- HICP 0.0% vs 0.0% y/y prelim

- HICP -0.6% vs -0.6% m/m prelim

A slight revision lower in headline annual inflation is the only change relative to the initial report, but it doesn't tell us anything new.

Inflation pressures are subdued in September across the region and that continues to keep the ECB on their toes as the threat of deflation starts to creep in ahead of the year-end.

Further Development

Analyzing the current trading chart of Gold, I found that there is successful rejection of the rising trendline and potential running flat downside correction completion.

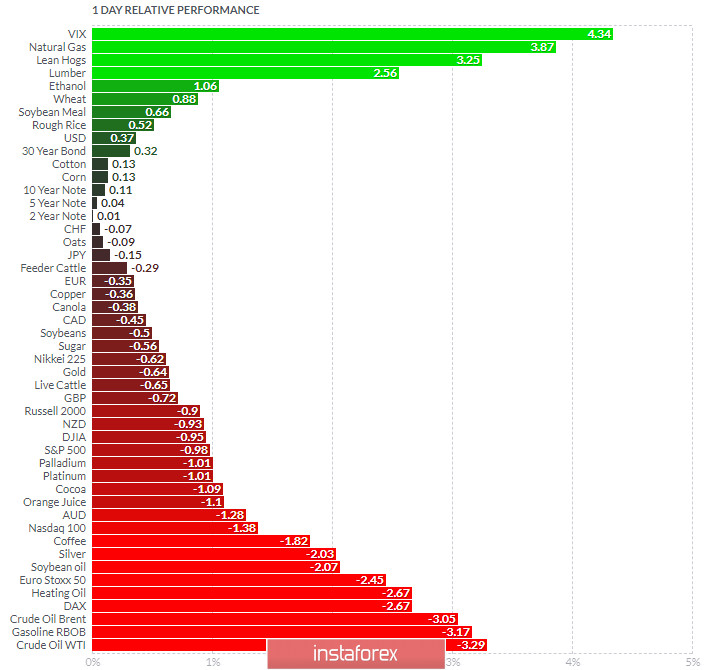

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Natural Gas today and on the bottom Crude Oil and Gasoline RBOB.

Key Levels:

Resistance: $1,912 and $1,930

Support level: $1,890

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română