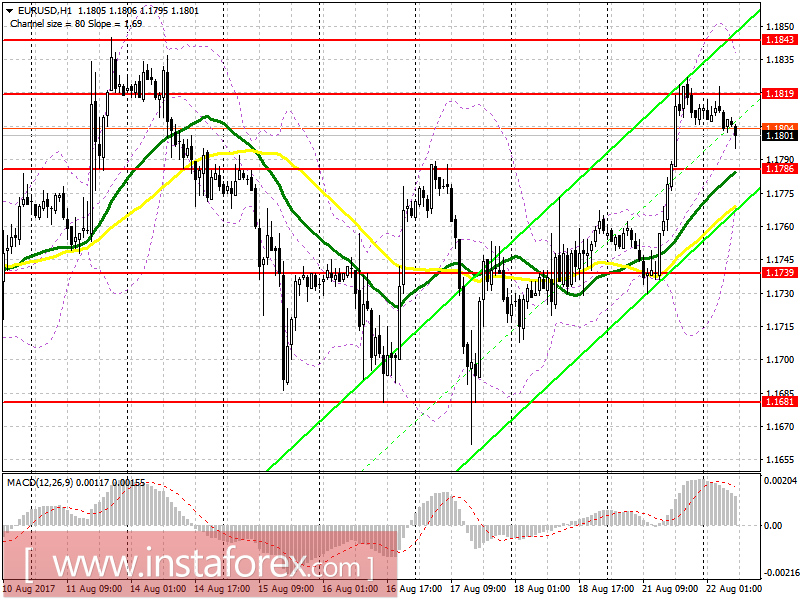

EUR / USD

To open long positions for EUR/USD, it is required:

The large growth of the euro against the backdrop of low trading volume led to a review of important resistance levels. At the moment, the euro is better to go back to buying after upgrading the support of 1.1786, when there is a false breakdown there, or on a rebound from 1.1739. In the case of consolidation above 1.1819, you can also look at purchases to update the new weekly highs around 1.1843 and 1.1874.

To open short positions for EUR/USD, it is required:

Sellers will count on the breakdown and consolidation below 1.1786, which will lead to a fall of the pair already in the support area of 1.1739. The formation of a false breakdown at 1.1819 or higher at 1.1843 will also be a signal for an increase in short positions in the euro. In the case of larger growth, the return to EUR / USD sales is best for a rebound of 1.1874.

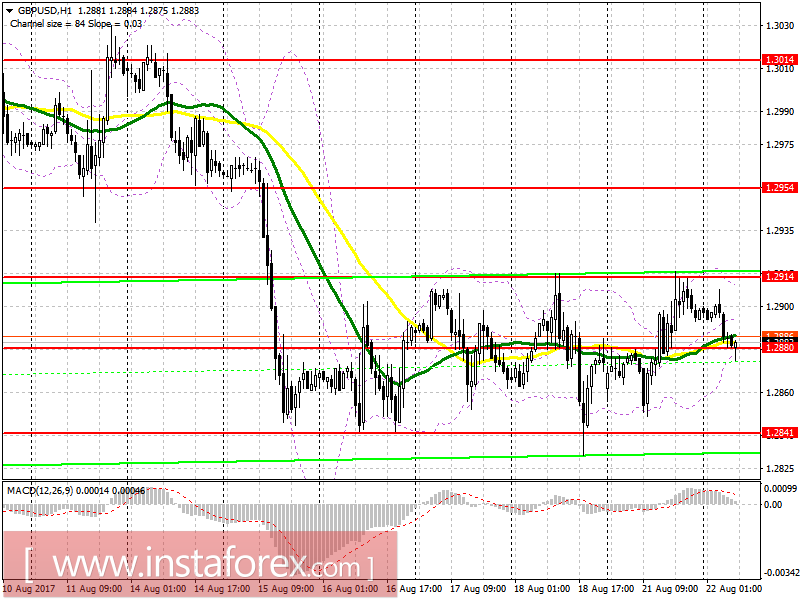

GBP / USD

To open long positions for GBP/USD, it is required:

As long as the pair is above 1.2879, you can count on continued growth. False breakdown of 1.2879 and a return to this level will also be a good signal to increase long positions with the main target of breakdown and consolidation above 1.2914, where a new weekly maximum of 1.2954 opens, where I recommend fixing profits. In the event of a pound drop below 1.2879, it is best to go back to the purchases to rebound from 1.2841.

To open short positions for GBP/USD, it is required:

Sellers will count on the breakdown and consolidation below 1.2879, which opens the possibility of reducing the pair to the lower channel boundary area of 1.2841. In case of pound growth, I recommend that you watch sales after failing to secure and return to the level of 1.2914, or to rebound from the large resistance 1.2954.

Indicators

MA (medium sliding) 50 days - yellow

MA (medium sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română