Dear colleagues.

For the EUR / USD pair, we continue to monitor the upward structure of November 7. For the GBP / USD pair, we consider the uptrend from November 3 as the main trend. For the USD / CHF, the continuation of the downward movement is expected after the breakdown of 0.9877. For the USD / JPY pair, we currently expect to reach 112.22. For the EUR / JPY pair, the upward structure of November 8 is considered as a medium-term structure. For the GBP / JPY pair, the situation entered the equilibrium state due to the protracted development of the correction from the downward structure on November 1.

Forecast for November 17:

Analytical review of currency pairs in the scale of H1:

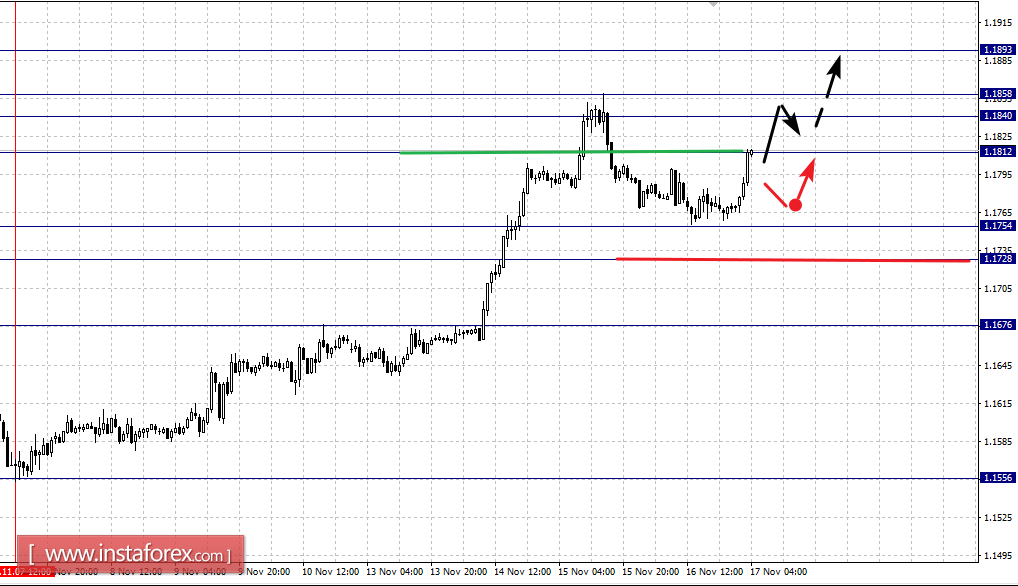

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1893, 1.1858, 1.1840, 1.1812, 1.1754, 1.1728 and 1.1676. Here, we continue to follow the upward cycle of November 7. Continued upward movement is expected after the breakdown of 1.1812. In this case, the target is 1.1840. In the area of 1.1840 - 1.1858 is the consolidation of the price. The potential value for the top is the level of 1.1893, upon reaching which we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.1754 - 1.1728. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1676.

The main trend is the upward structure of November 7.

Trading recommendations:

Buy: 1.1812 Take profit: 1.1840

Buy: 1.1860 Take profit: 1.1890

Sell: 1.1754 Take profit: 1.1730

Sell: 1.1725 Take profit: 1.1680

For the GBP / USD pair, the key levels on the H1 scale are: 1.3378, 1.3327, 1.3289, 1.3264, 1.3212, 1.3186 and 1.3144. Here, we consider the upward trend from November 3. currently we expect the movement towards the level of 1.3289 as the main structure. In the area of 1.3289 - 1.3264 is consolidation of the price. The breakdown of the level of 1.3290 will lead to the movement towards the level of 1.3327. Near this level, we expect the consolidation of the price. The potential value for the top is the level of 1.3378.

Short-term downward movement is possible in the area of 1.3212 - 1.3186. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3144. This level is the key support for the top.

The main trend is the upward structure of November 3.

Trading recommendations:

