Latest data released by Markit - 23 October 2020

Prior 53.7

- Services PMI 46.2 v 47.0 expected

- Prior 48.0

- Composite PMI 49.4 vs 49.2 expected

- Prior 50.4

The readings here fit with the narrative with what we have seen from the German and French readings - more so the former - earlier in the past 45 minutes.

It reaffirms a two-paced 'recovery', where the manufacturing sector is keeping more resilient overall while the services sector momentum continues to fade into Q4.

Further Development

Analyzing the current trading chart of Gold, I found that there is potential completion of the downside corretion, which is sign for further rise.

I would watch for buying opportunities with the targets at $1,931 and $1,955.

Stochastic just came out from oversold zone and there is the fresh bull cross, which is another sign for the furher rise....

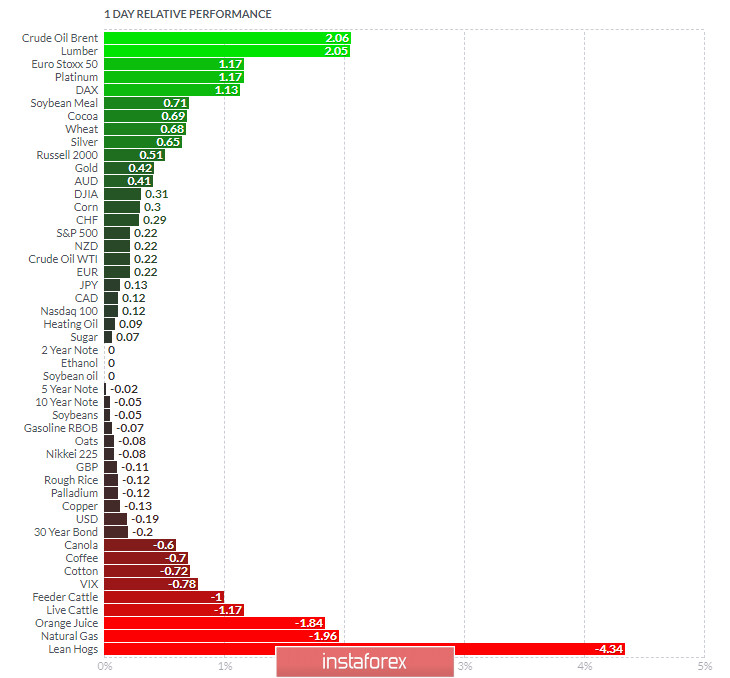

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Crude Oil and Lumber today and on the bottom Natural Gas and Lean Hogs.

Key Levels:

Resistances: $1,931 and $1,955.

Support levels: $1,894

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română