World markets remain in a state of uncertainty. On the other hand, it further shows a clearer picture that there is a tax reform in the United States, and on the other hand, political tension restrains investors' optimism.

Currently, the US parliament agrees on the draft of tax reform. It is expected that the tax reform will be approved and adopted before the year ends. If the basic postulates were preserved, it will reduce the corporate tax from 35% to 20%, as well as the beginning of its validity in the next year. It should stimulate the growth of investors' interest in dollar assets, which could increase the demand for the American currency.

The risk in the political confrontation between President D. Trump and his opponents did not disappear anywhere. His outspoken enemies will try to discredit the president and subject him to an impeachment procedure which is not possible. In case that happens the US stock market and the dollar exchange rate will become positive.

On Tuesday, the retail sales data in the euro area were released, showing worse than expected that placed pressure on the single currency. According to the data presented, retail sales fell year-on-year from 4.0% to 0.4%, versus the projected decline of 1.5%. On a monthly basis, the indicator fell by 1.1% in October against the 0.8% rise in the period earlier and the expected 0.7% decrease. The published figures indicate that expectations for the inflation growth in the eurozone may not be justified since this indicator is closely related to the consumer inflation indicator, which can be recalled of a failure to reach the 2.0%, level. This is the main reason for the ECB's caution regarding the issue of measures stimulating the eurozone economy that restrict the strengthening of the euro.

In general, the current situation on the foreign exchange market shows a steady position under the influence of news about tax reform and political instability in the United States, as well as Brexit's problems, which causes the main currency pairs to move in a sideways range.

Forecast of the day:

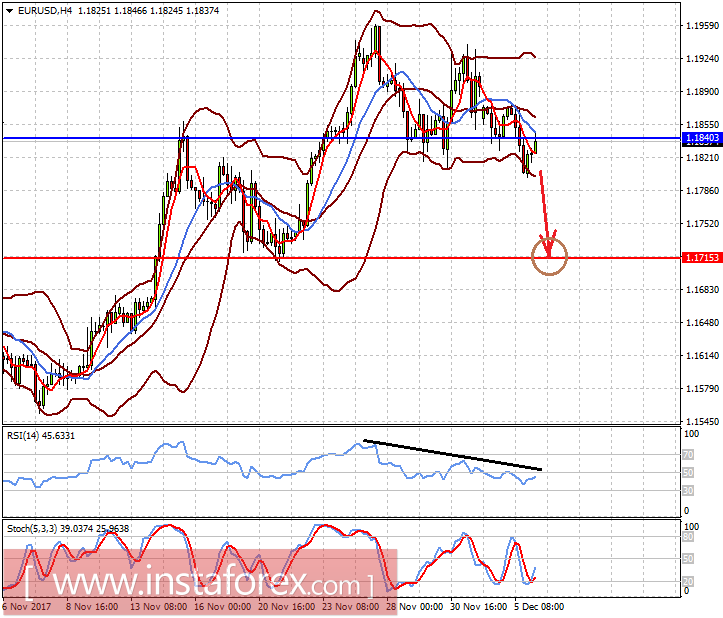

The EUR/USD pair is trading below 1.1840, but remains generally on the "outset". It can be assumed that if today's ADP employment data turn out to be strong, it can drag the price lower to 1.1715.

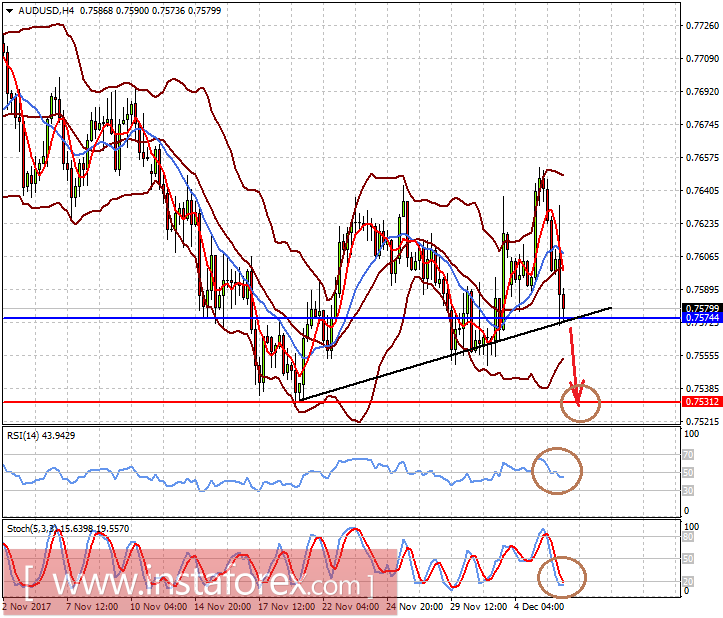

The AUD/USD pair fell to the lower limit of the short-term uptrend on the wave of Australia's GDP data that came out worse than anticipated. Given this, the price is expected to fall to 0.7530 if the pair falls below the 0.7575 mark.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română