Latest data released by the ECB - 27 October 2020

Prior +9.5%

Slight delay in the release by the source. Broad money growth continues to swell, with the annual change reflecting the biggest jump since December 2007.

Meanwhile, loans to households also increased to +3.1% y/y while loans to corporates were steady at +7.1% y/y.

Further Development

Analyzing the current trading chart of Gold, I found that the Gold is testing the support trendline at $1,900 but that price is still in consolidation and you should watch for the breakout to confirm further direction.

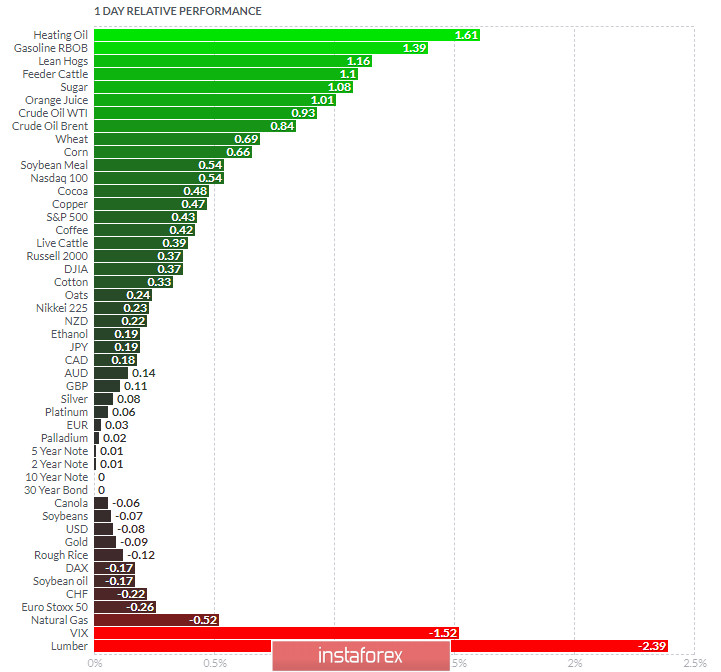

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Heating Oil and Lean Hogs today and on the bottom Lumber and VIX.

Gold looks neutral today on the relative strength list...

Key Levels:

Resistance: $1,913

Support levels: $1,895

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română