Hence, as long as the focus is on the relationship between Catalonia and Madrid, the single European currency will continue to remain under pressure. Also, the currency will pull itself and other currencies that are part of the dollar index.

The euro-dollar currency pair continues to decline, overcoming the recent local minimum of 1.1716. It is possible to assume that the "bearish" potential will still be preserved, directing towards the range of 1.1650 / 1.1680, where a 'stop' is already expected.

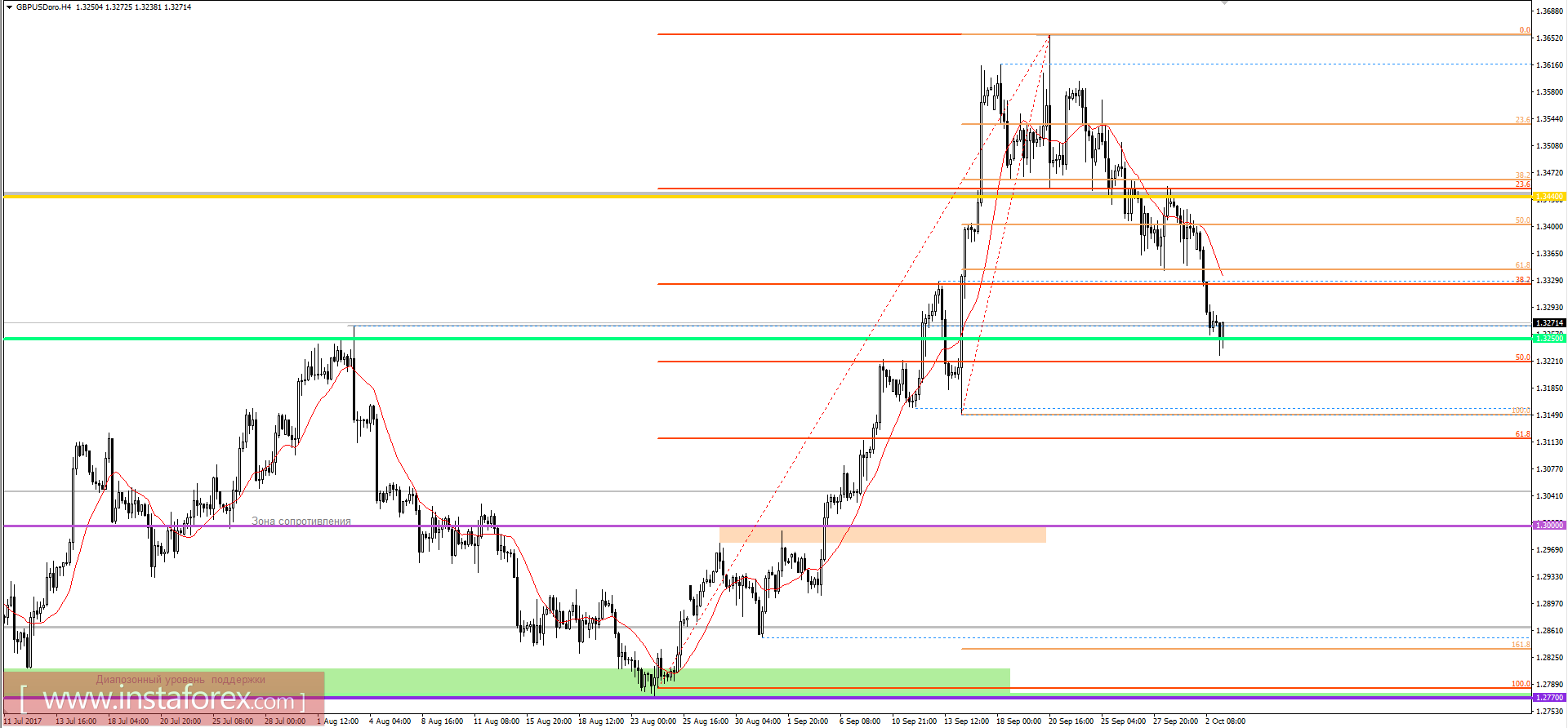

The pound-dollar currency pair was able to reach the support level at 1.3250 level, where it touches the periodic support. Expect some fluctuations within the 1.3220 / 1.3280 regions, where the "bulls" will try to find a support. In case that the tightening process continues, we expect an expansion of the range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română