Data on orders in the manufacturing sector of Germany did not significantly support the euro in the first half of the day, despite good performance.

The euro ignored the report of the German Ministry of Economy which reported that orders in the manufacturing sector of Germany increased by 0.5% while economists expected a decrease by 0.5%. Export orders in the manufacturing sector in Germany increased by 0.5% while domestic orders rose by only 0.4%.

Data for September were revised towards a small increase. Thus, orders in the manufacturing sector of Germany in September increased by 1.2% and not by 1.0%, as previously reported.

Good data on labor productivity in the US for the the third quarter of this year were ignored by the market, which indicates a restrained inflationary pressure despite the economic growth.

According to the report of the US Department of Labor, labor productivity outside agriculture in the third quarter of 2017 increased by 3% compared to the same period in 2016. Specific labor costs were revised downwards and fell by 0.2 while it was reported that growth was 0.5% earlier.

Economists predicted an increase in labor productivity by 3.3% per annum and an increase in expenses for payment of 0.3%.

Data from ADP on the US labor market also passed over the market completely without a trace.

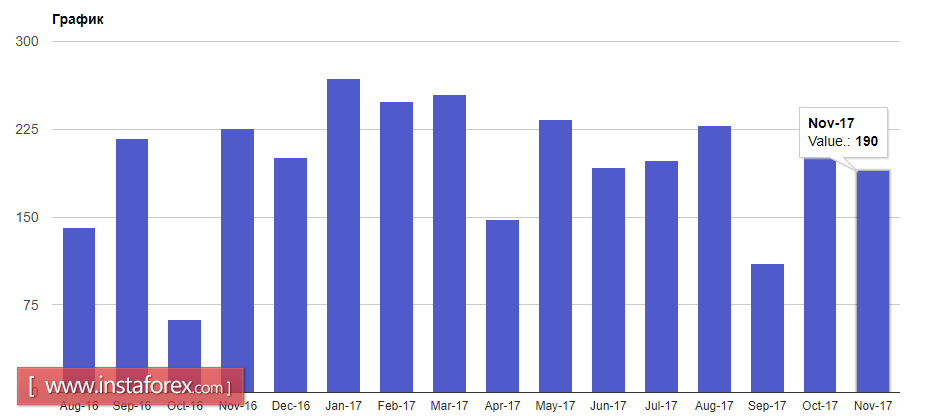

According to the report, the number of jobs in the private sector of the US in November this year rose by 190K while economists predicted a more modest growth of 175K. It is important to note that back in October, this figure increased by 235K after a serious recession in September due to hurricanes.

As for the technical picture, it did not change seriously compared with the morning forecast.

It was expected that the breakthrough at the support level of 1.1820 could lead to the continuation of the downward trend for the euro. However, after the lows, the decline in risk assets slowed yesterday. Only a consolidation below 1.1800 will allow us to expect a larger decline in the trading instrument with the update at the area of 1.1780 and 1.1740.

The British pound continues to remain under pressure due to problems with negotiations related to Brexit. If this Friday, the parties will not be able to come to the next agreement at the talks in Brussels pressure on the pound may strengthen at the end of the week. Many experts expect another failure of negotiations and renewed pressure on the British pound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română