The published data on consumer inflation in the euro area came in line with expectations and did not have a significant impact on the rate of the euro, which, despite the negative data, continues to be in demand amid strong economic growth in Germany and the eurozone as shown by the previously reported GDP data .

According to the data presented, the consumer price index in the euro area on an annual basis retained growth in October by 1.4%. In monthly terms, the indicator also added in line with expectations with a 0.1% increase.

Against the background of these data, the EUR/USD pair declined but insignificantly. The most noticeable decrease was the EUR/GBP cross in the wake of better retail sales figures in the UK. It showed an increase in retail sales for October by 0.3% against a 0.7% decline in September and a forecast of a 0.1% increase.

Let's go back to the euro. As indicated above, the euro is supported as a counterbalance to the dollar on the wave of demand for assets denominated in euros thanks to strong data on Germany's GDP and the euro area. As for data on consumer inflation, their values were expected and therefore did not cause a noticeable change. From the ECB, we do not expect a change in the monetary policy. However, the uncertainty around the tax reform in the United States is holding back the strengthening of the dollar. Investors continue to speculate on the coffee grounds about the likely timing of the new tax code and its content.

Uncertainty in this matter is an important destabilizing factor for the US dollar's positions as the expectation that the Fed will raise rates in December is already fully priced in and cannot provide additional substantial support. Therefore, until the situation around the tax reform is discharged in the positive or negative direction, the "weakness" of the dollar will from time to time, be expressed in the movement in the lateral trends relative to the major currencies.

Forecast of the day:

The EUR/USD pair is trading on a wave of mutually exclusive forces that do not allow it to fall and not grow. Today it will most likely consolidate in the range of 1.1730-1.1850 against expectations of the result of the adoption of tax reform in the United States. In this situation, we consider the sales of the pair on growth to be a priority with the local target of 1.1730.

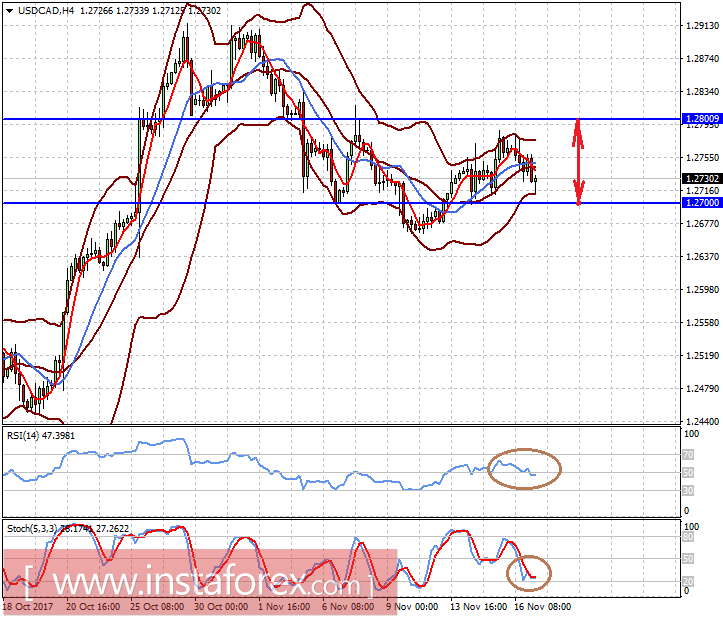

The USD/CAD pair is consolidating in the range of 1.2700-1.2800 against the backdrop of the oil market throwing between the statistics on oil and petroleum products from the USA and OPEC plans. Today, the pair is will most likely not break out of the range, unless there are new positive news on the tax reform in the United States.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română