Daily Express' Brussels correspondent, Joe Barnes, also corroborates with the report in saying that Barnier will be briefing EU member states tomorrow to update on Brexit talks.

After the earlier development, the question now is will this be one where Barnier signals white smoke or just a reiteration of what we have heard time and time again?

There is every likelihood that talks could continue through the weekend and also into next week, so the update tomorrow is going to be key to set the tone.

Further Development

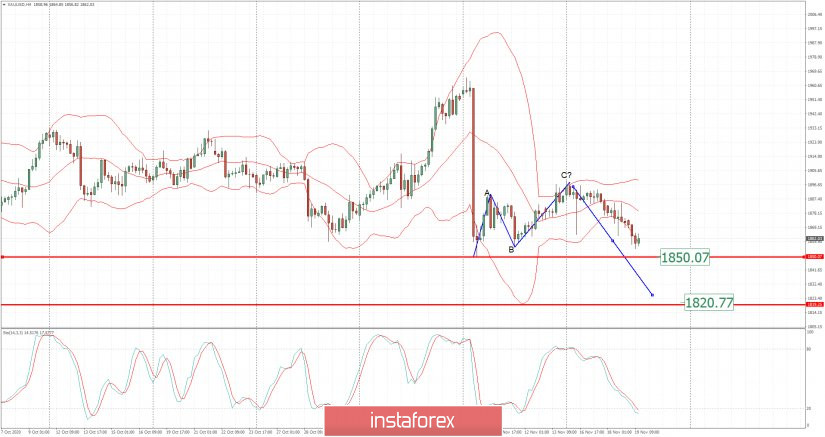

Analyzing the current trading chart of Gold, I found that Gold is heading towards our first yesterday's target at $1,850.

1-Day relative strength performance Finviz

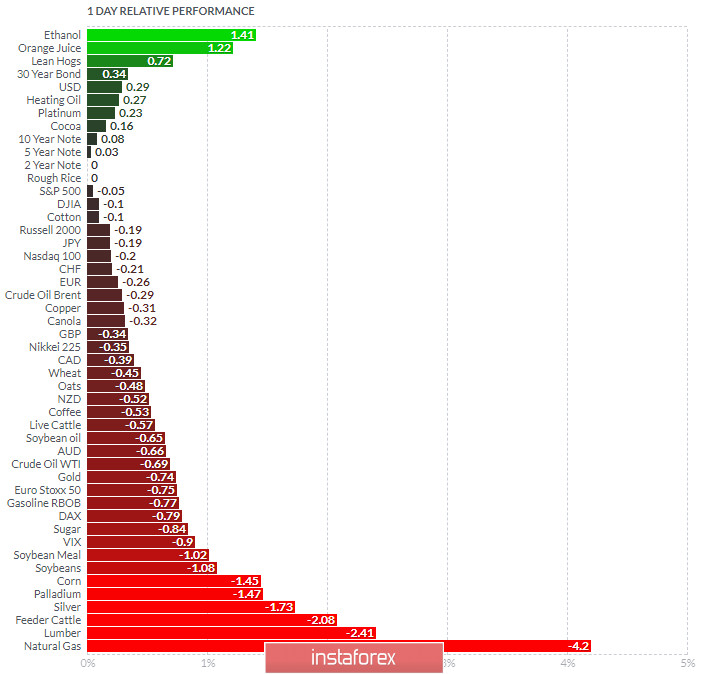

Based on the graph above I found that on the top of the list we got Ethanol and Orange Juice today and on the bottom Natural Gas and Lumber.

Gold is negative on the list, which is another sign of weakness.

Key Levels:

Resistance: $1,865

Support levels: $1,850 and $1,820.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română