Dear colleagues.

For the EUR / USD pair, the price forms a local structure from January 4 which is expected to continue on its upward trend after the breakdown of 1.2077. For the GBP / USD pair, the price is still in the correction zone from the upward movement. The continuation of the main trend is expected after the breakdown of 1.3611. For the USD / CHF pair, the price forms the potential for the top of January 2 in the correction of the downward structure. For the of USD / JPY pair, we follow the upward structure of January 2. For the EUR / JPY pair, the continuation of the main upward trend is expected after passing by the price of the noise range of 136.44 - 136.70. For the GBP / JPY pair, the continuation of the upward trend is expected after the breakdown at 154.00.

Forecast for January 8:

Analytical review of currency pairs in the scale of H1:

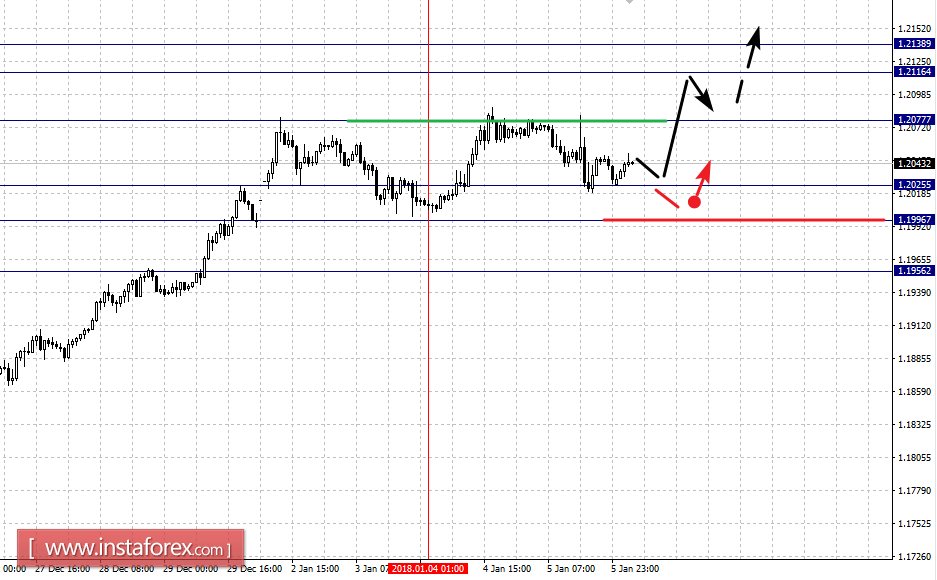

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2137, 1.2116, 1.2077, 1.2025, 1.1996 and 1.1957. Here, the price forms a local potential for continuing the upward trend of January 4. Continued movement towards the top is expected after the breakdown of 1.2077. In this case, the target is 1.2116. The potential value for the top is the level of 1.2137, upon reaching which, we expect a correction.

Consolidated traffic is possible in the area of 1.2025 - 1.1996. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1957. Up to this level, we expect the potential formation for the downward cycle.

The main trend is the formation of a local structure on January 4.

Trading recommendations:

Buy: 1.2078 Take profit: 1.2115

Buy Take profit:

Sell: 1.2024 Take profit: 1.1998

Sell: 1.1994 Take profit: 1.1960

For the GBP / USD pair, the key levels on the scale of H1 are: 1.3707, 1.3664, 1.3643, 1.3611, 1.3565, 1.3537, 1.3494, 1.3464, 1.3403 and 1.3372. Here, the price is in correction and forms the potential for the bottom of January 3. Continued development of the upward cycle from December 15 is expected after the breakdown of 1.3611. In this case, the target is 1.3643. In the area of 1.3643 - 1.3664 is the consolidation of the price. For the potential value for the top, consider the level of 1.3707. Upon reaching this level, we expect a pullback to the bottom.

The development of the downward structure is expected after the breakdown of 1.3527. In this case, the target is 1.3494. In the area of 1.3494 - 1.3464 is the consolidation of the price. A break of the level of 1.3403 should be accompanied by a pronounced movement towards the level of 1.3403. For the potential value for the downward structure, consider the level of 1.3372. Upon reaching this level, we expect a pullback to the top.

The main trend is the upward structure from December 15, the correction stage.

