EUR/USD, GBP/USD

Last Friday, the market was dramatic enough for an entire week. The day began with the growth of the euro and the pound against the rest of the market as well as the strengthening of the dollar. The biggest losses were suffered by the "Aussie" due to weak data on the trade balance. In the afternoon, strong retail sales data was released in Germany, showing a rise of 2.3% in November. The annual increase was 4.4% against the forecast of 2.5%. With the release of the news, investors began to sell the euro, which we saw earlier this week - the repositioning of major players against news. Afterwards, the CPI of the euro area was released which showed that in December it came in at the expected 1.4% y/y. The producer price index increased from 2.5% y/y to 2.8% y/y.

In the evening, US data on labor for December came out. The number of new jobs outside the agricultural sector amounted to 148 thousand against the forecast of 190 thousand, but the November figure was revised to increase to 252 thousand, that is, 24 thousand more, and the December increase can be taken for 172 thousand, which is a very good indicator, although it did not reach the forecast. Note that the quality of employment has increased - in the manufacturing industry, 25 thousand new jobs were created against the forecast of 15 thousand. The share of economically active population remained at 62.7%, while the unemployment rate remained at 4.1%. The average hourly wage increased by 0.3%, as expected. The data could not disappoint the investors, which was confirmed by the stock market, which grew by 0.70% (S&P 500) and the bond market, which also showed yield growth. The first reaction of the market was the fall of the dollar, but afterwards increased, again the fall and closing of the day with a result of: euro -37 pp, pound +20 pp, yen +30 pp, "aussie" -1 pp, "loonie" -74 pp (which means its strengthening).

Later, there were other data: the volume of industrial orders for November at 1.3% against expectations of 1.1%, ISM Non-Manufacturing PMI at 55.9 against the forecast of 57.6. However, investors continued to implement a strategy since the beginning of the year.

Today, good performance is expected for the euro area. The volume of industrial orders in Germany for November is projected to grow by 0.1-0.5 %, while retail sales in the euro area for the same month are projected at 1.3%. Today is a national holiday in the US.

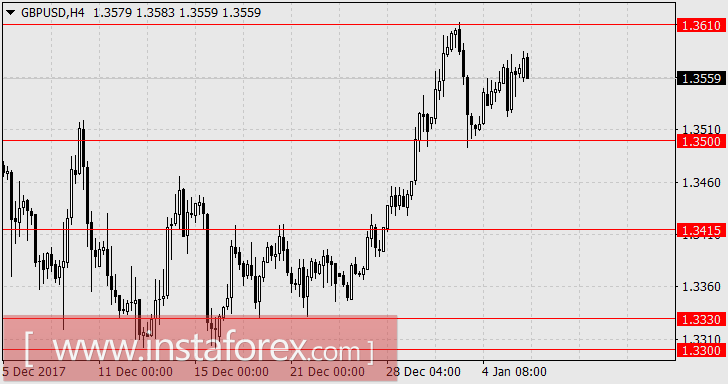

We believe that investors will continue to build long positions in the dollar, selling counter-dollar currencies against news. We are waiting for the euro in the range of 1.1880-1.1900, the pound sterling at the level of 1.3415.

USD/JPY

On Friday, the Japanese yen grew by 30 points, practicing positive data on labor in the US and the driving growth of stock indices. The US Dow Jones added 0.88%, the European EuroStoxx 50 gained 1.00%, the Japanese Nikkei 225, although the Asian market was closed long before the release of US data.

Considering the medium-term prospects of the yen, you can see that the potential for its growth is quite large. The economy of Japan in comparison with other regions is very strong. Thus, by the end of last year, industrial production was at 3.7% y/y, with a peak at 5.9% y/y. In the euro area, industrial production is also 3.7% y/y, but during the second half of 2017 it went up unevenly. In the UK, 3.6%, and the whole second half of the year industrial production pulled back from lows from -0.5% y/y. In India, this indicator is 2.2% y/y, in the US 3.4% y/y. In the first place was China with 6.1%, while Japan followed second.

Given the current situation, the yen is growing in conjunction with the US stock market, from this side it can receive additional support. New taxes on business in the US will begin to operate from January of this year, and very soon we will see the effect of these innovations in the form of strong data. We believe that investors, not from excess of emotions, actively started buying out shares of American companies, raising the Dow Jones by 2.24% for an incomplete week.

Today is another national holiday in Japan, but we expect to see the USD/JPY quotation in the range of 114.70/90 within a few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română