Latest data released by Eurostat - 18 November 2020

CPI -0.3% vs -0.3% y/y prelim

No change to the initial estimates as Eurozone inflation continues to remain more subdued. This just reaffirms the need for the ECB to take more decisive measures next month.

Further Development

Analyzing the current trading chart of EUR/USD, I found that there is rejection of the important pivot level at 1,1890, which is good sign for further downside movement.

My advice is to watch for selling opportunities with the targets at 1,1850 and 1,1820

Additionally, there is the bearish divergence on the Stochastic oscillator, which is another confirmation for the further downside....

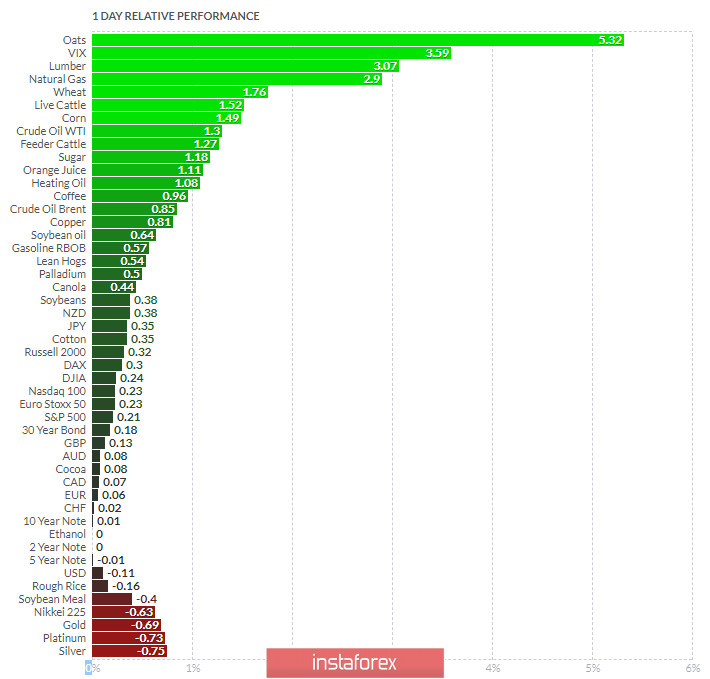

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Oats and VIX today and on the bottom Silver and Platinum.

In my opinion both Gold and Silver might be extended today and ready for to downside rotation.

Key Levels:

Resistance: 1,1890

Support levels: 1,1850 and 1,1820

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română