The financial markets have become incredibly boring. The summer factors, the absence of important economic news, as well as the expectation of the results of the meeting of the leaders of the world's largest central bank leaders at the forum in Jackson Hole constrained the markets.

On the eve of the symposium in Jackson Hole, investors are trying to understand two very important things for themselves. First - will the Fed for the third time raise rates this year or not.Everything thus far speaks against this. These are the lack of continued growth in inflation, according to the latest data, as well as some slowdown in economic growth in the United States.

The second event that the markets are eagerly awaiting is the speech of ECB President M. Draghi. In the eurozone, as well as in the United States, recent months have seen a lack of inflation and, most importantly, a sharp drop in economic growth in Germany in the second quarter to 0.8% after surging during the first quarter by 3.5%. Germany, by the way, is the economic powerhouse of the eurozone.

After very obscure comments from Draghi earlier, who convinced the market that the central bank will go to liquidate the quantitative easing program in 2018, investors are in a state of confusion, asking themselves the question, so will the ECB turn in the direction of tightening monetary policy? And the answer to this question is not so explicit as, for example, it was two months ago.

Markets are increasingly inclined to think that the European regulator will not make such a decision. In our opinion, the decision of the central bank can be half-hearted. Under the pressure of market expectations, and with investors are still considering the possibility of the end the stimulation of the economy, and the stalling inflation against the backdrop of a decline in economic growth in the FRG, the ECB will exit the stimulus program, for example, until mid-2018, but it may reduce its volume of purchases from the current 60 billion euros a month to 30 or 40 billion euros a month, explaining such move by the fact that the sudden halt of inflationary pressures forces the bank to monitor the situation more closely and thereby delay its decision to stop supporting the European economy. If such a message comes from the ECB, the local growth of the euro will come to an end and it will be possible to expect a reversal of the single currency to a downward trend. But with regard to M. Draghi's speech, it is likely to be vague, which may put pressure on the euro, as it will confirm the worst fears of investors that the ECB will not dare to liquidate the quantitative easing program.

Forecast of the day:

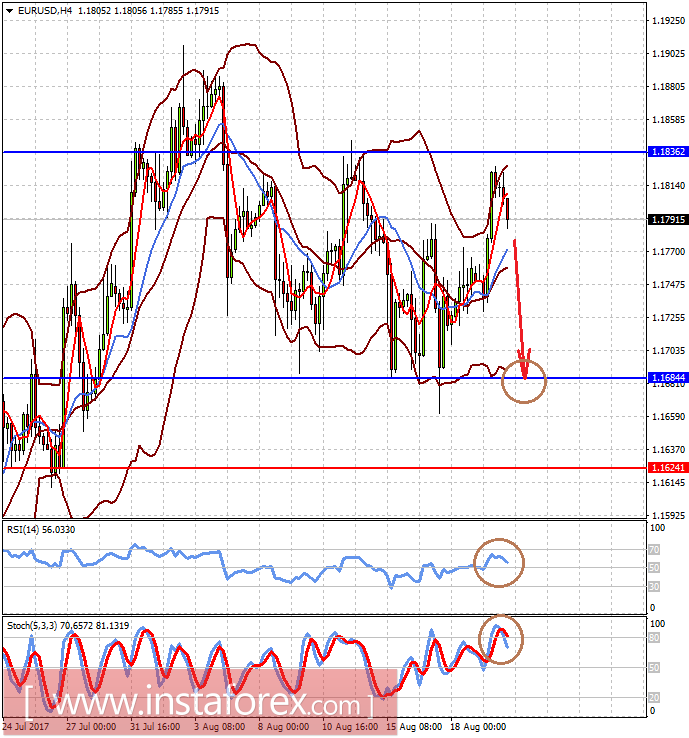

The EURUSD pair is trading in the range of 1.1685-1.1835. It is likely that today it will remain in it. Proceeding from this, it can be assumed that the price will "go" to the lower limit of this range - 1.1685.

The USDJPY pair found support at around 108.75. It is likely that against the background of a decrease in the degree of tension in geopolitics, as well as a strong technical oversold price, we should expect its movement to 110.90 after overcoming the level of 109.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română