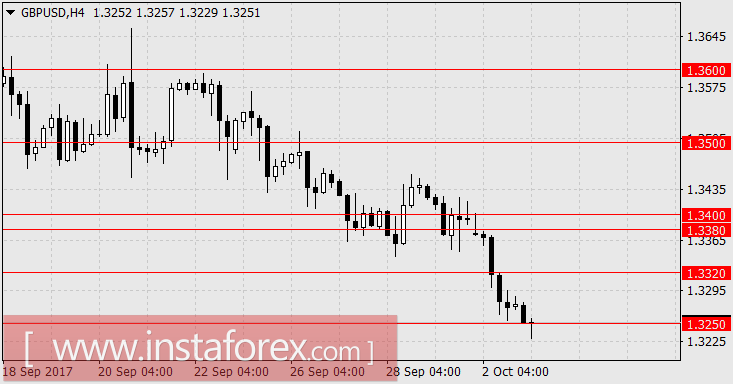

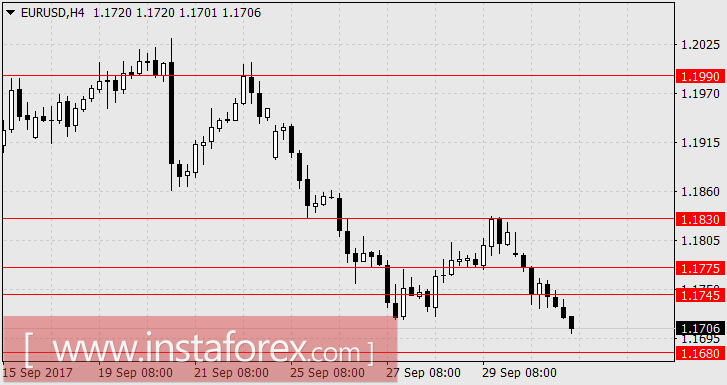

EUR / USD, GBP / USD

The quiet struggle of the White House with the Fed begins to be displayed at market quotes. The expected weighted average rate for December rose to 1.255%, yields on government bonds slowly increased. Macro-statistical indicators of the US came out better than the forecasts and by the end of Monday, the euro fell by 82 points, the British pound by 118 points. The index of business activity in the manufacturing sector (ISM Manufacturing PMI) for September grew from 58.8 to 60.8, with a decrease to 57.9. According to Markit, the final estimate of Manufacturing PMI was 53.1 compared to 53.0 before. Construction costs increased by 0.5% against expectations of 0.4%. Taking into account, the Friday's data on incomes and expenditures of consumers, the forecast for GDP for the 3rd quarter of the Atlanta Fed increased from 2.3% to 2.7%. And if Friday's employment data comes out slightly better than the forecast (88-90 thousand new jobs), then the consequences of hurricanes will have a minor impact on economic indicators.

In the eurozone, on the contrary, the final estimate of the September Manufacturing PMI turned out to be weaker: 58.1 against 58.2 earlier and the unemployment rate remained at the previous 9.1% against the expectation of a reduction to 9.0%.

The main event of today is the publication of the minutes of the meeting of the Bank of England's Financial Policy Committee (09:30 London time). Probably, the intention of VoE to get out of the ultra-soft monetary policy will be reflected in them. The index of business activity in the construction sector in Great Britain for September is expected to remain unchanged, 51.1 points. For investors, this will be a convenient moment to fix profits, which will lead to quotations for growth. The target is 1.3320.

In the euro area, the producer price index will be published in August, with a forecast of 0.1% versus 0.0% earlier, the number of unemployed in Spain in September could grow by 21.3 thousand after 46.4 thousand in August. Tomorrow, the markets are waiting for data on retail sales in the euro area for August (forecast 0.3%) and data on employment in the private sector in the US in September (forecast 151 thousand against 237 thousand earlier). We are waiting for lateral trade in the range of 1.1680-1.1745.

AUD / USD

On Monday, the Australian dollar tried to grow on the positive Saturday data of China but the overall pressure of the US dollar prevented it from doing so. The decrease was 8 points. September Manufacturing PMI of China was 52.4 against expectations of 51.5 and 51.7 in August. The non-production PMI increased from 53.4 to 55.4. According to Caixin, Manufacturing PMI, on the contrary, declined, the index was 51.0 against 51.6 in August.

This morning, sales of new homes for August showed an increase of 9.1%, and the number of issued permits for new construction in August increased by 0.4%. But the statement of the Reserve Bank of Australia after the meeting on monetary policy neutralized this positive stimulus. The RBA further strengthened verbal pressure on the national currency rate and noted the negative impact of low wage growth and debt growth.

The oil market is clearly fixing profits, oil fell by 2.2%. Prices for iron ore are falling at the close of several iron and steel works in China, the current price is 62.59 dollars per ton. Non-ferrous metals are declining for the third consecutive day. Agricultural crops, even if they have a weak impact on the Australian dollar, also become cheaper under pressure from the US dollar. On Thursday there will be important data on Australia. Retail sales for August are expected to grow by 0.3%, the trade balance in the August estimate could increase from 0.46 billion dollars to 0.87 billion. The current pressure on the "Australian" is expected to be no lower than 0.7750, after which a correction to the current range of 0.7800 / 30 or higher (0.7870), if the US data on labor contributes to this.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română