Activity on world markets fell to almost zero on the wave of expectations of the outcome of the Fed meeting, as well as the press conference of its head, J. Yellen.

Investors are waiting with tension for the result of the meeting of the American regulator. And the main reason here is not that an increase in interest rates is expected, just not. This is what investors do not expect. An important and truly significant event will be the announcement of the beginning of a reduction in the balance sheet. This will indeed be a historic event that will mark the end of the period of support for the US economy, which did not end with the end of the three quantitative easing programs. It continued even after that since the Fed continued to reinvest part of the money received from sales of state bonds, which provided a sufficient inflow of dollars into the financial system and stimulated demand for shares and bonds. But with the beginning of the contraction of the balance, which has now reached the level of 4.5 trillion dollars, the dollar supply in the system will begin to decline, and no matter how quickly or slowly. The process will be launched, and this is important.

What is "threatening" the adoption of this decision on the balance sheet? In our opinion, any reduction in volumes will sooner or later lead to an increase in the deficit in the financial system of the US dollar, which will help to increase its rate, of course, while maintaining the monetary policy of the Central Bank of the currency, which is the main currency. As for the situation with the currencies of emerging economies, they will be the first to fall under the impact of capital flight to the United States. Against this background, the prospects for the Russian currency will not be too optimistic. But this process will be stretched in time, but it will be with an unambiguous finale, the outflow of capital from emerging markets in the US.

Today, until the results of the meeting of the Federal Reserve, we do not expect the growth of investors' activity on world markets and we suggest that traders refrain from active actions.

In addition to the central event, the meeting of the Federal Reserve. Today, the market will focus on the publication of data on oil and petroleum products in the US from the Ministry of Energy of the country.

Forecast of the day:

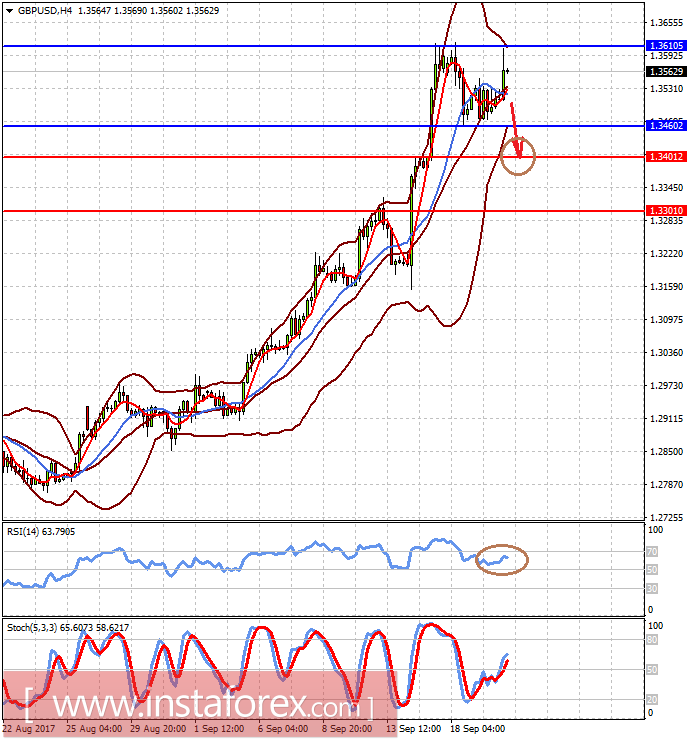

The GBP/USD pair continues to consolidate in the range of 1.3460-1.3610. It may be under local pressure following the Fed meeting and fall to 1.3400 if a decision is made to start reducing the balance sheet.

The pair USD/JPY can get support on the wave of positive for the dollar news about the beginning of the Fed's decline in the balance sheet. Against this background, the pair can locally grow to 112.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română