This week, the Canadian dollar paired with the U.S. dollar broke its upward movement and sharply turned down, breaking 200 points in one day. Now bearish dynamics continues, although not at such an active pace. Traders suspended the aggressive selling of the USDCAD, as tomorrow will be the last meeting of the Bank of Canada this year. And although the market does not expect any action from the regulator, investors decided to take a break. After all, the intrigue of tomorrow's meeting still remains: the main question is how smoothly the Bank of Canada will tighten monetary policy next year. The latest published data show conflicting statistics, but the oil market may bring the date of the next round of rate hikes closer.

Last Friday, a key indicator of the growth of the Canadian economy was published. The overall result can be characterized as follows: the country's economy is trying to regain the former growth rate (which was observed in the first half of this year), but these attempts are not impressive. On a monthly basis, the GDP index increased by 0.2% (after -0.1%), while in annual terms the indicator continues to decline gradually - the increase was 3.3% after the previous 3.5%. For comparison: in May-June, GDP growth in annual terms was 4.6-4.3%. It was an annual peak, after which a gradual (but sure) recession began.

Canadian inflation demonstrates a similar situation. From June to September, stable growth was registered (to 1.6%), but in October, price pressure eased to 1.4%. In monthly terms, inflation also shows weakness - over the past four months, the indicator has fluctuated in the range of 0-0.2%.

But the labor market, on the contrary, surprised the market with unexpectedly strong numbers. The unemployment rate fell immediately by 0.4% (ie to 5.9%), while the number of employees jumped to 80, 000. Such a low level of unemployment was last seen almost a decade ago, in 2008.

Such a contradictory statistics on key indicators does not allow definitive conclusions. And although the GDP indicator shows a decline, the nature of the decline does not cause much concern. The same can be said about inflation: the consumer price index came out at a predictably low level, while the average hourly wage rose by 2.8%, which is the biggest increase since April last year. This, in turn, suggests that next year the consumer activity of Canadians can significantly increase, thereby "accelerating" inflation. Meanwhile, it was the weak growth of wages that worried the members of the regulator at the October meeting. Now this item can be (at least temporarily) deleted.

In general, the central bank of Canada, most likely, will be optimistic about the current situation. An unexpectedly strong report on the labor market can not be ignored by the regulator. But here one significant issue should be noted, which can become a stumbling block in the matter of further rate hikes. It is about the fate of NAFTA, that is, the deal on the North American Free Trade Agreement's revamp. At the end of November, the negotiations on the formatting of this agreement were concluded, and, judging by the incoming information, the talks ended in failure. "Canada hopes for the best, but prepares for the worst": this capacious comment by the Canadian side eloquently characterizes the situation.

However, the search for a compromise is not over. The next stage of the negotiation process will be held in late January next year. In fact, it will be a decisive round: the parties need to find a common denominator before the spring of 2018, when the campaign in Mexico will begin.

The Bank of Canada has previously voiced its concern about this. After all, NAFTA is considered one of the largest economic relationship in the world, therefore any uncertainty here has a strong impact on the industrial sector, exports, and, in general, on the investment attractiveness of the country. In view of the fact that the recent negotiations ended with nothing, the regulator can again focus on this. And if the central bank connects this issue with the prospect of further tightening of monetary policy, the Canadian dollar may be under considerable pressure, although such a scenario is highly unlikely.

Also, the regulator can focus on the oil market. Now there is a corrective price rollback (due to fixing profits after the OPEC + meeting), but in general, the Canadian economy can count on the support of "black gold". Especially, if dynamics on reduction of stocks of crude oil in the USA will continue.

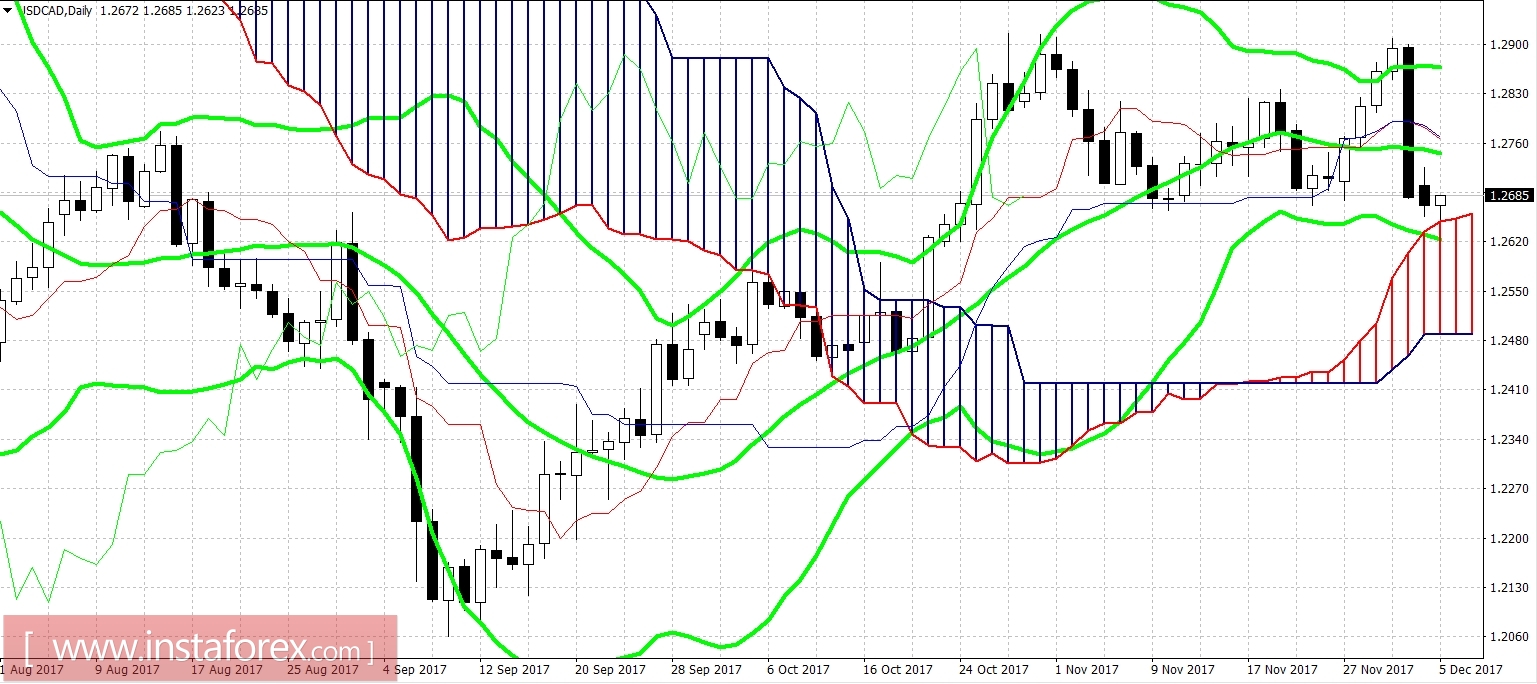

Thus, traders knowingly "held their breath" on the eve of the December meeting of the Bank of Canada. Figuratively speaking, the situation resembles that of a glass of water, which is either half empty or half full. And depending on what general mood prevails among the regulator's members, the future direction of the USDCAD pair will depend. In my opinion, the central bank will not emphasize the situation, and take on a wait-and-see attitude. In this case, the pair will test the base of the 26th figure, where the lower line of the Bollinger Bands indicator is located on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română