Trading recommendations:

Buy: 1.3612 Take profit: 1.3640

Buy: 1.3666 Take profit: 1.3705

Sell: 1.3525 Take profit: 1.3494

Sell: 1.3462 Take profit: 1.3416

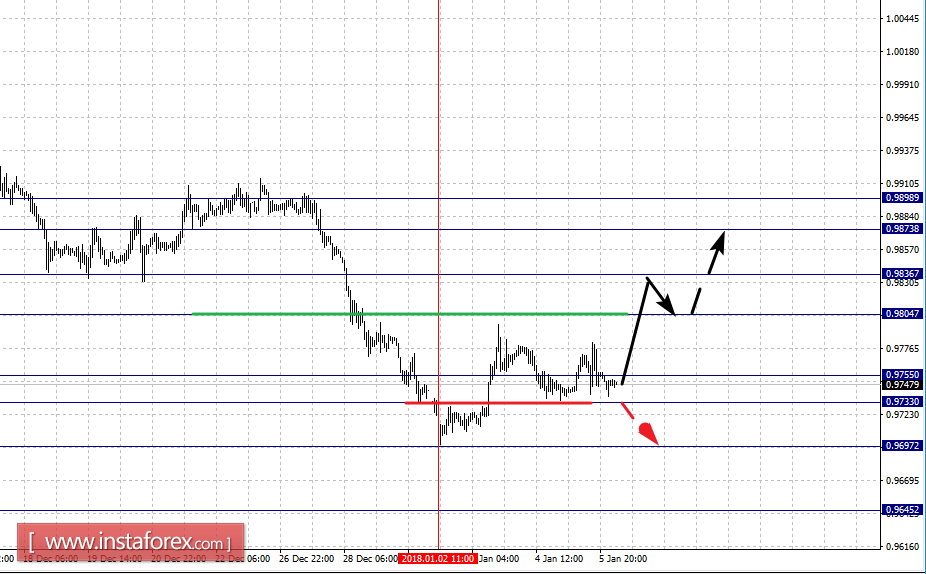

For the of USD / CHF pair, the key levels in the scale of H1 are: 0.9898, 0.9873, 0.9836, 0.9804, 0.9755, 0.9733, 0.9697 and 0.9645. Here, the price forms the potential for the top of January 2 in correction of the downward cycle. Continued movement towards the top is expected after the breakdown of 0.9804. In this case, the target is 0.9836. Near this level is the consolidation of the price. The breakdown at the level of 0.9836 should be accompanied by a pronounced movement towards the level of 0.9873. For the potential value for the top, consider the level of 0.9898. Upon reaching this level, we expect a pullback to the bottom.

Consolidated movement is possible in the range of 0.9755 - 0.9733. The breakdown of the last value will lead to the development of the downward structure. Here, the first target is 0.9697. As a potential value for the bottom, consider the level of 0.9645.

The main trend is the downward structure from December 8, the correction stage.

Trading recommendations:

