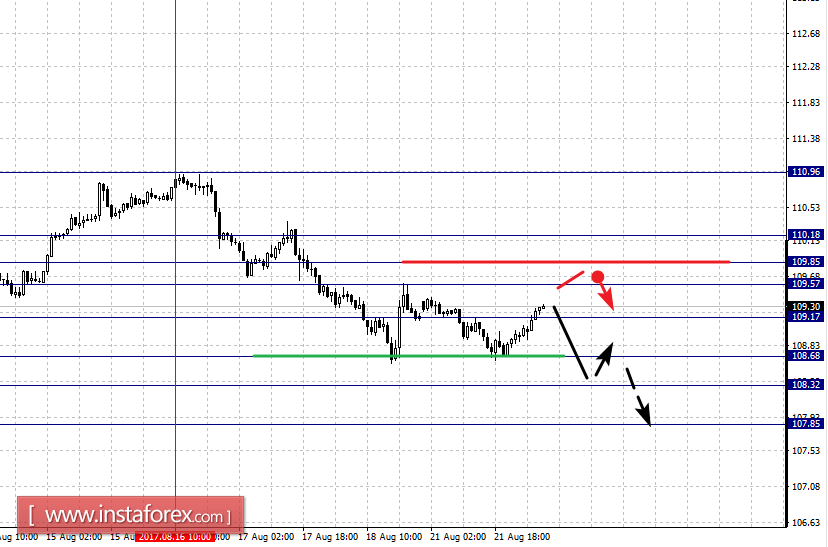

For the pair Dollar / Yen, the key levels on the scale of H1 are: 110.18, 109.85, 109.57, 109.17, 108.68, 108.32 and 107.85. Here, we follow the formation of a downward structure from August 16. The continuation of the downward movement is expected after the breakdown of 109.15. In this case, the target is 108.68 and the breakdown of which will lead to a short-term downward movement to the level of 108.32. In the corridor of 108.68 -108.32 is the consolidation of the price. The potential value for the bottom is the level of 107.85.

The short-term upward movement is possible in the corridor of 109.57 - 109.85 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 110.18 and this level is the key support for the downward structure of August 16.

The main trend is the downward structure of August 16.

Trading recommendations:

Buy: 109.57 Take profit: 109.85

Buy: 109.87 Take profit: 110.15

Sell: 109.15 Take profit: 108.70

Sell: 108.65 Take profit: 108.36

For the Canadian Dollar / Dollar pair, the key levels on the scale of H1 are: 1.2717, 1.2658, 1.2618, 1.2540, 1.2471, 1.2441 and 1.2392. Here, we follow the formation of a downward structure from August 15. The continued downward movement is expected after the breakdown of 1.2540. In this case, the target is 1.2471 and in the corridor of 1.2441 - 1.2471 is the consolidation of the price. The potential value for the bottom is the level of 1.2392, upon attainment of which we expect the departure to correction.

The short-term upward movement is possible in the corridor of 1.2618 - 1.2658 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 1.2717.

The main trend is the downward structure of August 15.

Trading recommendations:

Buy: 1.2618 Take profit: 1.2655

Buy: 1.2660 Take profit: 1.2715

Sell: 1.2540 Take profit: 1.2471

Sell: 1.2440 Take profit: 1.2395

For the Australian Dollar / Dollar pair, the key levels on the scale of H1 are: 0.8097, 0.8056, 0.8004 0.7960, 0.7893, 0.7856 and 0.7802. Here, we continue to follow the formation of the upward structure of August 15. The continued upward movement is expected after the breakdown of 0.7960. In this case, the target is 0.8004 and in this range is the consolidation. The break of the level of 0.8006 will allow to count on the movement to the level of 0.8056. The potential value for the top is the level 0.8097, from which we expect a pullback downwards.

The short-term downward movement is possible in the range of 0.7893 - 0.7856, hence the probability of a turn up is high. The breakdown of the level of 0.7856 will have a downward structure. Here, the first target is 0.7802.

The main trend is the ascending structure of August 15.

Trading recommendations:

Buy: 0.7960 Take profit: 0.8002

Buy: 0.8006 Take profit: 0.8055

Sell: 0.7890 Take profit: 0.7857

Sell: 0.7854 Take profit: 0.7802

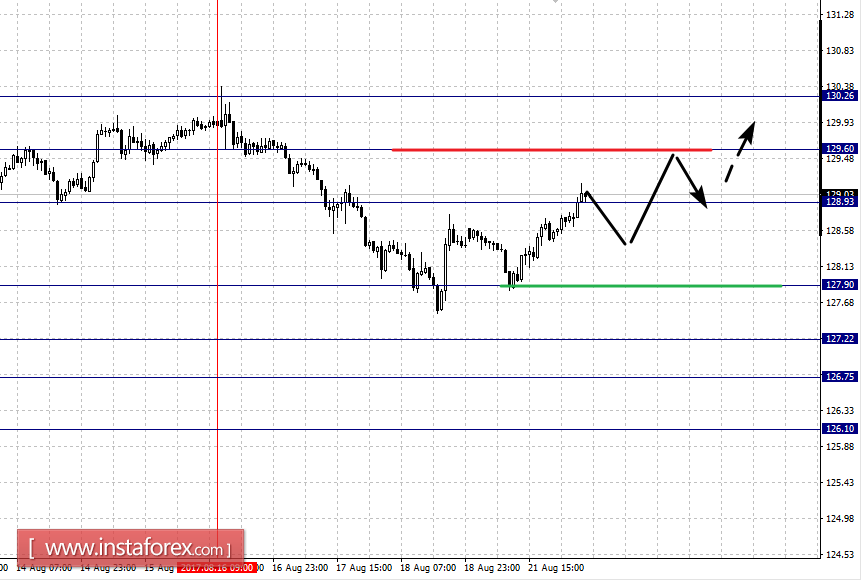

For the Euro / Yen pair, the key levels on the scale of H1 are: 129.60, 128.93, 127.90, 127.22, 126.75 and 126.10. Here, we follow the formation of a downward structure from August 16. Currently, the price is in the area of the initial conditions. The continued downward movement is expected after the breakdown of 127.90. In this case, the target is 127.22, upon achievement of this goal we expect consolidation in the range of 127.22 - 126.75. The potential value for the bottom is the level of 126.10, upon attainment of which we expect a departure to correction.

The short-term upward movement is possible in the corridor of 128.93 - 129.60. The latter is the key support for the downward structure from August 16 and its breakdown will have to form an upward structure. Here, the potential target is 130.26.

The main trend is the formation of a downward structure from August 16.

Trading recommendations:

Buy: 129.65 Take profit: 130.22

Buy: 128.95 Take profit: 129.55

Sell: 127.90 Take profit: 127.30

Sell: 127.20 Take profit: 126.80

For the Pound / Yen pair, the key levels on the scale of H1 are: 141.94, 141.47, 141.12, 140.22, 139.92 and 139.31. Here, we follow the development of the downward cycle from August 15. The current price is in the correction area. The continued downward movement is expected after the pass at the price range of 140.22 - 139.92. In this case, the target is 139.31, upon reaching which we expect a rollback to correction.

The short-term upward movement is possible in the corridor of 141.12 - 141.47 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 141.94 and this level is the key support for the downward structure from August 15, before it we expect formalized initial conditions for the upward cycle.

The main trend is the downward cycle from August 15, the correction stage.

Trading recommendations:

Buy: 141.12 Take profit: 141.45

Buy: 141.55 Take profit: 141.94

Sell: 140.22 Take profit: 139.94

Sell: 139.88 Take profit: 139.40

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română