The New Zealand dollar paired with its American counterpart tested the monthly lows, trying to break through a strong resistance level of 0.7140. The pair has repeatedly tried to go below this level, but the bears on the pair do not have enough information to open their path towards further decline.

It should be noted that the "kiwi" is under the pressure of several fundamental factors. First of all, the political background changed. In the parliamentary elections, none of the parties was able to gain complete majority, and now politicians are forced to negotiate among themselves to create a coalition government. Despite the fact that the elections were held almost two weeks ago, a political compromise between the parties has not yet been found. There are two options: either the leader of the country's largest party, the National Party, Winston Peters, joins New Zealand First (which has strong anti-immigration sentiments), or a broad coalition is created between Labor, the Greens and New Zealand First. At the moment, discussions continue. Tomorrow, Peters (on which, in fact, depends the configuration of the coalition) meets with the leaders of the Labor Party. The final decision must be made before October 12.

Thus, the New Zealand economy is experiencing political uncertainty, which affects the behavior of the national currency and the position of the Reserve Bank of New Zealand. The last meeting of the regulator, which was held on September 27, turned out to be neutral and vague. As expected, the central bank left all the parameters of monetary policy unchanged and practically did not change its comment in comparison with the August meeting. It can only be noted that RBNZ still expects a slowdown in inflationary growth, and does not expect any significant growth from the country's economy. The new governor of the Central Bank, Grant Spencer, generally continued the policy of his predecessor. He said that monetary policy will remain on current parameters for a "significant period of time", as many uncertainties remain in the market. This position was not surprising, but also did not disappoint the market - traders were expecting such a scenario, so the September meeting of the RBNZ was almost ignored.

It is worth recalling that in the course of his speech, the head of the New Zealand Central Bank noted that the current policy can be "revised at any time". Given the general fundamental background, these words can only be interpreted in the direction of possible easing of monetary policy, therefore the current macroeconomic data are of great importance for bears of the pair NZDUSD.

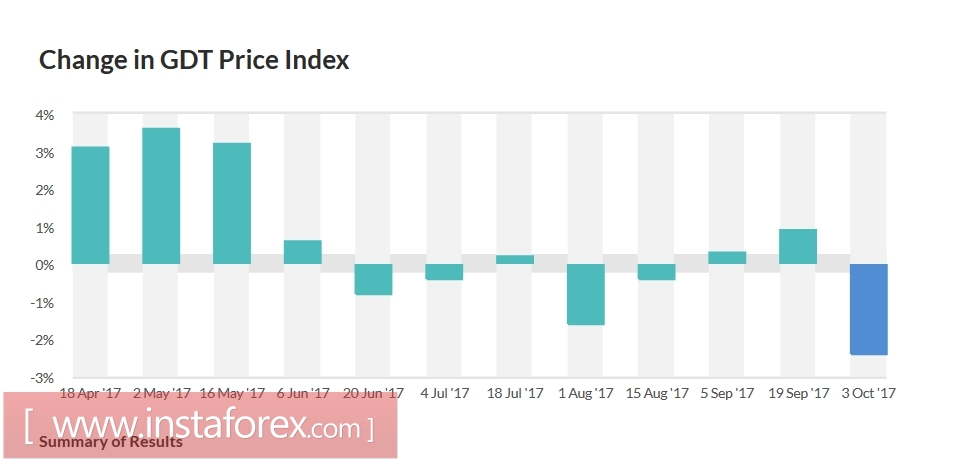

A particular concern of traders is the decline in the dairy products index. For New Zealand, this index has the same value as for Canada as the cost of oil, so a significant decline in this indicator affects the dynamics of the currency. At the last auction, which took place the day before yesterday, almost all dairy products' prices declined. This affected the overall index, which again fell into the negative area and amounted to -2.4%. This is the worst result since March this year. Some experts explain the drop in demand for milk is in line with a long weekend in China, where national holidays are celebrated. China is one of New Zealand's main trading partners, so this explanation looks plausible. However, until October 17 (when the next auction takes place), the situation will still be in limbo, so the New Zealand dollar remains under pressure.

Today, the NZDUSD pair tries to show the upward correction, retreating from the local resistance level. This price dynamics is explained by two reasons. First, today there are quite good figures of the commodity price index, which measures the cost of raw materials. For the first time in two months, the indicator came out of the negative zone and reached 0.8%. The second reason is on a global scale - the US dollar today lost its positions in almost all pairs due to a weak report on the labor market from ADP. According to their data, in September, 135, 000 jobs were created. And although recently the ADP report does not always coincide with official data, the dollar bulls weakened their pressure somewhat.

All this allows the NZDUSD pair to go into correction, but in general the trend for the pair remains bearish. Political uncertainty, a decline in the price index for milk, the extremely cautious position of the RBNZ and low inflation continue to put pressure on the New Zealand Dollar. For example, when paired with the Australian dollar, the "kiwi" is now cheaper, confirming the disadvantage of its position. Thus, with the NZDUSD pair, the corrective rollback can be used as an excuse to open short positions.

On the technical side, the pair is showing a downward trend, being on the bottom line of the Bollinger Bands indicator. The indicator Ichimoku Kinko Hyo formed its strongest signal - "line parade", in which all the main lines of the indicator are above the price chart. Oscillators are in the sales area. The resistance level is 0.7140 (the bottom line of the Bollinger Bands indicator on D1), and the support level is 0.7250 (the middle line of this indicator, which coincides with the Tenkan-sen line). Thus, judging by the main trend indicators, the downtrend in its midst - its strength in the short term could lead to testing the level of 0.7140.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română