Buy: 0.9805 Take profit: 0.9832

Buy: 0.9838 Take profit: 0.9870

Sell: 0.9730 Take profit: 0.9700

Sell: 0.9695 Take profit: 0.9650

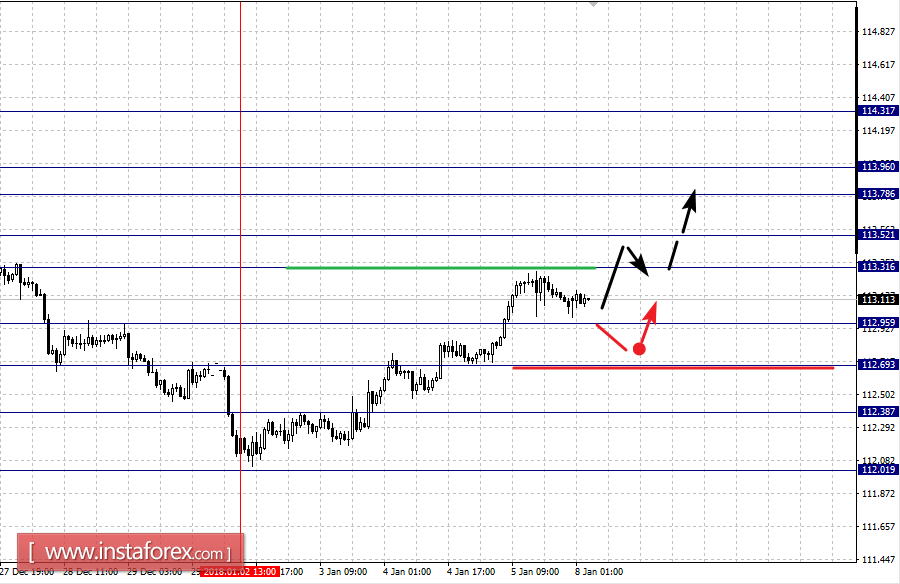

For the USD / JPY pair, the key levels on a scale are: 114.31, 113.96, 113.78, 113.52, 113.31, 112.95, 112.69 and 112.38. Here, we follow the development of the upward structure of January 2. Short-term upward movement is possible in the area of 113.31 - 113.52. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 113.78. In the area of 113.78 - 113.96 is the consolidation of the price. The potential value for the top is the level of 114.31. Upon reaching this level, we expect a rollback to correction.

Short-term downward movement is possible in the area of 112.95-112.69. The breakdown of the last value will lead to an in-depth correction. Here, the target is 112.38. This level is the key support for the top. Passing the price will lead to the development of the downward structure. In this case, the first target is 112.01.

The main trend is the upward structure of January 2.

Trading recommendations:

Buy: 113.31 Take profit: 113.50

Buy: 113.55 Take profit: 113.75

Sell: 112.95 Take profit: 112.72

Sell: 112.65 Take profit: 112.44

For the CAD / USD pair, the key H1 scale levels are: 1.2563, 1.2469, 1.2429, 1.2390, 1.2340, 1.2278 and 1.2222. Here, we follow the downward structure of December 19. Short-term downward movement is expected in the area of 1.2390 - 1.2340. The breakdown of the last value will lead to the movement towards the level of 1.2278. For the potential value of the bottom, consider the level of 1.2222. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.2429 - 1.2469. The breakdown of the last value will lead to an upward movement. Here, the target is 1.2563.

The main trend is the downward structure of December 19.

Trading recommendations:

Buy: 1.2430 Take profit: 1.2466

Buy: 1.2473 Take profit: 1.2560

Sell: 1.2340 Take profit: 1.2282

Sell: 1.2275 Take profit: 1.2225

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7846, 0.7792. 0.7759, 0.7737 and 0.7699. Here, the price is near the limit for the top, namely the level of 0.7846. In connection with this level, we expect a move towards correction. The development of a downward movement is possible after the breakdown of 0.7792. In this case, the first target is 0.7759. In the area of 0.7759 - 0.7737 is short-term downward movement and the consolidation of the price. For the potential value of the downward structure, consider the level of 0.7699. Upon reaching this level, we expect the formation of pronounced initial conditions for the development of the trend.

The main trend is the upward cycle from December 8, we expect a correction.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 0.7790 Take profit: 0.7765

