GBP / JPY

The pair returned to key support level (149.92-week Tenkan + daytime Kijun and 149.24-month Fibo Kijun). Failure to maintain the situation following the update of the maximum level (152.83), usually leads to the formation of a combined reversal candle. On the daily timeframe, similar developments are already observed and closing the week in the support area or below will allow discussing more confidently about the advantages and plans of players to decline.

The pair achieved the goal for the breakdown of the H1 cloud and descended into the key support area of the higher halves (149.92-24). In this area (149,92-24) of the younger timeframes, there is an H4 cloud, while in the breakdown of the supports and the cloud will form the new downside target, while bears in the younger time intervals will be able to seize the long-term advantage. Among the resistance resistance today, the levels of 150.62 (Tenkan H4 + daily level) and 151.32 (Kijun H4 + cloud H1) should be noted today.

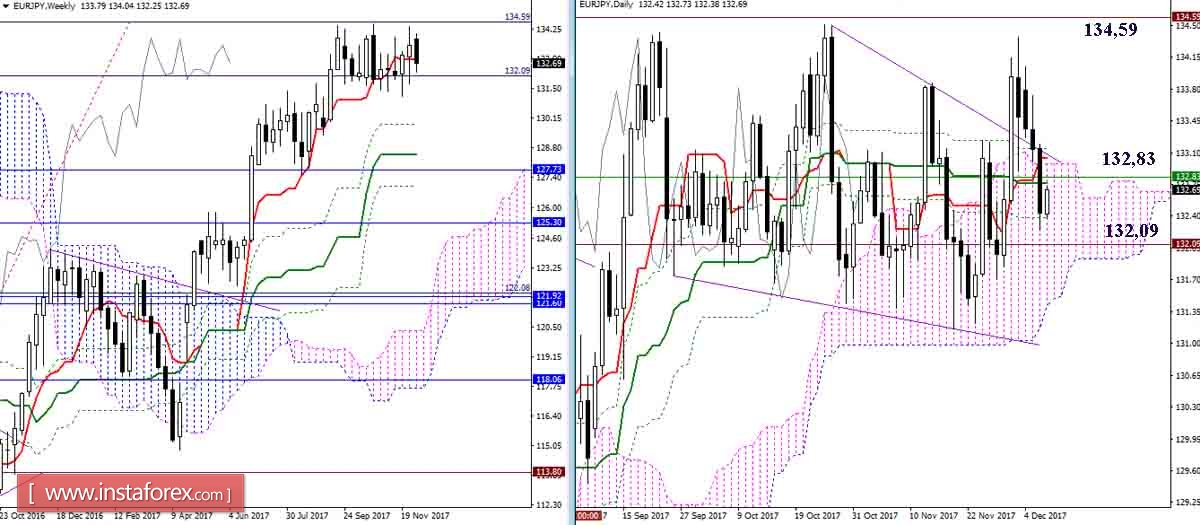

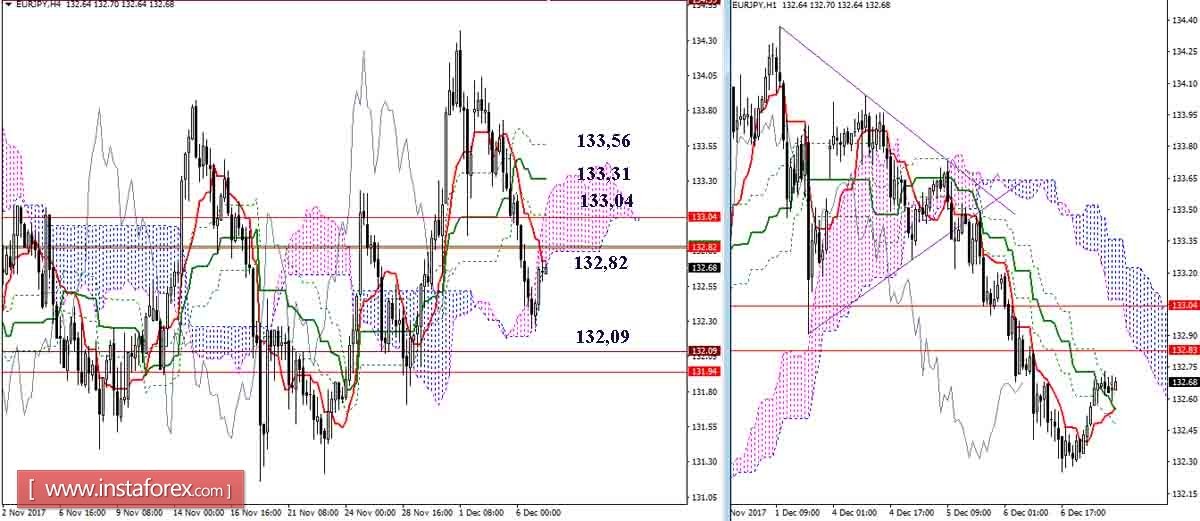

EUR / JPY

Another attempt by players to increase the 100% level of testing of the weekly target at the breakdown of the cloud (134.59) failed. Players on the rise again could not reach the level. To date, they have already returned to the key zone and unites the most significant levels of support and attraction (a week-long Tenkan 132.83 + a daytime cross of 132.76 + day cloud + the first target of the weekly target at break of the cloud 132.09). Long enough, this zone kept the events from development, stopping the attempts both from bulls and from bears to change the situation.

The pair descended to the most significant levels (high-time levels + cloud H4 + cross H4), which now form the most reinforced and significant resistance zone (132.83 - 133.56). If the situation does not change in the next few hours, a downward target will most likely be formed for the breakdown of the H4 cloud. Along the path of fulfilling the goal of H4 timeframe, it is strong enough and important support (the lower boundary of the day cloud + the first target of the weekly goal for the breakdown of the cloud) and the prospects of a breakout to this level depends on the development of the situation.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română