Buy: 1.3290 Take profit: 1.3325

Buy: 1.3330 Take profit: 1.3375

Sell: 1.3212 Take profit: 1.3188

Sell: 1.3184 Take profit: 1.3150

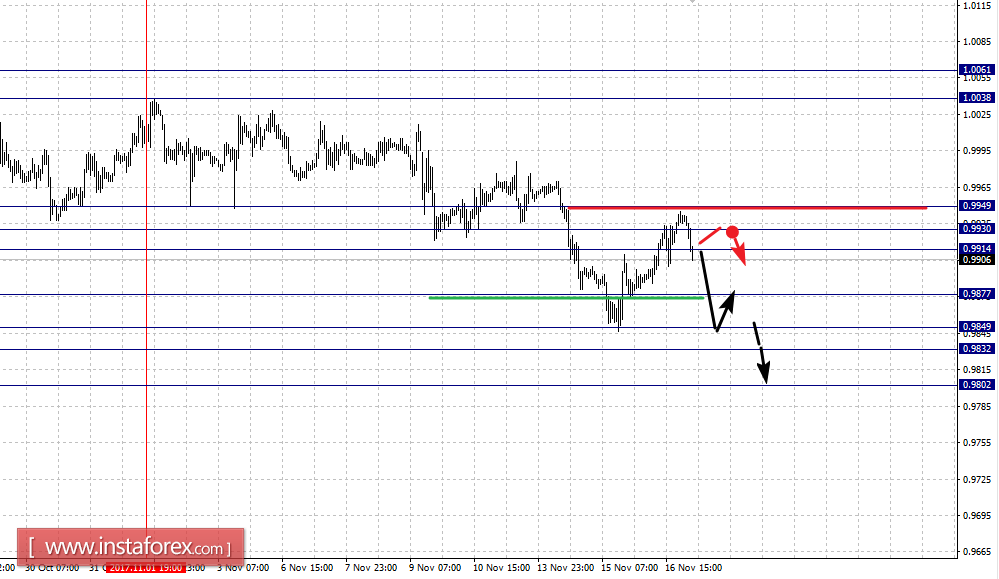

For the USD / CHF pair, the key levels in the scale of H1 are: 0.9949, 0.9930, 0.9914, 0.9877, 0.9849, 0.9832 and 0.9802. Here, we continue to follow the downward structure of November 1. Continued downward movement is expected after the breakdown of 0.9877. In this case, the target is 0.9849. In the area of 0.9849 - 0.9832 is the consolidation of the price. The potential value for the bottom is the level of 0.9802, from which we expect a rollback to the top.

Short-term upward movement is possible in the area of 0.9914 - 0.9930. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9949.

The main trend is the downward structure of November 1.

Trading recommendations:

Buy: 0.9914 Take profit: 0.9930

Buy: 0.9932 Take profit: 0.9947

Sell: 0.9875 Take profit: 0.9850

Sell: 0.9830 Take profit: 0.9804

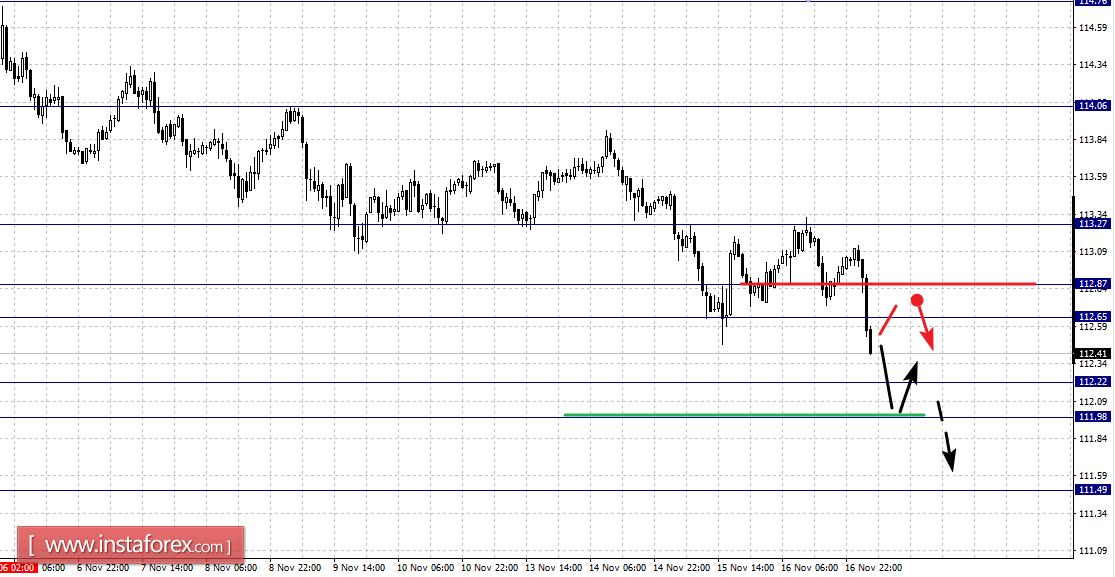

For the USD / JPY, the key levels on a scale are: 113.27, 112.87, 112.65, 112.22, 111.98 and 111.49. Here, we continue to follow the downward structure of November 6. Short-term downward movement is possible in the area of 112.22 - 111.98. The breakdown of the last value will allow us to count on the movement towards the potential target of 111.49. From this level, we expect a rollback upward.

Short-term upward movement is possible in the area of 112.65 - 112.85. The breakdown of the last value will lead to in-depth correction. Here, the target is 113.25. This level is the key support for the downward trend.

