This was very much expected already as Eamonn highlighted earlier in the day here. After the passing of safety data on Wednesday, the latest move here was anticipated.

The response to the latest development above is relatively mild but it sees 10-year Treasury yields hold at the highs for the day, up 1.8 bps to 0.847%. European equities are also keeping firmer still and the dollar is losing some ground on the session.

I don't expect the knee-jerk reaction here to be a massive one, all things considered. However, just be mindful of the key levels at play for the dollar that are still intact and with S&P 500 futures near flat levels, watch out for the 3,600 level.

On the latter especially, get above that and we could see risk swing back heavily in favour of buyers ahead of the weekend.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today at the level at 1,1880 and that there is potential for the downside continuation based on the last downside swing.

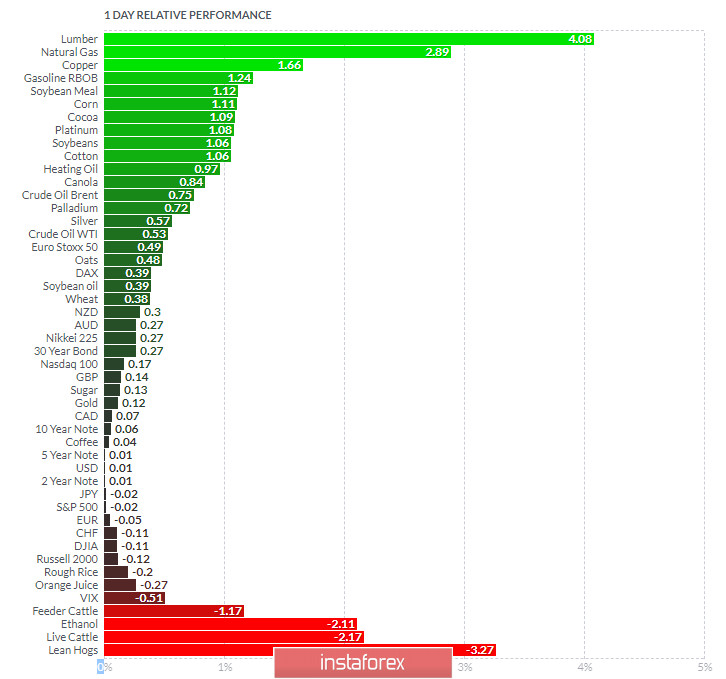

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Natural Gas today and on the bottom Lean Hogs and Live Catlle.

Key Lvels:

Resistance: 1,1880

Support levels: 1,1850 and 1,1820

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română