The European currency fell against the US dollar on Friday afternoon after the release of the US labor market data. Despite the economists' unjustified forecasts for the figure of new jobs, euro buyers failed to manage to break beyond the weekly highs, which led to a quick sell-off and fixing profit on long positions at these levels by the end of the week.

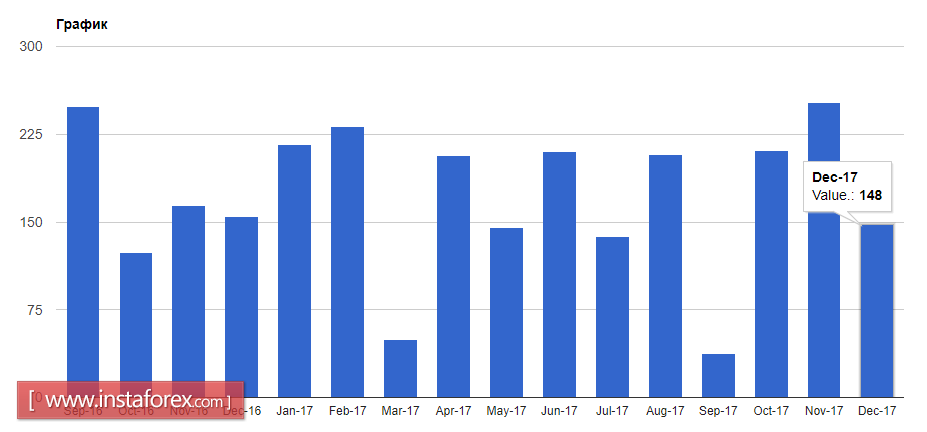

According to the report of the US Department of Labor, the growth rate of jobs in December 2017. Thus, the number of jobs is less than 148,000, while economists expect a larger growth of 180,000. It can recall that this indicator was equal to 252,000 in November, indicating a slowdown.

As noted above, unemployment remained unchanged at 4.1% which completely coincided with the forecasts of economists.

The US dollar was supported by the good data on sales growth in the manufacturing industry in the United States. According to the report of the US Department of Commerce, production orders in November 2017 rose by 1.3% compared with the previous month, while without considering the volatile category, it was a question of defense orders, sales in November also rose by 1.3%. Economists had expected that the total increase in orders for the month of November would be 1.4%.

Activity in the US services sector slowed down in December. However, the growth remains quite significant. According to the data, the index of supply managers for the non-production sector fell by 1.5% to 55.9 points in December last year. Be reminded that the values above 50 indicate an increase in activity. Economists had expected the index in December to reach 57.6 points.

The speech of Federal Reserve representative Patrick Harker, could also positively affect the purchase of the US dollar.

Patrick Harker, president of the Federal Reserve Bank of Philadelphia, said on Friday that he expects at least two rate increases from the Federal Reserve System in 2018. However, he also noted that continuous weak inflation will cause a problem for the Fed. As for the labor market, the Fed representative expects a slowdown in its growth considering that there are very few under-loaded capacities.

As for the technical picture of the EUR/USD pair, it is likely that the pressure on the euro will continue to form a larger downward correction at the beginning of the year. Considering long positions in risky assets at the beginning of the week is best after updating support levels 1.1970 and 1.1940.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română