The positive data in the US activity and the statements by Fed representatives continue to renounce its support for the US dollar, in which the dollar had strengthened its position against the euro and the pound to new monthly highs.

Yesterday, the activity in the US manufacturing sector for September was released showing another increase. The growth has been witnessed for 13 consecutive months.

According to the report of the Institute of Supply Management, the index of supply managers for the US manufacturing sector in September this year have reached 60.8 points from 58.8 points in August. Economists predicted that the index will obtain 58 points.

Robert Kaplan, President of the Federal Reserve Bank of Dallas, said yesterday that the impact of hurricanes to the US economy is likely to be temporary. In addition to that, this will not put any significant pressure on the economic activity for the third quarter, which should be restored by the end of this year.

Kaplan also talked about inflation, saying that he was not surprised by the restraint as of the moment. The Federal Reserve representative did not rule out the rate increase, which will directly depend on the data. The Fed still has the chance to consider the timeline of the next rate hike, and the committee is able to determine much conservative position with regard to further changes in monetary policy.

As for the technical picture of the EUR/USD pair, a single update of the lower support range 1.1715 is insufficient. It is necessary to gain a foothold below this level and further direction will depend on the bears, whether they will be able to accomplish it today or not. If the trade moves again above the 1.1715 range, and sellers fail to keep this level, we can expect a denser upward correction on risk assets within the resistance area 1.1760, the exit can be found at 1.1820 in the near future.

If the reversal to the 1.1715 level will not happen, the pressure on the euro will only increase which could lead the trading instrument to new weekly lows and towards the support range of 1.1660 - 1.1560.

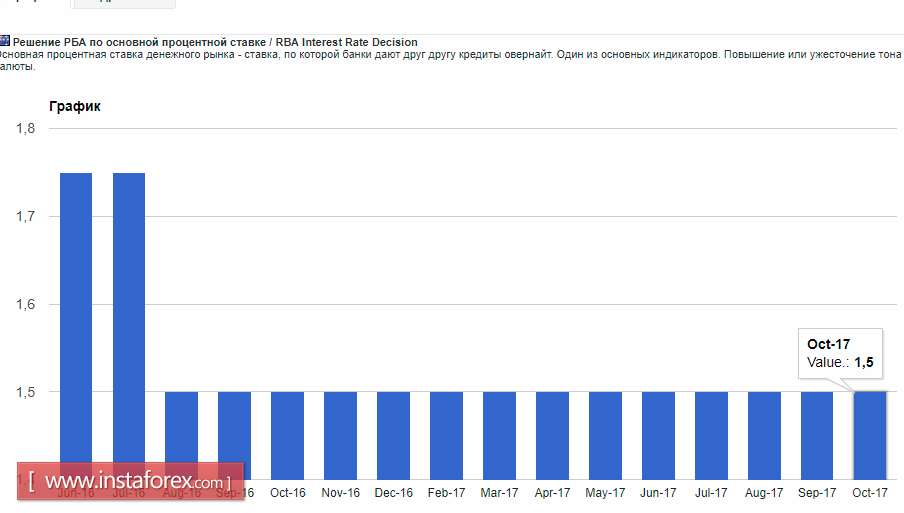

Today, the Australian dollar did not pay attention to the Reserve Bank of Australia's decision regarding the interest rates.

The Reserve Bank of Australia left the key interest rate unchanged at 1.50%, saying that low-interest rates continue to support the Australian economy. The RBA also noted that the level of interest rates corresponds to the RBA's goals with respect to GDP, inflation. The high rate of the Australian dollar will put pressure on the outlook for economic growth and employment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română