Prior -0.6%

- Market index 807.8 vs 794.2 prior

- Purchase index 305.2 vs 304.6 prior

- Refinancing index 3,711.6 vs 3,620.5 prior

- 30-year mortgage rate 3.00% vs 3.02% prior

The rise last week largely stems from an increase in refinancing activity, although purchases were also seen higher as well. This reaffirms the narrative that the housing market still remains somewhat steady despite the massive wave of virus infections in the US.

Further Development

Analyzing the current trading chart of EUR/USD, I found that there is the breakdown of the few day balance in the background, which is great sign for further downside.

The EUR reached my first yesterday's target at 1,1775 and is heading towards the next downward targets at 1,1715 and 1,1690.

If the EUR breaks the 1,1690 with strong momentum, there is even chance for test of 1,1615.

Watch for selling opportunities on the rallies....

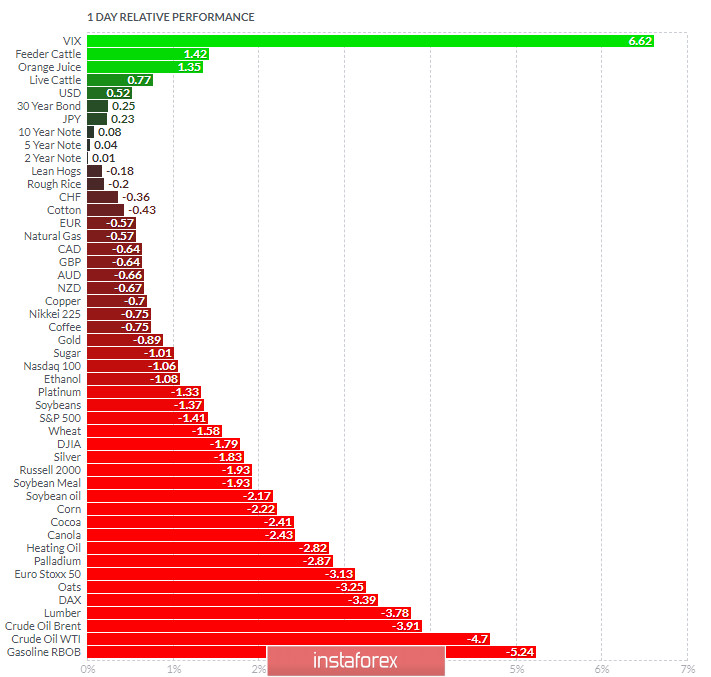

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Feeder Cattle today and on the bottom Gasoline RBOB and Crude Oil.

Key Levels:

Resistance: 1,1778

Support levels: 1,1700 and 1,1615

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română