The euro managed to restore some of its positions against the US dollar in the second half of the North American session after the release of weak data on the growth of the US foreign trade deficit, as well as slowing activity in the services sector.

According to the report of the US Department of Commerce, the budget deficit grew in October this year due to a slowdown in oil exports and an increase in imports of foreign goods.

Thus, the deficit of foreign trade in goods and services in October rose by 8.6% compared to the previous month and amounted to 48.73 billion US dollars. Economists had expected a deficit of $ 47.5 billion. Import grew in October by 1.6% compared to the previous month while the export indicator remained unchanged.

Activity in the US services sector slowed in November 2017. Despite this, the indicator is at a fairly good level which in the future, will support the economy of the country.

According to the Institute of Supply Management, the index of supply managers for the non-manufacturing sphere in November fell by 2.7% and amounted to 57.4 points. Economists had expected the index to be at 59 points in November. The index of new orders fell to 58.7 points.

As for the technical picture of the EURUSD pair, the pressure on the euro may continue but much will depend on the indicators on the US labor market which will be released this afternoon.

An increase in the number of employees from ADP at 191K is expected in November after growing at 235K in October this year. If the indicator is better than the forecasts of economists, US dollar buyers will quickly return to the market.

A breakthrough at the support level of 1.1820 may lead to a continuation of the downward trend for the euro but much will depend on the behavior of sellers in the area of weekly lows. Only the consolidation below 1.1800 will allow us to count on a bigger drop in EURUSD with the update in the area of 1.1780 and 1.1740.

The Australian dollar collapsed against the US dollar after rising against the background of interest rates. The main pressure on the pair was made by weak data on the state of the Australian economy in the third quarter of this year, whose growth slowed.

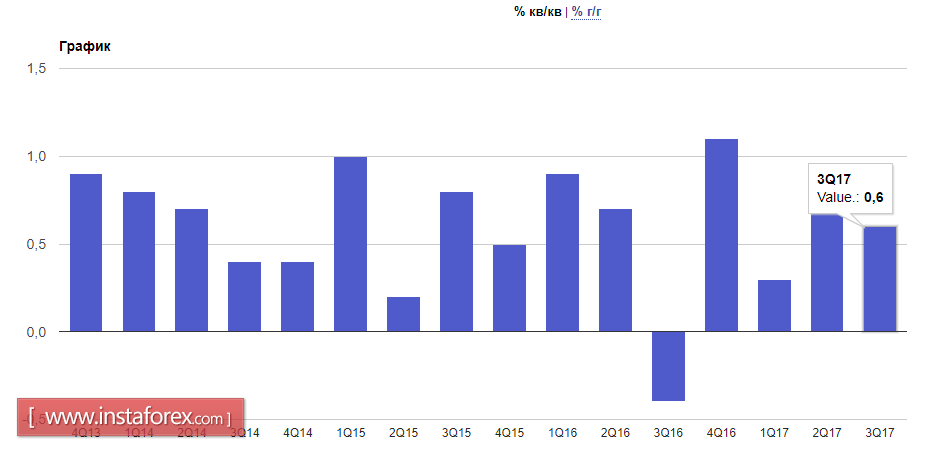

According to the Australian Bureau of Statistics, GDP in the third quarter of this year, compared with the previous quarter, grew by only 0.6%. And compared with the third quarter of 2016, the growth was 2.8%. Economists had expected growth of 0.7% for the quarter and 3% for the year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română