EUR / USD, GBP / USD

According to yesterday's result, the euro increased by 22 points due to a slight easing of tensions versus the dollar. The total bookmarks for new homes in the United States for September decreased from 1.18 million to 1.13 million, while the number of issued permits for new-home construction fell from 1.27 million to 1.22 million. On that day, Robert Kaplan speaks about his conclusion of 2.5% neutral rate and that he "did not see imbalances" in the financial markets. During the conference of "Structural reforms in the euro area", ECB head Mario Draghi stood up for the importance of soft monetary policy and he indirectly hinted for its possible continuation. Nevertheless, market participants began to prepare for the next ECB meeting which will take place in a week, it is expected to announce the decline of the rate of purchasing assets since earlier next year.

The data from the United Kingdom in August came out better than expected. The number of unemployed increased by 1.7 thousand against the forecast of 1.0 thousand. But the average wage level, without considering bonuses for 3 months, increased by 2.1% with expectations of 2.0%. On the other hand, salary with bonuses has increased by 2.2% with a forecast of 2.1%. It further includes the growth of counter-dollar currencies, showing an intensive rise in stock indices such as Dow Jones that gained 0.7% and Russell 2000 that accelerated to 0.5%.

With the release of uncertain Chinese economic indicators later this day, the optimism in the markets may fade. While in the UK, retail sales are expected to decline by 0.1% in September and China's GDP for the third quarter rose by 6.8% YoY to 6.9% YoY in the second quarter.

In the US, the number of applications for unemployment benefits is expected to experience another decline, with a forecast of 240K against 243K during the week earlier. The index of leading economic indicators for September is projected to grow by 0.1%. Business activity in the manufacturing sector of Philadelphia in October may fall from 23.8 to 21.9. The greatest risk is the execution of the federal budget report for September, which shows an expected small deficit worth $0.9 billion and regarded as the worst indicator of September for the last 5 years. However, the growth pressure from the last month's deficit is -107.7 billion dollars versus the projected -0.9 billion (106.8 billion) is very significant and far from the worst in this 5-year period.

We are expecting for the euro at 1.1720, then on 1.1670. Pound sterling is expected in the range of 1.3095-1.3120, and a further decline to 1.3010.

AUD / USD

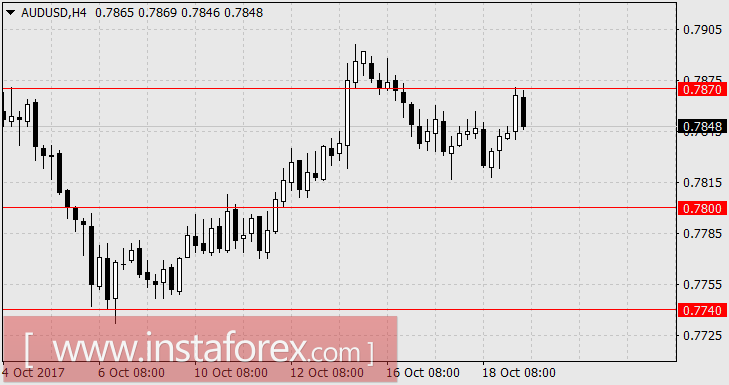

The Australian dollar moved sideways for the third day in the absence of positive global drivers. The excellent employment data for today shows that AUD/USD pair gained 20 points, but it returned to its starting positions by the end of the Asian session. In September, 19.8 thousand jobs were created against the 15.0 thousand forecast, while the unemployment rate decreased from 5.6% to 5.5%. Actually, there was an adjustment for the economically active population, as there was a drop from 65.3% to 65.2% in August. This figure continued until the next month and affected the decrease in unemployment rate. The NAB's sentiment index in business circles of Australia for the third quarter had reduced from 8 points to 7 points. The greatest pressure on the APR markets for today is the slowdown of China's economic growth in the third quarter, as the GDP rose by 6.8% YoY to 6.9% YoY in the second quarter. Fixed assets investments for September declined from 7.8% YoY to 7.5% YoY. The positive data was in the industrial production which shows a lift by 6.6% YoY against 6.0% YoY in August. At the same time, retail sales in China increased by 10.1% YoY to 10.3% YoY.

Commodity prices are falling. The Chicago Iron Exchange futures fell by 0.3%, -3.5% in China, coking coal reduced by 0.1%, Aluminum lost 0.9%, and copper down by -0.5%.

We are anticipating the decline of the "Australian" to 0.7800, then to 0.7740.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română