EUR / USD, GBP / USD

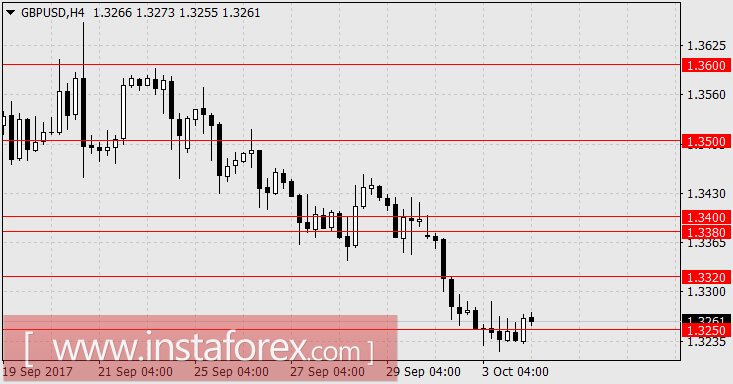

Bank of England minutes of the meeting was released yesterday which clearly showed that the bank intends to raise its rates in the near future. But this was supported by the weak data of business activity in the construction sector, along with pessimistic comments from the minister for Brexit affair, David Davis and Michael Gove. This could not help in the corrective growth of the British currency, as it turned out in the euro while the pound fell by another 39 points and additional 10 points for the euro. Actually, the Bank of England also mentioned that risks of destabilization increased in the banking system after leaving the European Union. The British Construction PMI for September fell from 51.1 to 48.1 points.

The single European currency supported for a remarkable increase in producer prices for August, which gained 0.3% against expectations of 0.1%. The market also recorded a profit before the US indicators in employment. Today at 1:15 London time will revise the figures of jobs in the private sector on September from ADP. The forecast is 131 thousand against 237 thousand in August. But, business activity in the non-manufacturing sector is expected to grow (ISM Non-Manufacturing PMI) in September with an estimate from 55.3 to 55.5. In the eurozone, the retail sales data in August showed a forecast of 0.3% against -0.3% in July which could help the single currency. Additionally, the final September evaluations of the Services PMI in France, Germany and the eurozone, in general, are coming out. But forecasts are unchanged, showing 57.1 for France, 55.6 for Germany, and 55.6 for the euro area.

At 5:15 London time, ECB head Mario Draghi speaks regarding the topic unrelated from monetary policy. At 8:15 London time, Fed Chairman Janet Yellen speaks at the conference, "Community Banking in the 21st Century," but it is expected that it will not be a fundamental speech.

According to Bloomberg, the US president has the final list of candidates for the next head of the Federal Reserve. The list includes Kevin Warsh, Jerome Powell, Gary Cohn, and John Taylor. Janet Yellen is also considered, but not recommended as a candidate. As described earlier, the behind-the-scenes struggle involves Yellen's candidacy. While we do not see any obvious changes in this scenario. Perhaps, closer to the winter, the outlines of this struggle will become clearer, but for now, the news restrains the growth of counter-dollar currencies.We are expecting the growth of the euro in the range of 1.1820 / 50 and the growth of the British pound at 1.3320.

USD / JPY

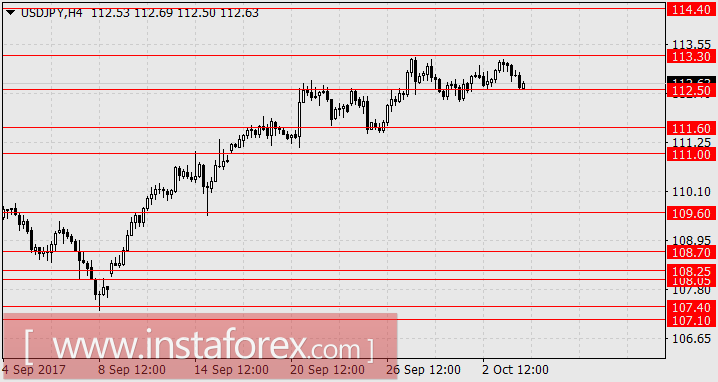

For the Japanese yen, the main risk is the attempt to shake the position of the incumbent Prime Minister Shinzo Abe by the "Party of Hope", a new opposition party headed by the Governor of Tokyo, Yuriko Koike, who was briefly the Minister of Defense in the summer of 2007. Current surveys show that 24% preferred the party in power (Liberal Democratic Party) and 15% for the "Party of Hope".

From the side of macroeconomic data, the Japanese yen continues to receive positive support. After the release of the optimistic Tankan indices on Monday, and the basic CPI from the Bank of Japan came out on Tuesday, indicate growth from 0.4% YoY to 0.6% YoY, and the household confidence index for September showed an increase from 43.3 to 43.9.

Today, Nikkei reported a decrease in the services sector activity from 51.6 to 51.0. As of this writing, this decline is not alarming until the composite index of leading economic indicators comes out on Friday, it is projected to increase from 105.2% to 107.2%.

The American stock market yesterday rose by 0.22% (S & P500), today the Japanese Nikkei 225 rose by 0.16%.

In order to continue the growth of the yen, it is necessary to handle US data on employment in the private sector for today and Friday non-businesses. Despite the forecasts that indicators would weaken due to hurricanes, the data can be directly opposite since construction organizations recruited additional workers to restore the destructions made by these hurricanes.

In the current situation, we are expecting for a sideways trend in the range 112.50-113.30 before the data output. The positive scenario implies an increase to 114.40, and contrarily, the negative scenario is the possible fall into the range of 111.00 / 60.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română