Bitcoin managed to win back some of its losses and stopped around 4,000 dollars. After the partial price recovery, investors decided to take a short pause and noted the reaction of monetary authorities. It is not necessary for the Bank of China to wait for further actions since the imposed restrictions are already quite tough. The Chinese central bank itself needs time to evaluate the effect of its own actions. Other central banks are not yet rushing to repeat its actions, while the ECB and the Federal Reserve are engaged in completely different issues. At the same time, Bitcoin might react to the statements for today during the Janet Yellen press conference, which will take place immediately after the meeting of the Federal Open Market Committee on open market operations. If the Fed Chair stated for the possible increase in the refinancing rate scheduled in December, the growth of Bitcoin may stop, as investors are preparing for this event and the capitals will benefit the dollar and the stock market. If Janet Yellen does not justify the investors' hopes, Bitcoin may begin to recover to its highs.

Technical picture

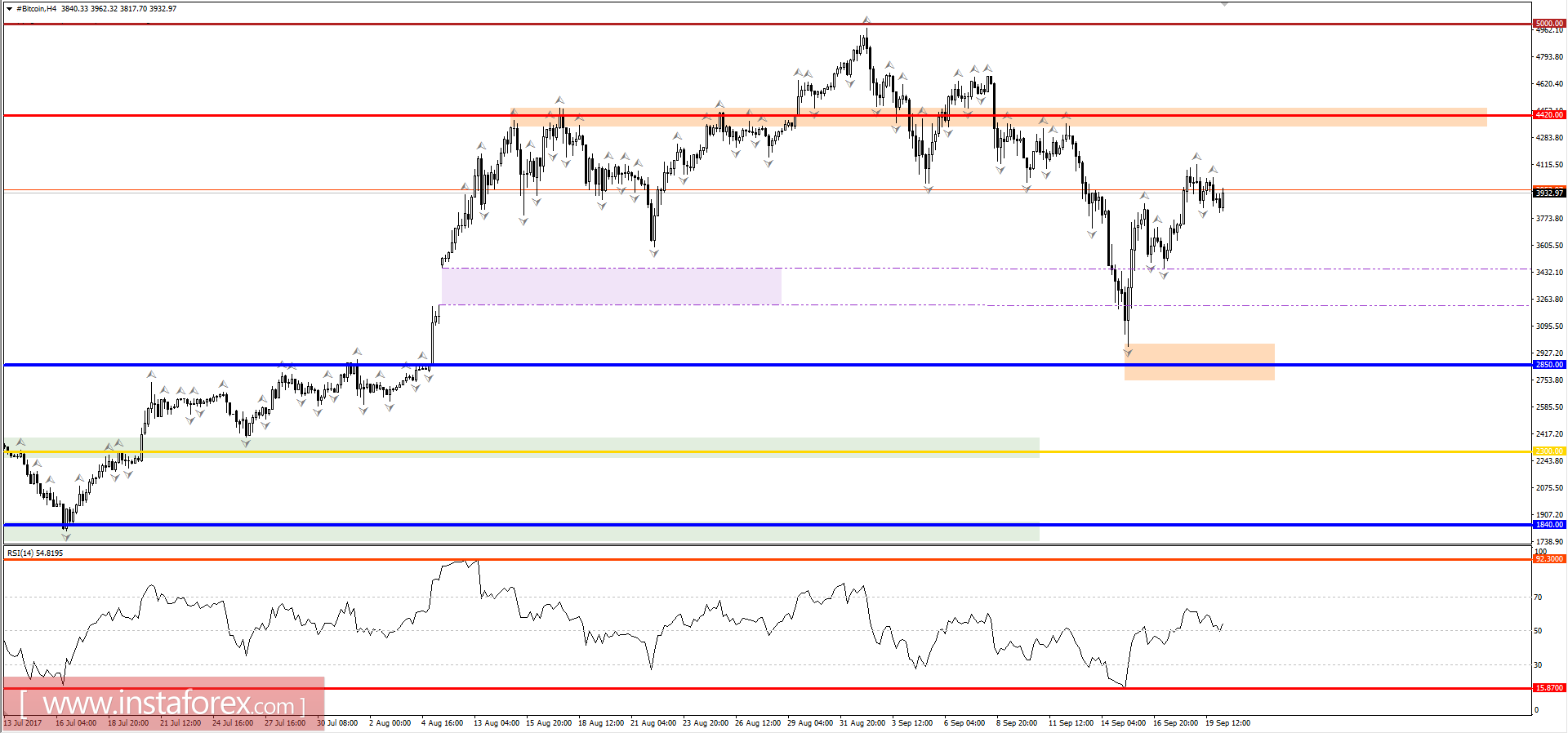

As previously discussed, after the convergence of prices with the level of 4000, the bulls calmed down and resulted in a rollback towards the value of 3800. Now, we are still in the 3850/4100 range, which was discussed yesterday in the review. This will either change today but a short-term movement to the value of 4100 is very possible. The medium-term forecast remains unchanged, there is an upside potential and a lot of speculative interest. However, in the current situation, it is advisable to increase the positions gradually, putting them in 4150 - 4420 - 4650. Generally, analyzing these points is required to conduct an analysis of accumulations and a conservative method of managing capital, in order not to run into unnecessary losses.

Earn through the movement of crypto currency with InstaForex by opening a deal in the terminal of MetaTrader4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română