- We want a Canada-style deal and think it is reasonable

- A Brexit deal can be done

- We've made some real progress with the EU

For those confused by the terminology, Australia terms simply means a no-deal outcome.

This mainly reaffirms the UK's stance ahead of talks once again. As things stand, the supposed deadline will be the end of the transition period i.e. 31 December but given how many times we've been down this road before, it is hard to take that at face value.

Further Development

Analyzing the current trading chart of GBP, I found that there is potential completion of the Intraday ABC downside correction, which is good sign for further rise....

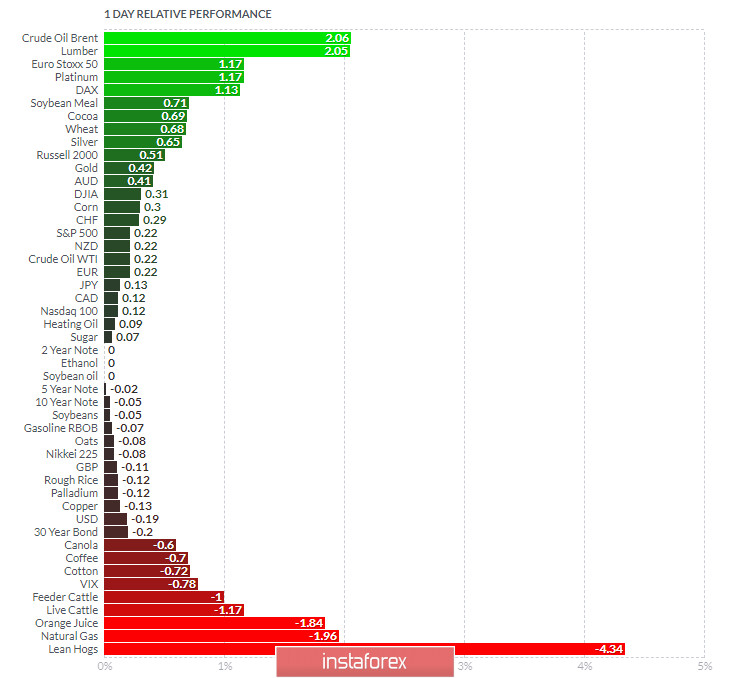

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Crude Oil and Lumber today and on the bottom Natural Gas and Lean Hogs.

Key Levels:

Resistance: 1,3150, 1,3180

Support levels: 1,3050

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română