The main trend is the downward structure of November 6.

Trading recommendations:

Buy: 112.65 Take profit: 112.85

Buy: 112.92 Take profit: 113.24

Sell: 112.22 Take profit: 112.00

Sell: 111.96 Take profit: 111.60

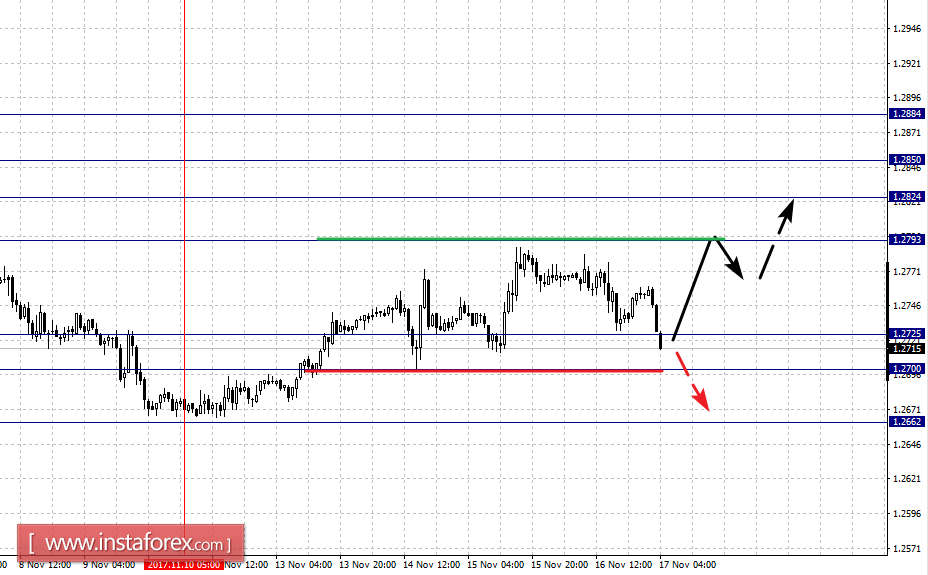

For the CAD / USD pair, the key levels on the H1 scale are: 1.2884, 1.2850, 1.2824, 1.2793, 1.2725 and 1.2700. Here, we follow the upward structure of November 10. At the moment, the price is in correction. Continued upward movement is expected after the breakdown of 1.2793. In this case, the target is 1.2824. In the area of 1.2824 - 1.2850 is a short-term upward movement. The potential value for the top is the level of 1.2884, from which we expect the correction to begin.

Short-term downward movement is possible in the area of 1.2725 - 1.2700. This range is the key support for the top. Its breakdown will lead to the development of a downward structure. In this case, the target is 1.2662.

The main trend is the upward structure of November 10, the correction stage.

Trading recommendations:

Buy: 1.2795 Take profit: 1.2822

Buy: 1.2826 Take profit: 1.2850

Sell: 1.2700 Take profit: 1.2665

Sell: Take profit:

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7660, 0.7638, 0.7616, 0.7568, 0.7545, 0.7510, 0.7491 and 0.7449. Here, we continue to follow the downward structure of November 2. Short-term downward movement is possible in the area of 0.7568 - 0.7545. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 0.7510. In the area of 0.7510 - 0.7491 is the consolidation of the price. The potential value for the bottom is the level of 0.7449, from which we expect a rollback to the top.

Short-term upward movement is possible in the area of 0.7616 - 0.7638. The breakdown of the last value will lead to in-depth movement. Here, the target is 0.7660. This level is the key support for the bottom.

The main trend is the downward structure for the bottom of November 2.

Trading recommendations:

