Economic confidence 87.6 vs 86.0 expected

- Prior 90.9; revised to 91.1

- Industrial confidence -10.1 vs -10.9 expected

- Prior -9.6; revised to -9.2

- Services confidence -17.3 vs -16.3 expected

- Prior -11.8; revised to -12.1

Euro area economic confidence slumped on the month amid tighter restrictions across the region and that highlights the struggle with the recovery towards the year-end.

As the restrictions look set to continue until the closing stages of the year, it makes for a very uncertain outlook going into Q1 2021 if the virus situation isn't contained.

Further Development

Analyzing the current trading chart of Gold, I found that Gold is doing consolidation at the price of $1,807 but there is still chance for the downside continuation.

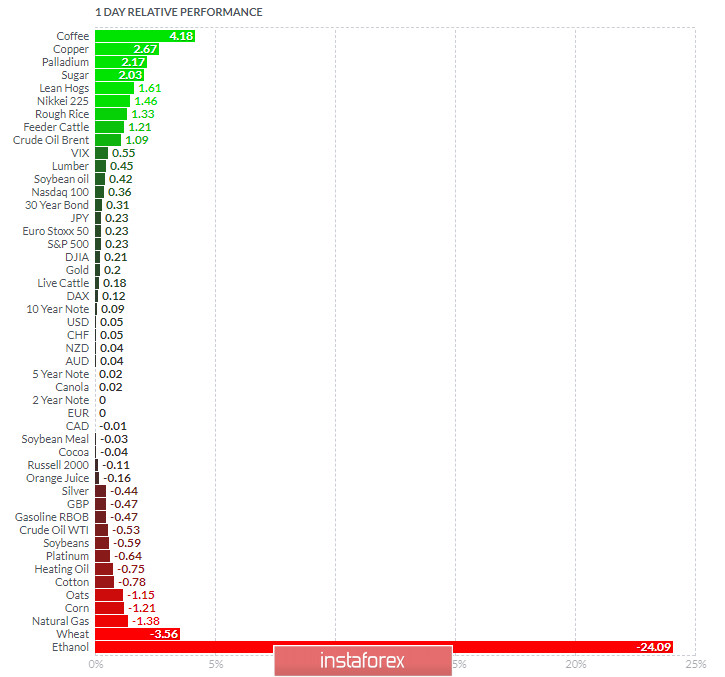

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Coffee and Cooper today and on the bottom Ethanol and Wheat.

Gold is flat on the list....

Key Levels:

Resistance: 1,1932

Support levels: $1,799 and $1,786.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română