- Output rose 210K bpd to 24.59 mbpd

- States bound by supply cut pledges complied at 101%

- OPEC+ states bound by pledges cut output by 100K bpd

This whole paradigm underscores the tough situation that OPEC and the world oil market is in. OPEC is cutting a bit more by Libya will bring another 600-800kbpd online before year-end. Libya is not bound by the OPEC+ agreement because it had dropped production due to a civil war.

Further Development

Analyzing the current trading chart of EUR/USD, I found that EUR reached our downside target at 1,1690 and that is heading for the test of the next downward target at 1,1615.

My advice is still to watch for selling opportunities on the rallies with the main downside target at 1,1615 (Daily pivot low).

The downside pressure is still very strong and selling opportunities are preferable in this condition...

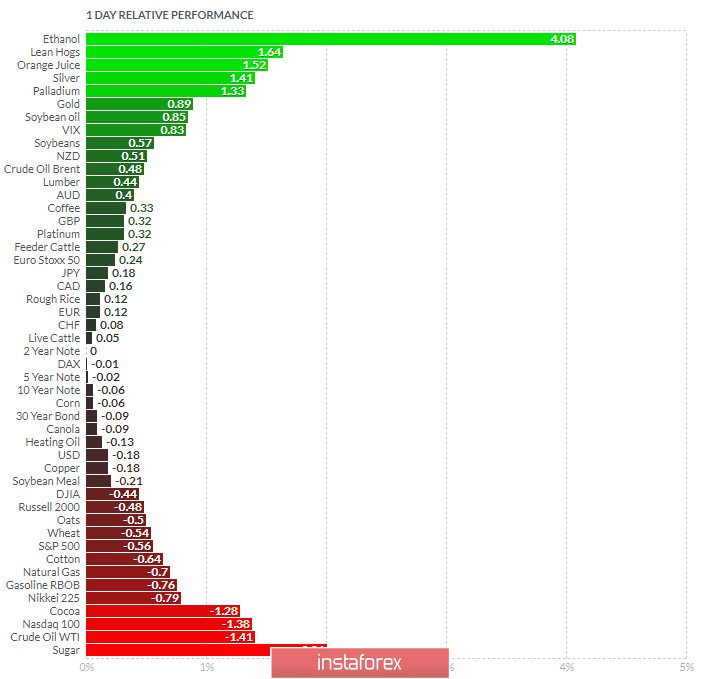

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Ethanol today and on the bottom Nasdaq100 and SP 500.

Key Levels:

Resistance: 1,1688

Support level: 1,1615

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română