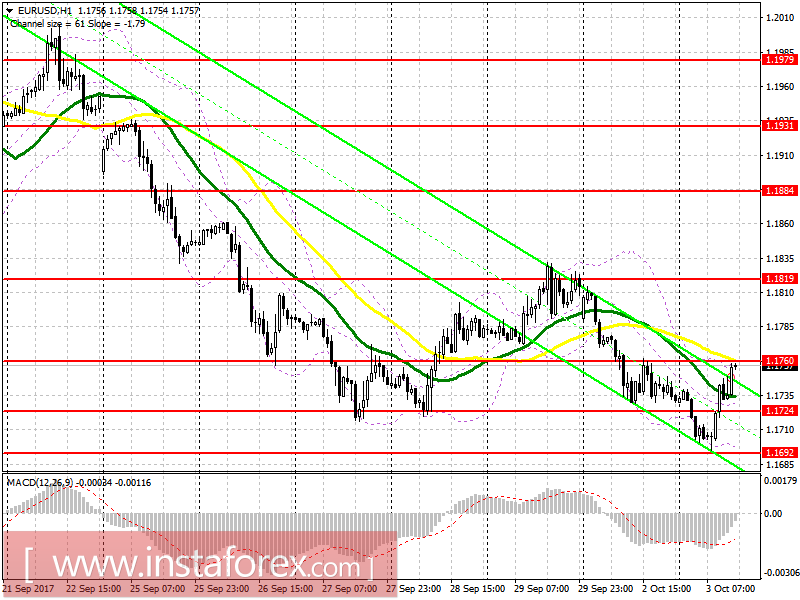

EUR / USD pair

To open long positions for EUR/USD pair, you need:

Buyers managed to tighten the euro at 1.1724 level and reach the target level of 1.1760. Only a break with a consolidation above this level will lead EUR / USD pair to a new daily high towards the area of 1.1785 with a forecasted yield of 1.1819, where fixing the profit is recommended. If the growth above 1.1760 is unsuccessful and trade returns to this level, it is advised to purchase of the pair to be deferred at the support level of 1.1724.

To open short positions for EUR/USD pair, you need:

Sellers will try to form a false breakout at 1.1760, which would be a good signal to increase short positions to return to 1.1724 and update daily lows in the area of 1.1692. If the euro rises above 1.1760, it is best to return to selling this pair after upgrading towards the level of 1.1785.

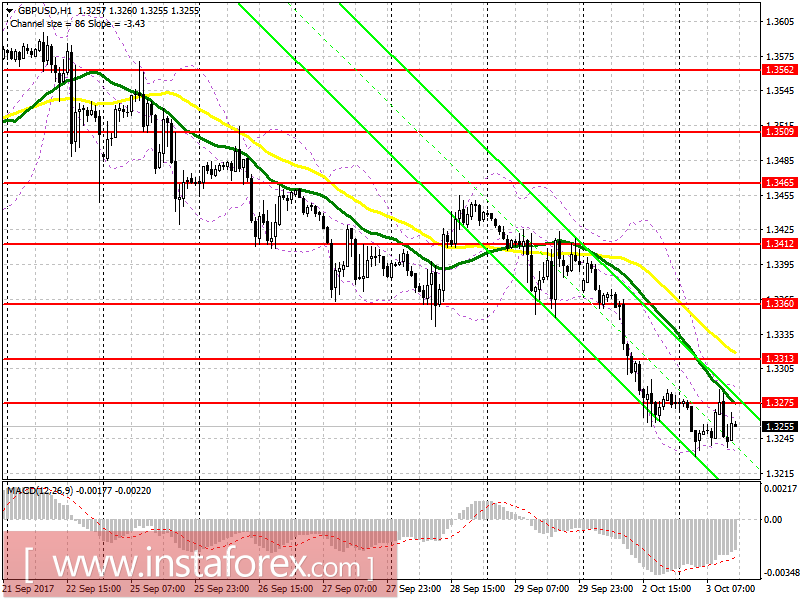

GBP / USD

To open long positions for GBP / USD pair, you need:

The buyers were not able to hold of 1.3275, which led to the sale of the pound in the morning. At the moment, it is recommended to return purchasing the pair only after a successful attempt to grow above 1.3275 or a rebound from new monthly lows in the area of 1.3205 and 1.3126. The main goal of traders is to update the resistance level of 1.3313.

To open short positions for GBP/USD pair, you need:

Currently, the trade is below 1.3275 and a further decrease in the pound is expected to reach the monthly lows in the area of 1.3205 and 1.3160. In the case of a repeat return at 1.3275, it is suggested to postpone selling of this pair until the resistance level is renewed at 1.3313, or open short positions immediately to rebound from 1.3360.

Fears of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

To familiarize with the basic concepts and the general rules of my TS is possible here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română