Buy: 0.7616 Take profit: 0.7636

Buy: 0.7638 Take profit: 0.7660

Sell: 0.7566 Take profit: 0.7547

Sell: 0.7543 Take profit: 0.7510

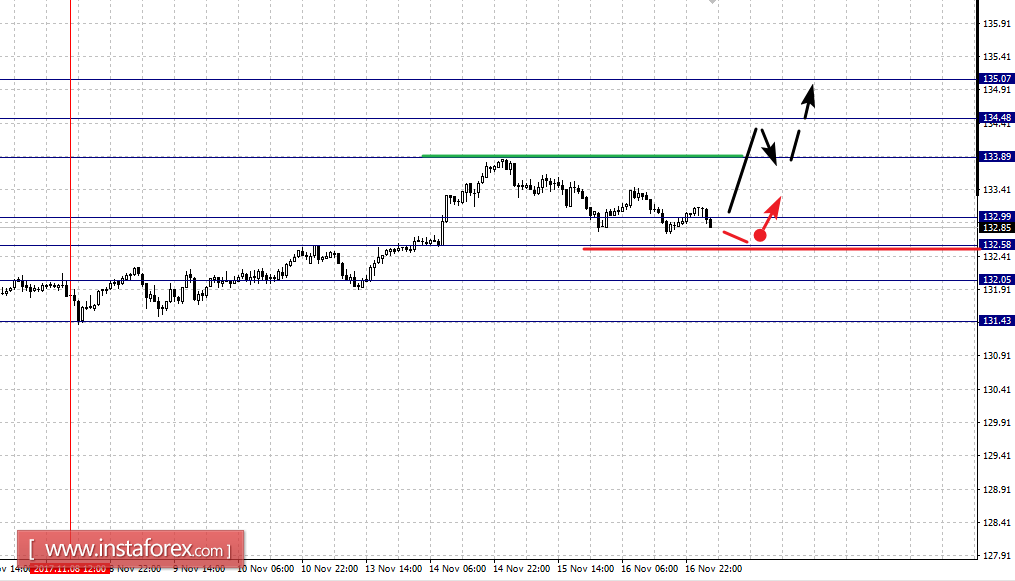

For the of EUR / JPY, the key levels on the scale of H1 are: 135.07, 134.48, 133.89, 132.99, 132.58 and 132.05. Here, we follow the upward structure of November 8. At the moment, the price is in correction. Continued upward movement is expected after the breakdown of 133.90. In this case, the target is 134.48. Near this level is the consolidation of the price. The potential value for the upstream structure is, for the time being, the level of 135.07. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is expected in the area of 132.99 - 132.58. The breakdown of the last value will lead to an in-depth movement. Here, the target is 132.05. This level is the key support for the medium-term upward structure of November 8.

The main trend is the upward structure of November 8, the correction stage.

Trading recommendations:

Buy: 133.90 Take profit: 134.45

Buy: 134.50 Take profit: 135.05

Sell: 132.55 Take profit: 132.08

Sell: 132.00 Take profit: 131.45

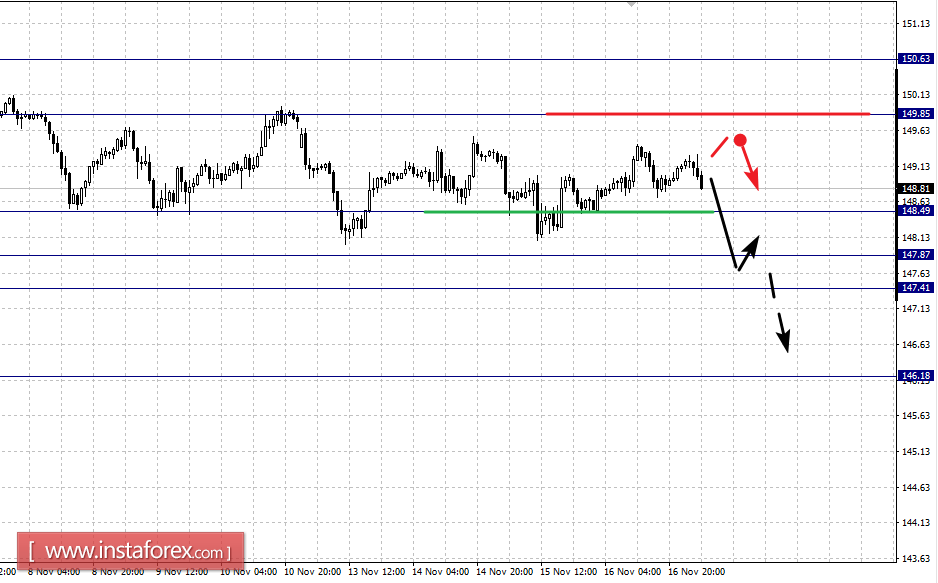

For the GBP / JPY pair, the key levels on the scale of H1 are: 150.63, 149.85, 148.49, 147.87, 147.41 and 146.18. Here, for the time being, we continue to monitor the formation of a downward structure from November 1. The current price is in correction. Continued downward movement is expected after the breakdown of 148.49. In this case, the target is 147.87. In the area of 147.87 - 147.41 is the consolidation of the price. The breakdown of the level of 147.40 should be accompanied by a pronounced downward movement. Here, the target is 146.18. From this level, we expect a pullback upward.

Short-term upward movement is possible in the area of 149.85 - 150.60. The breakdown of the latter value will lead to the development of an upward trend in the scale of H1. In this case, the potential target is 151.89.

The main trend is the formation of a downward structure from November 1, the stage of the initial conditions.

Trading recommendations:

Buy: 149.90 Take profit: 150.60

Buy: 150.70 Take profit: 151.60

Sell: 148.49 Take profit: 147.95

Sell: 147.40 Take profit: 146.40

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română