Sell: 0.7735 Take profit: 0.7705

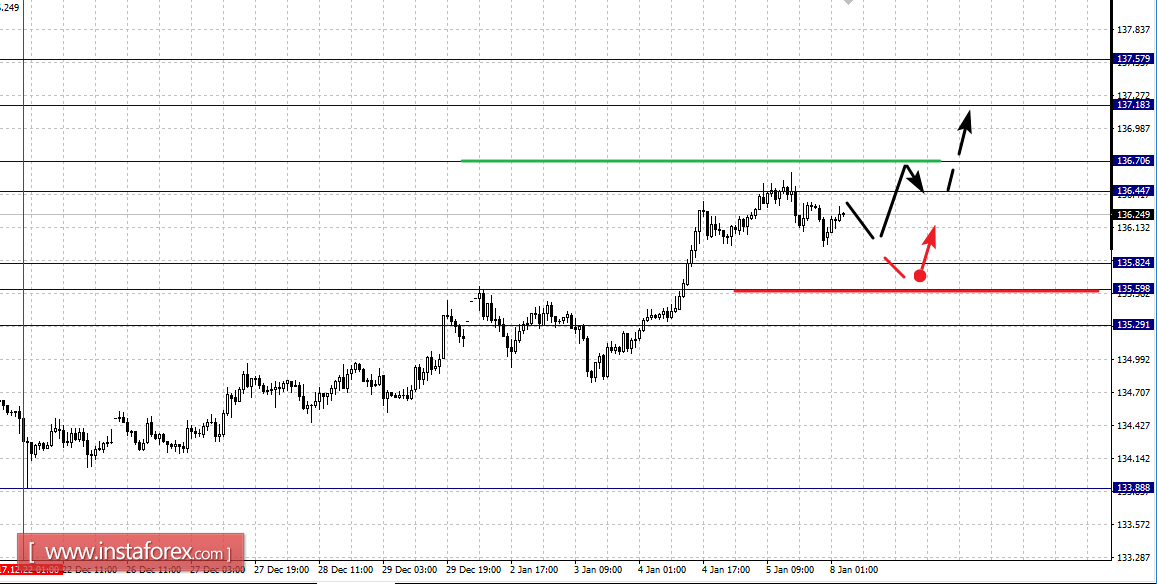

For the EUR / JPY pair, the key levels on the scale of H1 are: 137.57, 137.18, 136.70, 136.44, 135.82, 135.59 and 135.29. Here, we follow the local upward structure of December 22. Short-term upward movement is possible in the area of 136.44 - 136.70. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 137.18. Near this level is the consolidation of the price. For the potential value of the top, consider the level of 137.57. Upon reaching this level, we expect a departure towards correction.

Short-term downward movement is possible in the area of 135.82 - 135.59. The breakdown of the last value will lead to in-depth correction. Here, the target is 135.30. This level is the key support for the top.

The main trend is a local upward cycle from December 22.

Trading recommendations:

Buy: 136.45 Take profit: 136.65

Buy: 136.70 Take profit: 137.15

Sell: 135.80 Take profit: 135.65

Sell: 135.55 Take profit: 135.35

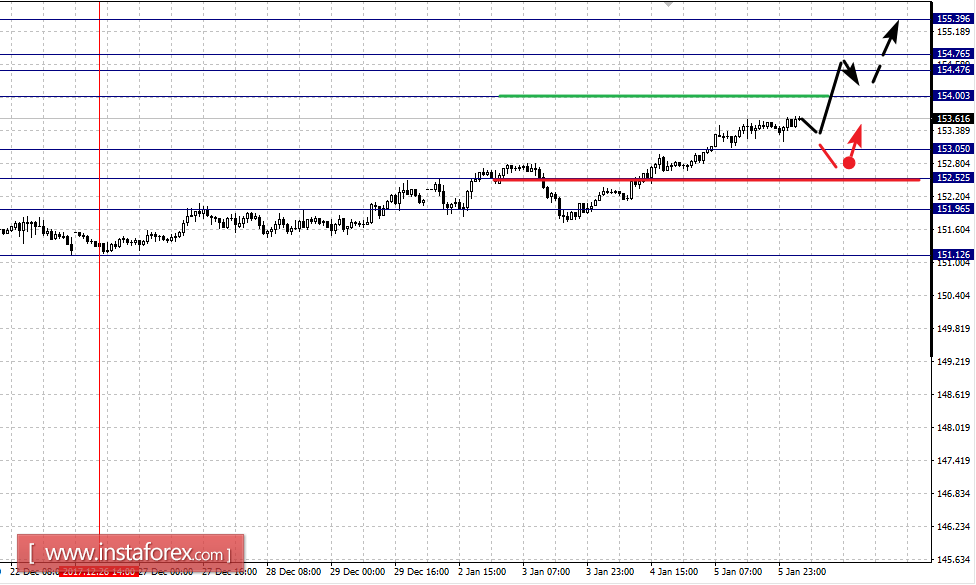

For the GBP / JPY pair, the key levels on the scale of H1 are: 155.39, 154.76, 154.47, 154.00, 153.05, 152.52, 151.96 and 151.12. Here, we follow the local upward structure of December 26. The continuation of traffic to the top is expected after the breakdown of 154.00. In this case, the target is 154.47. In the area of 154.47 - 154.76 is the consolidation of the price. For the potential value of the top, consider the level 155.40. Upon reaching this level, we expect a rollback towards correction.

Short-term downward movement is possible in the area of 153.05 - 152.52. The breakdown of the last value will lead to in-depth movement. Here, the target is 151.96. This level is the key support for the top.

The main trend is the local upward structure of December 26.

Trading recommendations:

Buy: 154.00 Take profit: 154.45

Buy: 154.78 Take profit: 155.35

Sell: 153.05 Take profit: 152.55

Sell: 152.50 Take profit: 152.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română